Why Oil Prices Fell in the Face of "Supply Shock"

Commodities / Crude Oil Jan 19, 2023 - 09:21 PM GMTBy: EWI

"Crude should be at the forefront of a..."

"Crude should be at the forefront of a..."

Looking back on 2022, one of the biggest fears about oil was that prices would skyrocket even more than they did due to a disruption in supply from Russia.

Of course, Russia has been a major world supplier of oil, but after Russia invaded Ukraine, many global financial institutions refused to back transactions involving Russian oil.

So, back in March of 2022, we had this headline from a major financial website (CNBC, March 4):

Oil market heads for 'biggest supply crisis in decades' with Russia's exports set to fall, IEA says

Conventional wisdom says that a disruption in supply, let alone the biggest in decades, would lead to soaring oil prices.

However, at the time that March headline published, NYMEX crude oil was trading around $115 a barrel -- and prices have been in a downtrend for most of the time since, for almost a year now.

In December, even the New York Times had a hard time explaining the disconnect (Dec. 9):

Oil Prices Drop, Despite Heightened Sanctions on Russian Crude

So, what's going on?

Well, Elliott Wave International has studied the historic price patterns of oil and has concluded that investors cannot count on a relationship between prices and the oil market's "fundamentals."

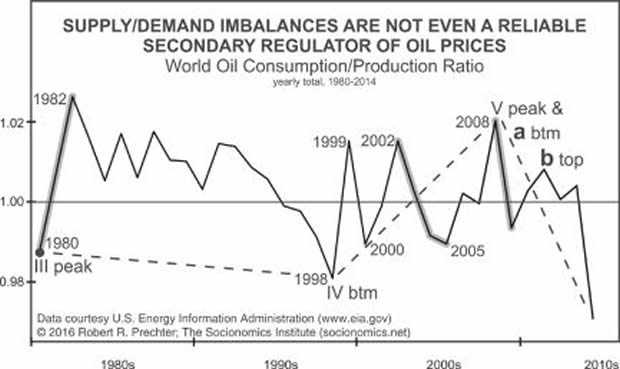

Indeed, Robert Prechter's Socionomic Theory of Finance provided historical analysis with this chart and commentary:

[The chart] shows the annual ratio between consumption and production worldwide. ... Take a look at the three shaded trends on the graph. The huge surge in the ratio between 1980 and 1982 -- the biggest rise on the chart -- did not cause the price of oil to rise; rather, it fell, a lot. Nor did the large decline in the ratio between 2002 and 2005 cause the price of oil to fall; rather, it rose, a lot. And the rapid plunge in the ratio during 2009 did not cause the price of oil to fall; rather, it tripled. These extreme anomalies render the proposed causality spurious.

What Elliott Wave International has observed is that oil's price does tend to follow Elliott wave patterns. As you probably know, Elliott waves reflect the repetitive patterns of investor psychology, the primary driver of financial markets.

Using the Elliott wave model, the December Global Market Perspective, a monthly Elliott Wave International publication which covers 50-plus financial markets, stated:

Crude should be at the forefront of a ... decline.

Indeed, as of this intraday writing on Jan. 9, NYMEX crude oil is trading lower than it was when the December Global Market Perspective published.

Now, the new January Global Market Perspective offers more insight into what you can expect for oil's future price path.

And, speaking of the Elliott wave model, if you're new to the subject, or simply need a refresher, read Frost & Prechter's Elliott Wave Principle: Key to Market Behavior. Here's a quote:

In markets, progress ultimately takes the form of five waves of a specific structure. Three of these waves, which are labeled 1, 3 and 5, actually effect the directional movement. They are separated by two countertrend interruptions, which are labeled 2 and 4. The two interruptions are apparently a requisite for overall directional movement to occur.

[R.N.] Elliott noted three consistent aspects of the five-wave form. They are: Wave 2 never moves beyond the start of wave 1; wave 3 is never the shortest wave; wave 4 never enters the price territory of wave 1.

... Elliott did not specifically say that there is only one overriding form, the "five-wave" pattern, but that is undeniably the case. At any time, the market may be identified as being somewhere in the basic five-wave pattern at the largest degree of trend. Because the five-wave pattern is the overriding form of market progress, all other patterns are subsumed by it.

Read EWI's new Global Market Perspective FREE

Now -- February 3

Dozens of markets around the globe are ending Elliott wave patterns right now. When they turn, they will make headlines.

And can change fortunes.

You can be ahead of that news -- ready, waiting and well-positioned. EWI's free State of the Global Markets event will get you ready.

Starting on January 16, and every two days, you'll get a section of the latest issue of EWI's Global Market Perspective.

At the end, you'll have the entire January 2023 Global Market Perspective. This will arm you with the wave patterns around the world that are about to reverse.

Don't miss it. And don't miss the edge it will give you. Follow the link to join in free below.

Get your GMP FreePass now at elliottwave.com >>

This article was syndicated by Elliott Wave International and was originally published under the headline Why Oil Prices Fell in the Face of "Supply Shock". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.