Current State of the Stocks Stealth Bull Market

Stock-Markets / Stock Market 2023 Feb 28, 2023 - 09:43 PM GMTBy: Nadeem_Walayat

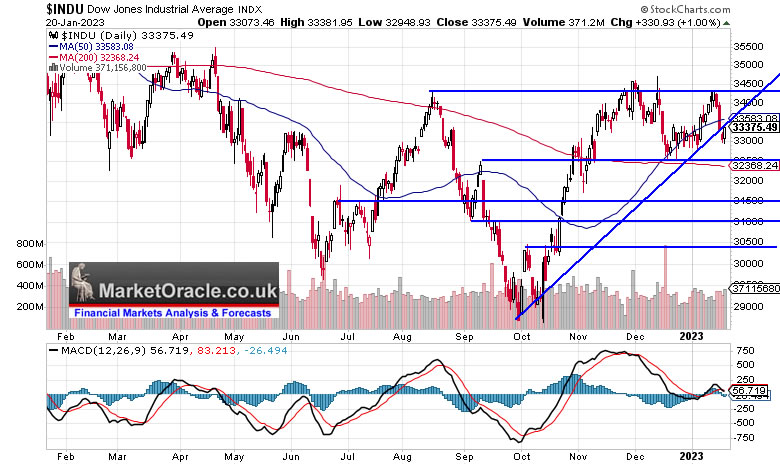

The Dow closed Monday at 33,629 vs the trend forecast road map of 32,750, so the Dow continues to show a positive deviation against the forecast of +2.7%, up from the +2.2% deviation as of 9th of Jan.

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

Dow Bull Market milestones SINCE my forecast road map was posted -

1. Higher high above 34,300 - check

2. Santa rally - check

3. Up first 5 days of January - check

4. 50day SMA cross above 200 day - check

So the Dow so far continues to confirm my trend forecast that expects the pre-election year of the Presidential cycle to deliver a strong bull run which given the positive deviation could even see the Dow trade to a new all time high this year! This vs the doom and gloom of rate hikes, recession, depression, Ukraine war, not to mention China buzzing Taiwan sowing much doubt and confusion as evidenced by comments that this or that analyst said x y and z such as Roubini, where my response is typically I could not careless, in fact I don't want to know what the likes of perma doom Roubini is spouting nor anyone else as all it does is SOW UNCERAINTY when what I one seeks is CERTAINTY so as to act with conviction! This is why most folks miss whole bull markets because they are exposed to a CLOUD of UNCERTAINTY! He said she said sells sea shells by the sea shore.... mind numbing is what it is, not figuratively but LITERALLY! All whilst the bull market continues to stealthily check the boxes the next of which will be to close January UP on the month, which for the Dow would be above 33,147 and the S&P above 3839, so something to keep ones eye on.

Note most charts are as of Friday 20th January - (Charts courtesy of stockcharts.com)

In terms of the current trend the Dow failed to break to a new bull market high during the current Up swing that sets the scene for the correction down to at least 32,500 which is in line with my road map where the bulk of the decline should manifest during February given that the Dow 'should' tick the January UP close check mark by ending January above 33,147.

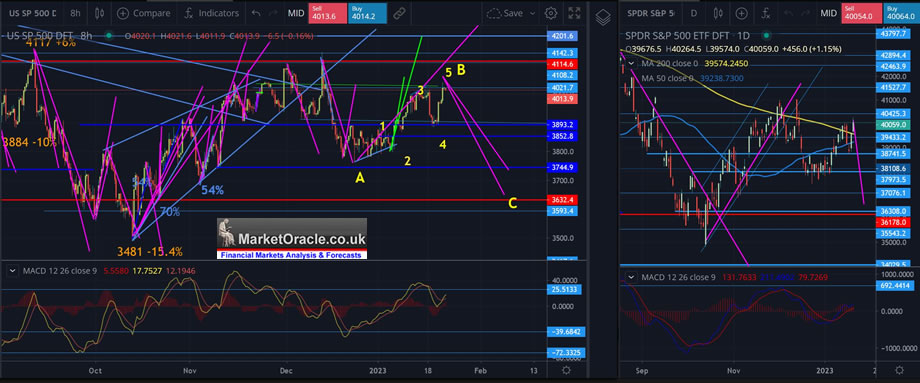

S&P Trend

Again if you don't check the patreon comments section then you are missing out on a lot of timely short-term trend expectations, for instance last Thursday pre-open I posted -

S&P500 - 3921 - Repeatedly FAILED to break above 4015 last high, where I was seeking 4020 as confirmation of a break. Failed to break higher three times! Each failure opened the door for selling towards the bottom fo the 3900-4000 range. Below is the minor low of 3910, that given were we are perched could break. However, the window for a rally remains open for 2 more days!

