Why I’m Buying These “Boring” Tech Stocks

Companies / Tech Stocks Nov 29, 2022 - 10:09 PM GMTBy: Submissions

By Justin Spittler : Is the bottom in?

It’s the most common question I’ve been getting.

At the time of writing, the Dow is coming off its best month since 1976. The S&P 500 is up 8% in four weeks. Many investors see this as an opportunity to get back into the markets.

As you’ll see, the markets haven’t give us the “all clear” yet.

But that doesn’t mean you should avoid all stocks. In this essay, I’ll show you where I’m putting my money today.

These stocks are in clear uptrends and should continue leading the market higher. But let’s first look at the mega-cap stocks.

- This is not what a bottom looks like…

Here we’re looking at a chart of Microsoft (MSFT). You can see that it recently put in a 52-week low.

Source: StockCharts

The same is happening with fellow tech giant Google (GOOG)…

Source: StockCharts

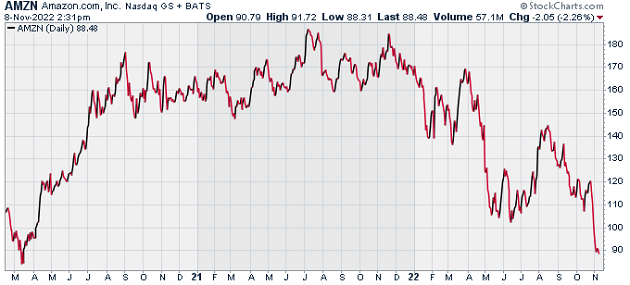

Finally, we have Amazon (AMZN), which is also putting in fresh lows.

Source: StockCharts

- These are America’s biggest, most important stocks…

Together, these three mega-cap tech stocks, along with Apple (AAPL), make up 17% of the S&P 500 and 35% of the Nasdaq.

If they’re falling, it’s a bad sign for the overall market.

Unfortunately, it could be some time before these giants start trending higher. You see, big tech stocks were the last stocks to head lower in 2021. The NYSE Fang Plus Index topped out in November 2021... nine months after popular growth stock fund ARKK did.

Unlike stocks in many other industries, these stocks need to build bases before they can really start moving higher again. That takes time.

In other words, mega-cap tech stocks aren’t my top picks to lead the market higher in the coming weeks and months.

Instead, I’d encourage you to have a long-term time horizon if you’re going to get involved with these names today.

As my colleague Chris Wood explained, right now is a good opportunity to accumulate shares in these world dominators if you plan on holding them for 3‒5 years or longer.

But if you’re a trader like me, there are much better bets right now…

- I’m not just saying this because of what I’m seeing in the charts either…

As I’m sure you’re aware, the Federal Reserve has been hiking interest rates aggressively to combat inflation.

This is a big reason why the yield on the US 10-Year Treasury surged from 1.5% in 2021 to 4% at the time of writing. That’s a huge move. You’d have to go all the way back to the ‘80s to see a similar rise.

The huge spike in rates benefits some companies, like regional banks. But it’s a headwind for growth stocks, including mega-cap tech.

So, I’m not expecting stocks like Amazon or Google to lead the market higher until rates top out or, better yet, decline.

The good news is that there are plenty of other trading opportunities to take advantage of…

- I’m particularly interested in “value stocks”…

Value stocks represent cheap, undervalued companies.

Unlike many growth stocks, these stocks can do well when interest rates are high or climbing.

So, it shouldn’t come as a surprise that they’ve been among the market’s best performers lately.

See for yourself. Here’s a chart comparing the performance of large-cap value stocks vs. the S&P 500. When this line is rising, large-cap value stocks are outperforming the S&P 500.

Source: All Star Charts

You can see that value stocks spent the last two years building out a huge base relative to the S&P 500… before recently breaking out of this consolidation pattern.

That’s bullish for value stocks. It suggests that they will be outperformers for the foreseeable future.

Now, I realize that value stocks aren’t the most exciting investments.

But your goal as a trader should not be to have exciting stocks to talk about at cocktail parties. It should be to make money.

And right now, the best stocks to own are in the healthcare, industrials, and energy sectors.

A simple way to gain exposure to these is to buy the iShares Russell 1000 Value ETF (IWD). It tracks the performance of large- and mid-cap US stocks that fall in the value category. Financials, healthcare, industrials, and energy represent about 60% of the ETF’s holdings.

In uncertain times like these, it’s best to follow the money trail.

Right now, that’s pointing me to value stocks.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.