PepeCoin (PEPE): Anticipating Crypto Reversals using Elliott Waves

Currencies / cryptocurrency Feb 27, 2025 - 06:46 PM GMTBy: EWI

With just a basic understanding of the Elliott Wave Principle, you have a tool that can help you anticipate trends and trend changes.

The Wave Principle says that markets move in five waves in their primary direction (motive waves) and three waves in the countertrend direction (corrective waves).

Once a 5-wave impulse is complete, you can expect at the very least a 3-wave correction in the opposite direction.

Here's a recent real-world example that shows how Elliott Wave International's analysts were able to identify the end of a 5-wave move and the reversal that followed.

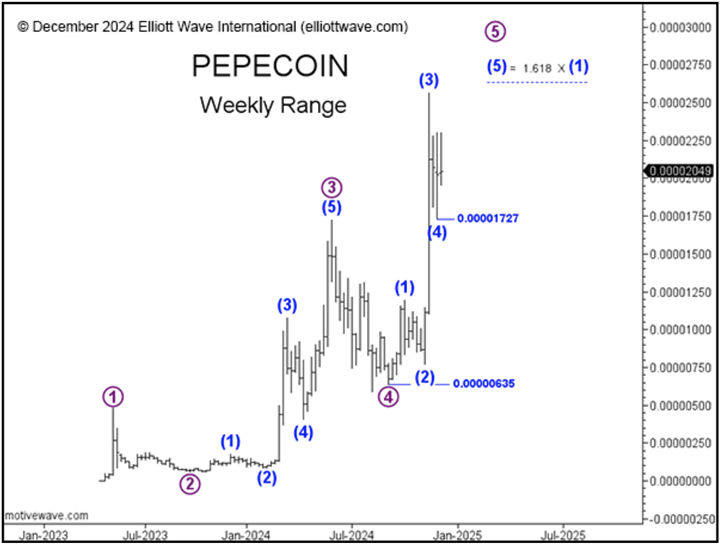

On December 6, EWI shared with subscribers this forecast for altcoin PEPE:

"Look for wave (5) to end near 0.00002630, the 1.618 multiple of wave (1)."

Result: PEPE rallied as forecast to complete wave (5) and then reversed course swiftly.

So, where's the next opportunity in cryptos?

See for yourself inside EWI's Crypto Opportunity Month. You'll find their detailed wave outlook for altcoins including PepeCoin and major cryptos: Bitcoin, Ethereum, XRP, Litecoin, Solana, Cardano and more.

Want to learn more about the Wave Principle? EWI's handy guide teaches you the essentials in just 30 minutes (it's free!)

This article was syndicated by Elliott Wave International and was originally published under the headline PepeCoin (PEPE): Anticipating Reversals using Elliott Waves. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.