Deaf, Dumb and Blind Economists Still Failing to Call Recession

Stock-Markets / Financial Markets Nov 08, 2008 - 10:07 AM GMT

More unintended consequences of the bailout. “When the government took over mortgage giants Fannie Mae and Freddie Mac, taxpayers inherited more than just bad debts. They're also potentially on the hook for tens of millions of dollars in legal fees for the executives at the center of the housing market's collapse.

More unintended consequences of the bailout. “When the government took over mortgage giants Fannie Mae and Freddie Mac, taxpayers inherited more than just bad debts. They're also potentially on the hook for tens of millions of dollars in legal fees for the executives at the center of the housing market's collapse.

With the Justice Department investigating companies involved in the mortgage and financial meltdown, executives around the country are hiring defense lawyers. Like many large companies, Fannie and Freddie had contracts promising to cover legal bills for their executives. When the Treasury Department delivered a $200 billion bailout to Fannie and Freddie, that obligation passed to the government, which may find itself paying for the lawyers defending the executives against the government's own prosecutors.

1.18 million Jobs lost…

( MarketWatch ) The U.S. labor market has collapsed in the past three months, shedding 651,000 jobs and driving the unemployment rate to its highest point in more than 14 years, the Labor Department reported Friday.

Payrolls have fallen for 10 straight months. Read the full government report. The last time the unemployment rate was as high as 6.5% was in March 1994. Most economists believe the jobless rate will probably rise to nearly 8% next year, territory last seen in the early 1980s. A low estimate, by any standards.

…still no economist wants to call it a recession.

( MarketWatch ) All but the most wildly optimistic believe the U.S. is in recession, but it may take months before it's official as the nation's recession watch-dog tries to figure out when it started.

"It's very unlikely we'll be able to resolve this before the end of the year," said Robert Hall, the Stanford University economics professor who chairs the business-cycle dating committee at the National Bureau of Economic Research, which has become the arbiter of U.S. recession dating.

By "this," Hall is referring to an opposing economic picture painted by the two most important indicators the committee uses to assess whether - and what month - the economy has entered a recession. The conflict is between job losses over 10 consecutive months and gross domestic product only contracting in the last quarter. Do you think those GDP numbers are accurate?

Post-crash planners keeping the faith…oops, not again!

Jane Bryant Quinn asks…” what about the financial planners who advise pre- and newly post-retirement clients to hold a substantial portfolio of stocks? Are there flaws in that theory of asset allocation? I put that question on the Web site used by members of the National Association of Personal Financial Advisors. The resounding answer: NO. They've kept the faith in a financial portfolio that's 50 percent to 60 percent invested in stocks for people facing a retirement of 20 to 40 years.” Will investors still believe them when the next wave is over?

Jane Bryant Quinn asks…” what about the financial planners who advise pre- and newly post-retirement clients to hold a substantial portfolio of stocks? Are there flaws in that theory of asset allocation? I put that question on the Web site used by members of the National Association of Personal Financial Advisors. The resounding answer: NO. They've kept the faith in a financial portfolio that's 50 percent to 60 percent invested in stocks for people facing a retirement of 20 to 40 years.” Will investors still believe them when the next wave is over?

Bond owners aren't going to like this news!

(Forbes) -- C oncerns of a pending onslaught of government debt hitting the market sent long-dated U.S. Treasury debt falling. Early equity weakness aside, the market locked its focus on the Treasury Department's announcement Wednesday that it would sell no less than $55.0 billion of 30- and 10-year notes, and will sell reopened 30-year bonds next week to meet its quarterly refunding needs. The total topped Wall Street's expectations, and was well ahead of the $18.0 billion refunding made in November of last year. Watch out below!

(Forbes) -- C oncerns of a pending onslaught of government debt hitting the market sent long-dated U.S. Treasury debt falling. Early equity weakness aside, the market locked its focus on the Treasury Department's announcement Wednesday that it would sell no less than $55.0 billion of 30- and 10-year notes, and will sell reopened 30-year bonds next week to meet its quarterly refunding needs. The total topped Wall Street's expectations, and was well ahead of the $18.0 billion refunding made in November of last year. Watch out below!

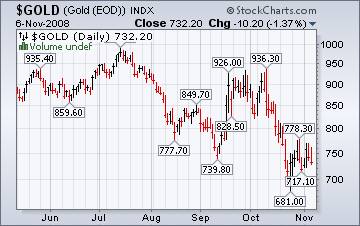

Can Gold keep from sliding?

( Bloomberg ) -- Gold rose for the first time in three days in London as the U.S. unemployment rate climbed to the highest since 1994, increasing the appeal of the metal as a haven against deepening economic gloom. Will the next onslaught of margin calls make an exception for gold?

Japan's individual investors more clever by half?

( Bloomberg ) -- Japan's individual investors, armed with more than $7 trillion in cash, piled into shares trading at their cheapest valuations ever last month, even as the global credit crisis prompted overseas fund managers to sell out. Individuals bought a record net 993 billion yen ($10.2 billion) of stock last month, according to Tokyo Stock Exchange data released today. New accounts at Japan's two largest online brokerage companies were opened in October at double September's pace, the companies said yesterday. This doesn't occur at bottoms.