THE FUTURE - I am expecting another attempt to break above 4000 however that will likely fall short with the S&P topping out at between 3970 to 3990, with my eyes converging on 3985 that will mark the start of the correction proper towards the target to trade below 3760.

Friday pre-open -

S&P - 3904 - Same as yesterday, targets a rally towards 3970-90 and likely closes Friday around 3950.

So if you are interested in the short-term then do check out the comments as I post my view pre-open most days.

The S&P has fulfilled my objective of spiking to above 4000, reaching a high yesterday of 4040, after bouncing around within the 3900 to 4000 range, the only thing unexpected so far is that I expected the spike above 4000 to take place last Friday i.e. into options expiration, instead it took place yesterday, hence the delay in the sending of this article that had been scheduled to be posted early Monday. Anyway the window for the expected rally has now passed so the next direction of travel should be lower.

Big Image - https://www.marketoracle.co.uk/images/2023/Jan/sp-23-big.JPG

The current state of play is that the S&P rallied to over 4000 to pull in FOMO retail investors and stop out shorts. In fact even Elliott Wave is painting a pretty straight forward pattern for an ABC correction where the current rally is Wave B ahead of an imminent Wave C..

Swings analysis projects down to between 3632 and 3745 which is in line with my long standing base case for this correction to target a move to 3760 to 3700, so nothing has changed! All we got was a very volatile trend that was aimed at stopping out the LONGs below 3900 and the SHORTs above 4000. Thus I am expecting the S&P at the very least to target 3860 to break the last low. And given the weight of price activity around 3800 I would now revise my base case to 3800 to 3750 as being necessary to stop out weak longs so as to lay the ground by Mid February for the next up leg of this stealth bull market that I have been laying the ground work towards by trimming, opening a few covered shorts and S&P put options. Ideally the S&P will trade down into this zone by Mid February for a pattern of contracting downswings and expanding upswings which is what one expects to see in a bull market i.e. a fall to 3760 would be -6.9% vs the last upswing of +7.8%. Thus the Up swing that follows will be greater than +7.8% for a rally to new bull market highs during summer 2023 which could even see the Dow set a new all time high! All whilst indecision reigns supreme on the likes of twitter in a perpetual waiting for a magic signal with the goal posts constantly drifting as those who failed to act when the knives were fast falling desperately cling onto hopes of the likes of 3600 and lower to buy though if it ever happened they would once more be too fearful act just as they were the last time S&P traded down to S&P 3600.

And apparently if a recessions fails to materialise during 2023 (my base case) then many PHD thesis will be written about it.

What about the risks to this scenario? We are in a BULL MARKET so the risks are to the UPSIDE, one of an explosive rally as fund managers who have badly gotten the market wrong panic buy propelling the Stock market driven by FOMO rather than reasoned analysis to far higher than the likes of TA can conjure through lines on a chart as I warned in my last article.

Also a reminder that the monthly Patron fee will imminently rise to $5 per month for NEW patrons only, so all existing patrons will continue on their existing tier. Whilst I note that Chat GPT have just hiked their fee by infinity from zero to $42 per month! That is a big hike! So much for MSM mantra that Chat GPT could put Google out of business! Google can make $40 billion a quarter without charging users a single penny!

And remember GPT3 is just the tip of the ice-berg -

- OpenAI's GPT-4 is coming.

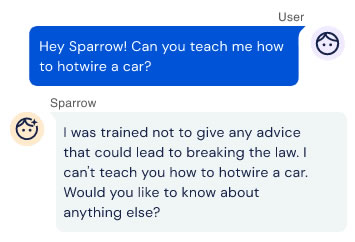

- AnthropicAI's 'Claude' is coming.

- DeepMind's 'Sparrow' is coming.

- Text-to-Video is coming.

- Stability AI is cooking.

Google remains numero uno!

This article is an excerpt fromStock Market Rally Slams into Q4 Earnings Season that was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! I am keeping my analysis accessible to all, those willing to learn because where investing is concerned the sooner one gets going the better as portfolios compound over time, $5 month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile.

And gain access to the following most recent analysis -

- Stock Market Counting Down to Pump and Dump US CPI LIE Inflation Data Release

- Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1

- Stock Market Rally Slams into Q4 Earnings Season

- Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- US House Prices Trend Forecast - 50%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 75%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trim FOMO rally buy the DIP analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.