Technical Analysis: Why You Should Expect a Popularity Surge

InvestorEducation / Technical Analysis Jun 28, 2022 - 09:27 PM GMTBy: EWI

Here's when a "rebirth of interest" in cycles and waves occurs

You probably know that the term "technical analysis" refers to analyzing the behavior of financial markets themselves -- such as the stock market -- as opposed to "fundamental" analysis, which is based on news and events outside of financial markets.

Well, in recent years, technical analysis has been out of favor.

A classic Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and cultural trends, explains why:

When bear markets mature, technical analysis is all the rage. When bull markets mature, it is not even on investors' radar.

The stock market had been in a bull market for more than a dozen years so newsletters based on technical analysis have struggled. You might catch a market technician getting interviewed on financial television or for a print article here and there, but most interviewees offered "fundamental" analysis or external reasons for their market forecasts. You see, "fundamental" analysis tends to be popular when the stock market is rising because people feel that the "machine of society" and the market are linked and they're both humming along as they should. In bear markets, people start to feel that "fundamentals" failed them, so they turn to other forecasting tools.

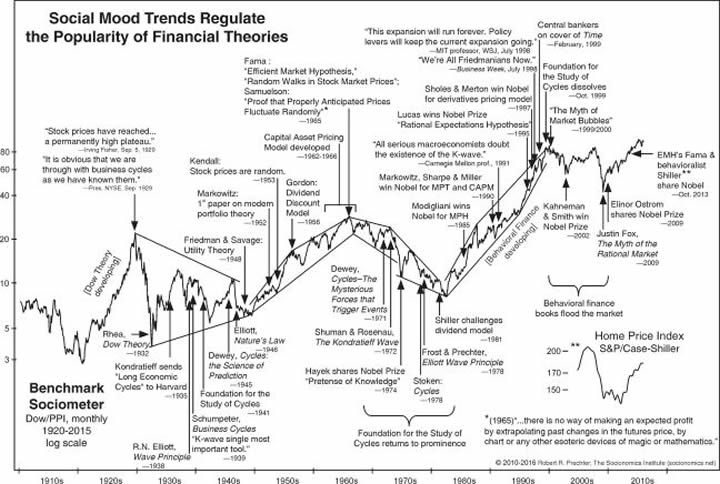

This chart and commentary from Robert Prechter's landmark book, The Socionomic Theory of Finance, reveals how the popularity of financial theories have waxed and waned with the trend of the stock market:

The chart shows that in times of increasingly positive social mood -- such as the 1920s, the 1950s-1960s and the 1980s-1990s -- people in the field of finance tend to believe in human rationality and humans' ability to control social trends. In times of increasingly negative social mood -- such as the 1930s-1940s, the 1970s, and the first decade of the 2000s -- there is a rebirth of interest in non-rational human behavior and the existence of cycles, waves and even extraterrestrial influences such as sunspots.

You probably know that Elliott wave analysis is a form of technical analysis. It tracks the market's pattern, which repeats in predictable ways.

If stock market prices continue to trend lower, expect a jump in the Wave Principle's popularity.

Of course, you don't have to wait to start using Elliott waves. In fact, individuals who were already following the message of the Elliott wave model were prepared before the downtrend started in the Dow Industrials and S&P 500 index in January.

Indeed, part 1 of the January Elliott Wave Theorist (published December 31, 2021) referred to an Elliott wave pattern when the publication said:

Diagonals occur at the end of larger sequences. If this diagonal proves true, the market is poised to roll over directly into a bear market.

Just two trading days later (Jan. 5), the Dow hit an all-time intraday high and then "rolled over." The senior index has been trading lower since.

By contrast, a Jan. 5 article in the mainstream financial press was titled (Marketwatch):

Why the bull market will stay alive in 2022 ...

The article referenced the comments of three market newsletter writers, and those comments largely centered on "fundamental" analysis, such as expectations for economic growth, earnings, pharmaceutical sales, General Motors' development of electric vehicles and so on.

No analytical method is perfect, including the Wave Principle. However, over decades of meticulous market observations, Elliott Wave International has concluded that the Elliott wave model is the most useful analytical method available -- in bull or bear markets.

If you'd like to delve into the details of the Wave Principle, you are encouraged to read Frost & Prechter's book, Elliott Wave Principle: Key to Market Behavior. Here's a quote from this Wall Street classic:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market's position within the behavioral continuum and therefore about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market's general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable. Many areas of mass human activity display the Wave Principle, but it is most popularly used in the stock market.

Good news: You can access the entire online version of the book for free once you become a member of Club EWI, the world's largest Elliott wave educational community (approximately 500,000 worldwide members and growing).

A Club EWI membership is also free and unlocks access to a wealth of Elliott wave resources on investing and trading. All the while, you are under zero obligation as a Club EWI member.

Just follow this link to get started right away: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Technical Analysis: Why You Should Expect a Popularity Surge. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.