( Bloomberg ) -- Japan's individual investors, armed with more than $7 trillion in cash, piled into shares trading at their cheapest valuations ever last month, even as the global credit crisis prompted overseas fund managers to sell out. Individuals bought a record net 993 billion yen ($10.2 billion) of stock last month, according to Tokyo Stock Exchange data released today. New accounts at Japan's two largest online brokerage companies were opened in October at double September's pace, the companies said yesterday. This doesn't occur at bottoms.

Can the Central Bank of China stop the decline?

Asian markets tumbled Thursday amid global economic worries, with China's main stock index dropping to a level it hasn't seen in more than two years, while benchmarks in Japan and Hong Kong slumped more than 5%.

Asian markets tumbled Thursday amid global economic worries, with China's main stock index dropping to a level it hasn't seen in more than two years, while benchmarks in Japan and Hong Kong slumped more than 5%.

On mainland China, the Shanghai Composite fell as low as 1,703.10, the benchmark's lowest since Sept. 14, 2006, before recovering. The index was recently down 2.7% at 1,713.38.

The worry in China is plunging exports.

The dollar is pausing to regroup.

(Bloomberg) -- The dollar fell against the yen and the euro on speculation a government report will show the U.S. economy lost the most jobs since 2003, bolstering the case for the Federal Reserve to lower interest rates. The speculation is that the Fed will lower rates again at the December Fed meeting by another 50 basis points. The question is, will the dollar continue falling or will it catch a bid.

(Bloomberg) -- The dollar fell against the yen and the euro on speculation a government report will show the U.S. economy lost the most jobs since 2003, bolstering the case for the Federal Reserve to lower interest rates. The speculation is that the Fed will lower rates again at the December Fed meeting by another 50 basis points. The question is, will the dollar continue falling or will it catch a bid.

Is the bottom in housing close? Should you even ask?

Is it pointless to ask whether a bottom is near? News reports have been seizing on data to raise the possibility of a leveling in house prices -- the tiny bump in new home sales reported this week is one example. Never mind that the 2.7% increase in new homes sold in September versus August was smaller than the bump in the same period last year.

Is it pointless to ask whether a bottom is near? News reports have been seizing on data to raise the possibility of a leveling in house prices -- the tiny bump in new home sales reported this week is one example. Never mind that the 2.7% increase in new homes sold in September versus August was smaller than the bump in the same period last year.

Irvine real estate consultant John Burns wonders why the idea of a bottom is getting so much play. "What's the expectation? That once a bottom is reached that housing prices will shoot back up? Doubt it," he writes .

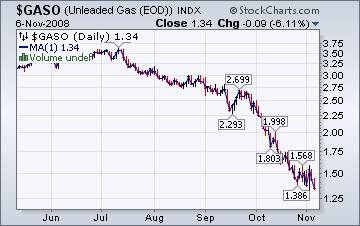

Gasoline may drop below $2.00/gallon at the pump!

The Energy Information Administration reports that, “Amid increasing concerns about a major economic downturn here in the United States and abroad, one bright spot for U.S. consumers is the continuing fall in the price of oil and oil products. At $2.40 per gallon on Monday, the U.S. average retail price for regular gasoline is down by more than $1.70 per gallon (wholesale) from its peak this past July.”

The Energy Information Administration reports that, “Amid increasing concerns about a major economic downturn here in the United States and abroad, one bright spot for U.S. consumers is the continuing fall in the price of oil and oil products. At $2.40 per gallon on Monday, the U.S. average retail price for regular gasoline is down by more than $1.70 per gallon (wholesale) from its peak this past July.”

Winter heating is more affordable.

The Energy Information Agency's Natural Gas Weekly Update reports, “ In contrast to the pattern of rising prices elsewhere in the Lower 48 States, prices in the Midwest, Northeast, and Alabama/Mississippi regions posted declines since last Wednesday. Relatively mild temperatures in the Midwest and Northeast regions likely contributed to the declines in these regions, as prices fell 5 and 25 cents per MMBtu on average, respectively.

The Energy Information Agency's Natural Gas Weekly Update reports, “ In contrast to the pattern of rising prices elsewhere in the Lower 48 States, prices in the Midwest, Northeast, and Alabama/Mississippi regions posted declines since last Wednesday. Relatively mild temperatures in the Midwest and Northeast regions likely contributed to the declines in these regions, as prices fell 5 and 25 cents per MMBtu on average, respectively.

We have met the Shallowest Generation and they are …US!

The Baby Boom Generation will never be mistaken for the Greatest Generation that survived the Great Depression and defeated evil in a World War that killed 72 million people. I hate to tell you Boomers, but putting a yellow ribbon on the back of your $50,000 SUV is not a sacrifice.

Our claim to fame is living way beyond our means for the last three decades, to the point where we have virtually bankrupted our capitalist system. Baby Boomers have been occupying the White House for the last sixteen years. The majority of Congress are Baby Boomers. The CEOs and top executives of Wall Street firms are Baby Boomers. The media is dominated by Baby Boom executives and on-air stars. We have no one to blame but ourselves for the current predicament. Blaming Franklin Roosevelt or Lyndon Johnson for our dire situation is a cop out. Baby Boomers had the time, power, and ability to change the course of our nation. We have chosen to leave the heavy lifting to future generations in order to live the good life today.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.