Another U.S. Interest Rate Cut and Financial Market Trends

Stock-Markets / Financial Markets Nov 12, 2008 - 09:27 AM GMTBy: Colin_Twiggs

Detroit Deja Vu - Speaker Nancy Pelosi and Senate Majority Leader Harry Reid recently sent a letter to Henry Paulson urging him to use funds from the Troubled Asset Relief Program (TARP) to rescue the big three automakers. Barack Obama has also hinted that he favors a taxpayer rescue ( WSJ.com ).

It is a sign of the times. The Australian government recently announced a $6.2 billion rescue package for their struggling automotive industry ( Canberra Times ). But I feel that I have seen this all before.

Detroit Deja Vu - Speaker Nancy Pelosi and Senate Majority Leader Harry Reid recently sent a letter to Henry Paulson urging him to use funds from the Troubled Asset Relief Program (TARP) to rescue the big three automakers. Barack Obama has also hinted that he favors a taxpayer rescue ( WSJ.com ).

It is a sign of the times. The Australian government recently announced a $6.2 billion rescue package for their struggling automotive industry ( Canberra Times ). But I feel that I have seen this all before.

The past does not repeat itself, but it rhymes. ~ Mark Twain

British LeylandRoll back the clock to 1975 when British Leyland was the largest automaker in the UK. Manufacturing 40 percent of all vehicles sold in Britain, the company boasted such famous marques as Jaguar, MG, Rover, Landrover, Triumph, Morris, Austin and the iconic Mini. However, BL was poorly run and over-staffed, with ageing manufacturing plant in nearly 40 different locations across Britain. No cohesive marketing plan and no provision for replacement of outdated models meant a struggle to compete with international brands. Then serious problems with trade unions made the company a by-word for Britain's industrial relations troubles of the 1970s. Frequent strikes, work stoppages, and mass walkouts — including more than 500 walkouts at their largest Midlands plant — brought the company to its knees.

Faced with the loss of one million jobs, Harold Wilson's Labour government agreed to a £2.4 billion bail-out. The government had entered the automotive business. Rather than recovering, BL continued to struggle until the arrival of new management in 1977. Sir Michael Edwardes was appointed Chief Executive and came close to shutting the company down, before splitting up and selling off the various divisions — with support from the newly-elected Margaret Thatcher. Austin Rover was eventually sold to BMW, who later on-sold it for the historic sum of £10. ( BBC )

The Path Of Least ResistanceCongress is now headed down the same path. Governments do not make good automakers. Rather than benefit the taxpayer, any bailout is likely to benefit investors, creditors and, for a short time, union members. When faced with tough decisions, management will inevitably follow the path of least resistance, with repeated calls for government assistance.

AMTRAKA few years earlier, in 1970, Congress bailed out the struggling Penn Central, authorizing $125 million in federal loan guarantees before creating AMTRAK the following year. The troubled AMTRAK has required on-going support ever since, squandering more than $30 billion of taxpayers' money. The annual subsidy from Congress reached almost $1.3 billion in 2007.

Buyer RebatesYou have heard it from me before, but I will repeat myself in case you missed it. The only way to rescue the automakers while at the same time avoiding becoming a welfare state is through buyer rebates. Offer a substantial rebate on the purchase of low emission or alternative energy vehicles. That stimulates new purchases while forcing automakers to innovate and compete for the buyer's dollar. Investors and creditors remain on the hook, and the Autoworkers Union will be more willing to compromise. To use an Australian expression: you have to keep the b.....ds honest.

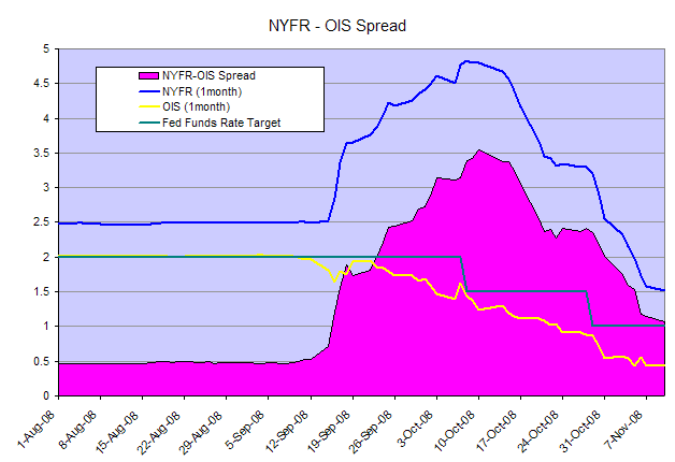

Another Rate CutThe Overnight Index Swap Rate (OIS), a close approximation of the effective Fed funds rate, points to another 50 basis point rate cut from the Fed. The chart below shows that the OIS is maintaining well below the Feds target rate of 1.0 percent. In effect the Fed has already passed the rate cut on to banks without formally announcing a target change.

