Nuclear Power - America is Finally righting its 100-year Wrong

Stock-Markets / Investing 2023 Oct 20, 2023 - 11:32 PM GMTBy: Stephen_McBride

Herb Kelleher was a chain-smoking attorney who often consumed 100 cigarettes a day.

He founded Southwest Airlines (LUV) in the late ‘60s. His mission: Disrupt air travel by launching America’s first low-cost airline in Texas.

But his competitors tried to stop Southwest from ever getting off the ground.

They filed nonsense lawsuits that bogged Herb down in court for four and a half years and drained $500,000 in investor money.

Herb argued the case all the way to the Texas Supreme Court and won!

Then, just two days before Southwest’s first flight, competitors sued again.

So Herb pulled an “all-nighter” and found a loophole he presented in court the next morning… winning yet again.

Southwest went on to make a profit for 47 straight years while every single one of its competitors went bankrupt at least once.

Talk about grit and determination! This is the kind of founder I want to invest in. As I write, LUV is up 14,944%+ over the past four decades.

Now, let’s get after it…

The worst American decision of the last 100 years… finally reversed!

There are several game-changing investment trends in motion right now: AI robo-doctors… self-driving taxis cruising around US cities… and photorealistic “metaverse” avatars, to name a few.

America’s first ever reopening of a nuclear power plant (Palisades in Michigan) trumps them all in the short term.

Yes, I’m serious.

The single worst decision America made in the last 100 years was turning its back on nuclear energy.

When most people hear the word “nuclear,” they see Homer Simpson nodding off in the control room.

It’s unfortunate a whole generation of environmentalists believed cartoons instead of checking the facts.

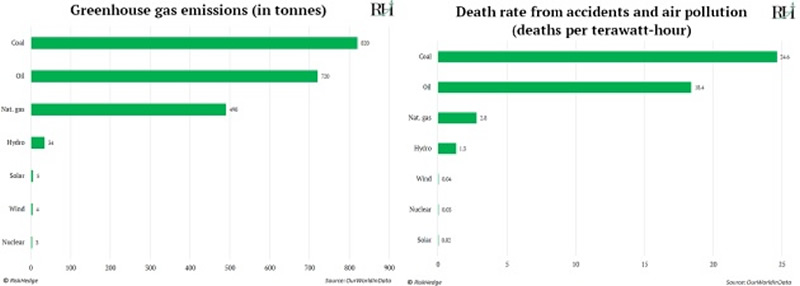

Because nuclear is indisputably the cleanest AND safest energy source in the world, as these charts show:

Embracing nuclear would be like a magic healing balm for the economy. It’d slash the cost of heating your home, powering every business, and fueling every electric car.

Well, better late than never. Because we’re in the early innings of a nuclear renaissance.

Not only did we get the first-ever plant restart. America’s first new nuclear unit in over 30 years is now up and running in Georgia.

Clean, cheap, abundant energy is the precursor to achieving that “Jetsons” sci-fi future we’ve all been waiting for.

This renaissance will cause demand for the “fuel” powering nuclear plants—uranium—to spike. In fact, uranium prices are breaking out to 15-year highs as I type.

I’ve been recommending the “Exxon Mobil” of uranium, Cameco (CCJ), to my readers since 2018. It’s tripled since then, and there’s plenty of juice left.

Warren Buffett’s favorite EV stock is about to pass Tesla (TSLA)…

This investing rule has served me well:

If I hear something once, I remember it. If I hear it twice, I write it down. Hear it a third time, I do something about it...

I’ve recently talked with three people across three continents about BYD (BYDDY).

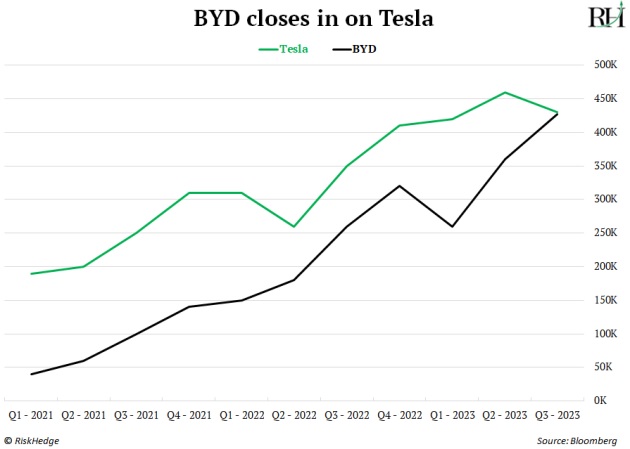

BYD (Build Your Dreams) is China’s version of Tesla. Last quarter, it sold nearly as many electric vehicles as Tesla!

China is now the world’s largest seller of cars, thanks to BYD.

When BYD launched in Ireland a few months ago, it sold 10,000 cars within 24 hours. They’re so popular because you can buy one for $10K to $20K less than a Tesla.

You hear about Tesla relentlessly slashing prices lately? It’s doing it to keep up with BYD.

Unfortunately, BYD is Chinese. As great as this company looks, we can’t fully trust its accounting.

But two things have me convinced BYD isn’t cooking the books. 1) I’m seeing its cars everywhere, in multiple countries, and 2) Warren Buffett has owned the stock for 15 years!

Buffett bought shares in 2008—before BYD IPO’d—and still owns roughly 8% of the $90 billion company.

If BYD was up to financial shenanigans, I think the old man would have found out by now.

BYD has a real shot at being one of the world’s 10 largest companies by 2030. We’re watching it closely. This might be the only Chinese stock you should own.

“Work from home” stocks like Peloton (PTON) and Zoom (ZM) are garbage, but…

There’s a big debate going on about the pros and cons of working from home.

For me, there is no debate: Remote work, works.

Unless you’re some goof-off who needs a boss shouting in your ear, you get far more done working from home (WFH).

The average commute pre-COVID was 54 minutes. Americans are saving over 60 million commute hours per day with remote work. Per day!

WFH is like a time machine that gives us thousands of hours of life back. We can all get a lot more done, which generates more wealth.

I’m confident the WFH revolution will lead to something HUGE. Possibly an economic boom unlike anything in our lifetimes.

WFH stocks like Peloton and Zoom are garbage. I never owned them. The implications here are much bigger.

Ever hear the old quote: “It was easy to predict mass car ownership but hard to predict Walmart?”

It was obvious American car ownership was going to explode in the 1950s. But the real money was made investing in the domino effects. Like the rise of Walmart (WMT).

Walmart pounced on the opportunity to put its supercenter stores on the outskirts where land and rent were cheaper. This allowed it to undercut competitors with its “everyday low prices.”

Walmart is one of the most successful businesses ever, and its stock has appreciated over 11,000% in the past 40 years.

I guarantee the Walmart of WFH is out there…

Today’s dose of optimism…

Having recently watched horrific footage from , it’s hard to be optimistic.

I can’t imagine the pain of my home—my personal sanctuary—being destroyed. Or seeing my children go hungry. Or worse yet, them being taken from me.

Would I still be so optimistic in the face of such unfathomable loss? I doubt it.

But it’s worth remembering this: In our parents’ lifetimes, thousands of men were slaughtering each other in trenches. From 1946 to 1950… even after WWII had ended… around half a million people died in wars each year.

Today, it’s one-tenth of that. That’s still 50,000 too many. But the reality is, this is the most peaceful time in human history.

It could be, and has been, far worse.

Stephen McBride

Chief Analyst, RiskHedge

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.

© 2023 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.