Stock Market Seasonal Buying Opportunities

Companies / Corporate Earnings Dec 04, 2023 - 07:15 AM GMTBy: Nadeem_Walayat

Dear Reader

Are you ready to rumble! Lets see of earnings season volatility can deliver some more buying opps in target stocks over the next couple of weeks.

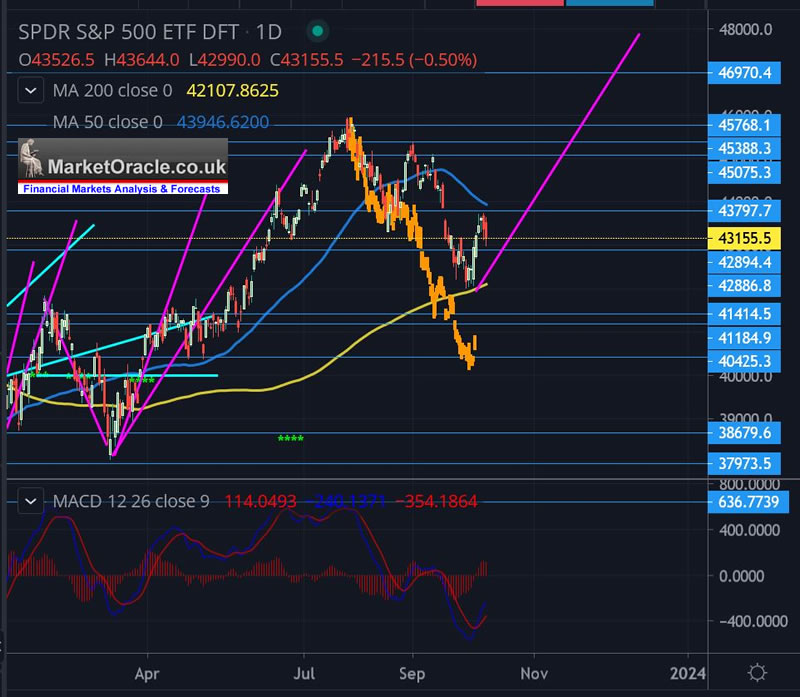

Where the S&P is concerned the expectation for an early October bottom at just below 4200 was freakily ac hived in terms of price and time and as my market brief illustrated going into October.

Stock Market Brief - 29th Sept 2023 - (5am UK Time)

Stock Market correction entering it's end game, S&P swing low is 4237 coming close to the sub 4200 target by Mid October, Thursday saw a technical bounce to 4300, therefore currently standing some 100 points above target. The window for the bottom is from late September to Mid October, so the S&P has upto 2 weeks left to trade to sub 4300 though most likely is just 3 trading days, so early next week could mark the end of this correction either via a lower low (sub 4200) or a higher low (above 4237)..

Too many were sat on the sidelines waiting for a plunge below 4200 towards 4100 so it's not much of a surprise that they didn't get what they wanted. Hence, one should be grateful for those opps that the market delivered in the likes of AMD, TSMC and ASML. We taketh what the market giveth, the market is the master and we are merely trying to ride on it's coat tails and not to fixate on the indices in ones individual stocks buying decision making process, the market gave numerous buying opportunities in a number of stocks, as it will likely do once again during earning seasons, it's just that we don't know exactly which will be the big surprises.

In terms of the overall market the S&P 'should' hold the early October low, if I had to guess how low it could go during earnings then to around 4270 looks a likely price point to target significant support, which fits with my existing base case for an UP October and a bull run into December to ac hive 4510+, that could even see a new bull market high. So I expect limited temporary downside, though again my focus is on the individual stocks rather than the S&P.

This article Stock Market Earnings Season Buying Opportunities was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my most recent analysis -

- AI Tech Stocks - The Good, the Bad and the Ugly

- Last Chance to Get on Board the Bitcoin Crypto Gravy Train - Choo Choo!

- AI Stock Market CRASH WARNING Going Into Big Tech Earnings Week

- Stock Market Earnings Season Buying Opportunities

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide 2023

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

Part 3 will follow in a few days time >

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Which is consistent with my expectations of how things would play out of over a year ago.

Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

EARNINGS Week starting October 16th

Tuesday 17th Oct

LMT $441 BMO - EGF -3% / -1% PE 15.9, -21% Range.

LMT is enjoying a price boost courtesy of the latest Middle East war that reversed an earlier downtrend that was targeting $370. Despite all of the wars earnings are not growing, so based on the fundamentals the stock should trade lower, i.e. target $370, but there is war fever inflating the stock price as the market discounts escalation to some degree, though nothing to suggest a major expansion in the conflict is imminent..

(Charts courtesy of stockcharts.com)

JNJ $157 BMO - EGF 4% / 4% PE 15.1, -81% Range.

JNJ is likely to respond positively to earnings, though I don't expect much price movement as it remains stuck in a $152 to $172 range, nevertheless the stock should rally on earnings to target the top of the range at $172,

Wed 18th Oct

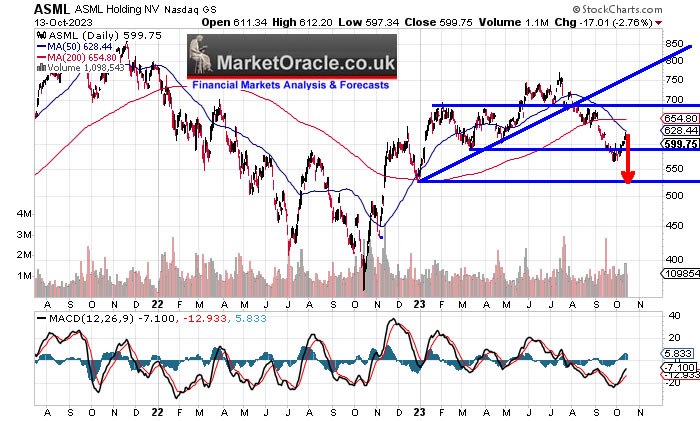

ASML $600 - BMO - EGF 7% / 14% PE 30.1, 33% Range.

A MONOPLOY that traded down to $564 from a high of $770. You don't often get such buying opps in such stocks! Which illustrates why the S&P is a nothing burger. As weakness begets weakness, we could get another dip into earnings that has a good chance of a break below $564 to target $530. Whilst the PE looks a little pricey at 30, ASML does have the growth to keep the bull run going.

The bottom line is that this is one of the best AI tech stocks out there which doesn't often deliver buying opps so don't blow it if as expected another one materialises! I will definitely be adding more to my 81% invested.

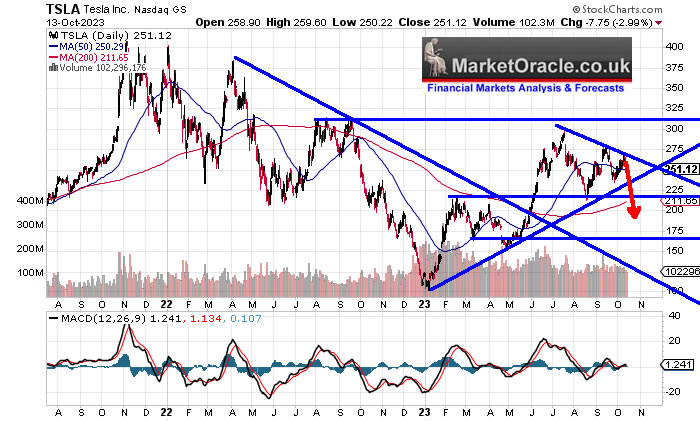

TSLA $255 AMC - EGF -15% / 2% PE 64, 9% Range

The EV Hype Master with a market cap greater than all other motor corps put together is primed to take a big plunge on earnings which could mark a trend that takes Tesla below $200. There just isn't the growth to justify a PE of 64. Compare ASML's metrics to that of TESLA, half the valuation for far higher growth which is because of TSLA hype. So Tesla should break it's August low to target sub $200, and could go as low as $175.

