Cisco Then vs. Nvidia Now

Companies / Nvidia Apr 18, 2024 - 10:45 PM GMTBy: Submissions

Owen Williams writes: We have been watching the S&P 500 and Nasdaq-100 melt-up since the minor correction ending in October 2023. While the narrative around a Fed “pivot” on rates sparked the turnaround, it is obvious since we started 2024 that the indexes are rising purely on momentum in a handful of stocks which are leading development of artificial intelligence (AI). Notably this is Nvidia, a semiconductor foundry, along with Meta and Microsoft.

Recent inflation data shows CPI and PPI inflation is getting sticky, with January, February, and March readings ticking up. The Fed rate cut narrative is fading (markets are down to pricing in only 3 or 4 cuts this year), yet the big cap indexes are not reflecting the deterioration of the interest rate cut narrative, nor the likelihood that “higher for longer” rates will slow economic growth. The reason is that the indexes have been hijacked by the mega cap stocks (25% of the S&P 500, but more important to the index due the implied volatility of these names). So goes Nvidia, so goes the other AI players, and so goes the S&P 500. Note that another mega cap, Apple, has failed to make new highs recently, as the company is not seen as an AI leader. This confirms that it is indeed AI that matters to markets today.

With Nvidia announcing another record quarter this past week, the stock jumped another +20%. In fact, any stock that beats earnings forecast and is active in AI is exploding. Just look at Meta earlier this month. As we started our career during the Tech Bubble, we recall how any company active in the development of the Internet say their stock prices go parabolic. Fast forward to today, and we are witnessing the same thing with AI. We are not making a judgment on the importance of AI. Maybe this technology is a game changer. But like with the internet revolution, markets are pulling forward a decade of earnings into today’s price (and likely being over-optimistic in Nvidia’s future chip sales).

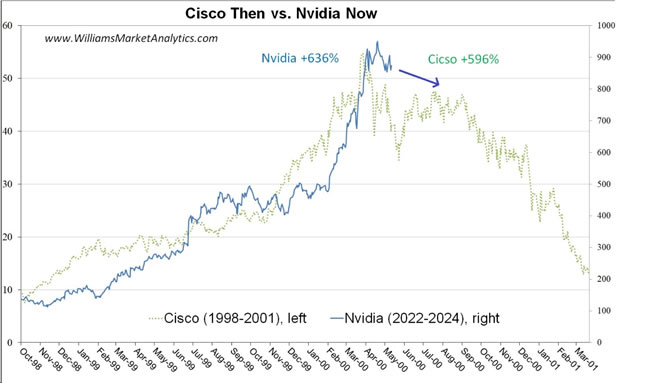

One of the poster children of the Internet Tech Bubble was Cisco. We carefully plotted the last two years of Cisco’s stock price against the leader of the AI Bubble, Nvidia. The similarities are astounding so we are sharing the chart below.

The overlay shows that the path of the two stocks over the past years has been similar. First, we see a run-up with only a several month consolidation period (no pull-back in price). Second, the magnitude of the rallies is similar, with Nvidia up +636% and Cisco up +596%. Finally, we see almost vertical price gains in the last stage for Cisco. While we can’t say Nvidia is over, we are again getting the vertical price gains.

We are confident that the Nvidia is a bubble, and we are equally confident that no one can know when it’s finally over. But a couple of interesting milestones we hit recently by Nvidia’s stock. First, Nvidia touched the $2.0 trillion market cap level, perhaps an objective for the algos. Second, the stock passed its pre-split highs around $840, as shown below, but stalled out below the symbolic $1000 price level.

Our only interest as investors in Nvidia is that the stock drives market sentiment currently. We don’t recommend buying, selling, or shorting Nvidia. For investors in the S&P 500 and Nasdaq, you are particularly exposed. With put options still cheap on the indexes, this is what we do recommend. As for our strategy portfolios, we remained focused on value dividend stocks, which should be relatively immune whenever the AI bubble bursts. Good luck to all!

By Owen WIlliams

Owen Williams is professor of finance at the EM Lyon Business School. He holds a PhD in finance from the Grenoble Ecole de Management and is a CFA charterholder. His research interests include asset pricing, currency markets, and portfolio theory.

© 2024 Copyright Owen WIlliams - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.