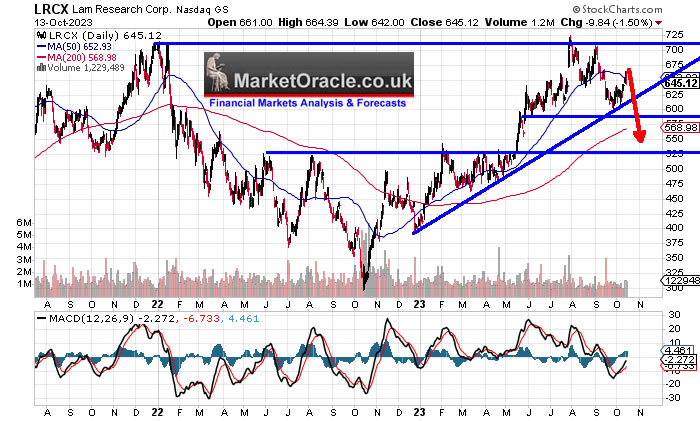

Lam Research AMC $645- EGF -29% / -11% PE 19, 73% Range

Very bad metrics are setting the scene for a potential sharp drop in the price of Lam Research into and on earnings, i.e. a break below $600 to target $550 which would be a 15% drop off the current price. Yes there is always a chance of an earnings surprise but without the benefit of hindsight I aim to capitalise on a break below $600, the stock has had a spectacular bull run off it's $295 low, all the way to high of $725 against which a drop to at least $550 is possible.

Thursday 19th Oct

TSMC $90,5 - AFMC - EGF -24% / -12% PE 15.3, 53% Range

TSMC bounced from $85 to $94 and given bad EGF's is primed to revisit the $85 low on earnings. Downside should be limited given that the stock has already fallen by 23% off it's $110 high, though a break of $85 would target $80.

Tech Stocks trading in or very near buying ranges, in portfolio order.

TSMC

Qualcom

ASML

PFE

RTX

UKW.L

ARW

On Semi

MED

CRUS

HPQ

BIDU

PRX

INMD

ULH

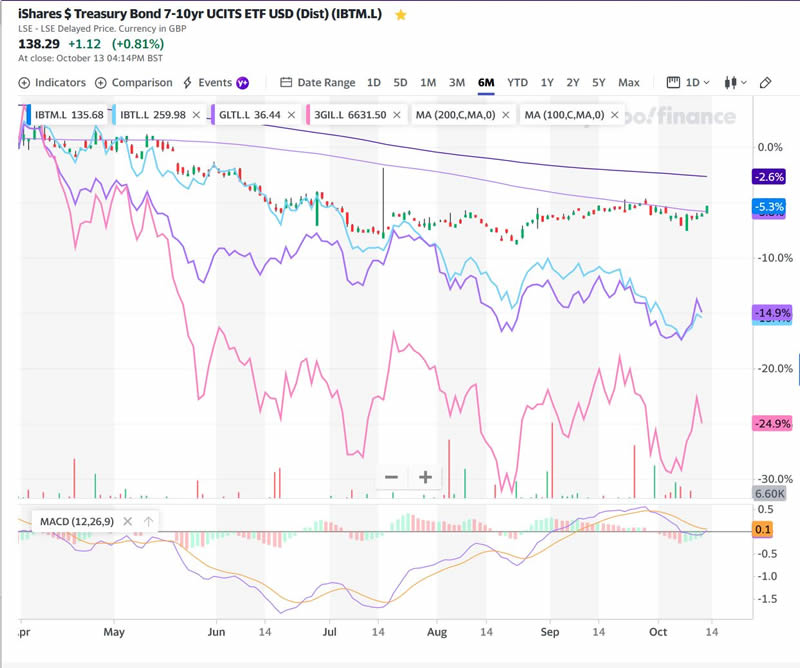

The Bond Trade

The Bond Markets look like they have bottomed.

Bond portfolio break down - percent invested of target.

IBTM.L 60%

IBTL.L 97%

GLTL 61%

3GIL.L 113%

Total size is 3% of portfolio. For more info see original 7th Aug Bond Trade article - https://www.patreon.com/posts/inflation-bond-87342150

The How to Get Rich part 2 Mega piece is virtually complete, I just need to read through and edit it a few times to make sure it all makes sense to others so I don't see why it should not be finalised and posted during the coming week.

Again this article Stock Market Earnings Season Buying Opportunities was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top, followed by correction to 4100 into Mid October before a year end rally to 4450+

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your cryptos accumulating analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.