The spread between the New York Funds Rate (1-month) and Overnight Index Swap Rate continues to decline and appears likely to reach 50 basis points within a few weeks. While spreads may be returning to normal, this does not necessarily indicate that confidence is restored. The market is on life support after massive injections of liquidity by the Fed. Stability will only return when there is full disclosure of both off-balance sheet liabilities and market value of securitized assets. Attempts to sweep these under the carpet will merely promote further mistrust. More banks still have to fail. The sooner the better.

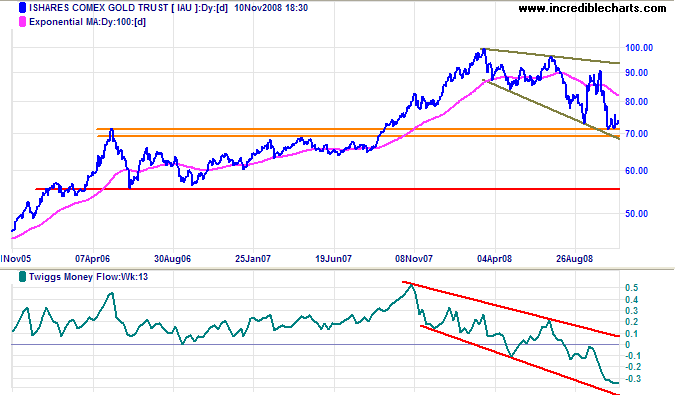

GoldSpot gold formed a pennant continuation pattern over the last two weeks. Breakout above $770 would offer a target of $870, calculated as $770 + ( 780 - 680 ). Reversal below $730 is less likely, but should not be ruled out — and would warn of another test of the band of support between $700 and $680.

Source: Netdania

The long term chart offers conflicting signals. The broadening descending wedge is a bullish pattern, but displays a bearish failed up-swing. And the downward trend channel on Twiggs Money Flow (13-Week) warns of long-term selling pressure. The primary trend is down, as well, and reversal below $680 would warn of another down-swing — to the June 2006 low of $550.

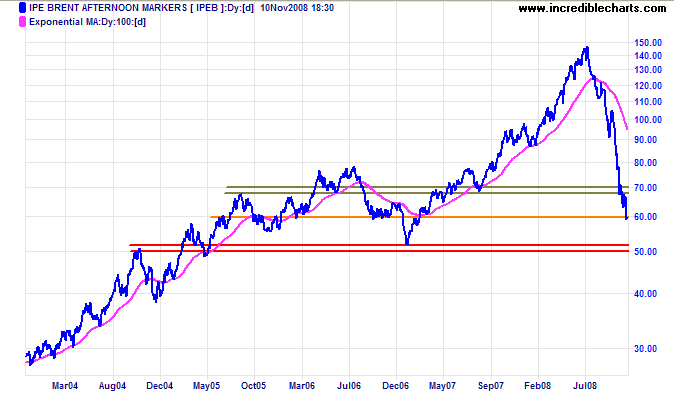

Crude Oil

West Texas Intermediate Crude broke downwards from a small flag continuation pattern and is now testing support at $60. Failure would offer a target of $50 per barrel.

Source: Netdania

The primary trend is down, driven by expectations of a global recession. OPEC production cuts have had little effect so far and failure of $50 would warn of long-term weakness.

|

Currencies

EuroThe euro formed a pennant continuation pattern. Downward breakout is more likely and would offer a target of $1.16, the 2005 low. Upward breakout is unlikely and would offer a target of $1.43.

Source: Netdania

Japanese YenThe dollar found strong resistance at 100 against the yen. Watch for narrow consolidation which would indicate an upward breakout, but reversal below 96 would warn of another test of support at 90.

In the longer term, failure of support at 90 would test 80 yen, while breakout above the descending trendline would signal another test of 111.

Source: Netdania

Australian Dollar

The Australian dollar is consolidating between $0.65 and $0.70 against the greenback, indicating uncertainty. Downward breakout would test $0.60, while upward breakout would offer a target of $0.80. Watch for narrow consolidation at either border which would warn of a breakout. The primary trend remains down.

Source: Netdania

The Aussie is consolidating between 63 and 71 against the yen. Downward breakout would test 55, while upward breakout would offer a target of 80.

Source: Netdania

We should measure welfare's success by how many people leave welfare, not by how many are added. ~ Ronald Reagan

By Colin Twiggs

http://www.incrediblecharts.com

Colin Twiggs is the leading commentator at Incredible Charts where he writes the Trading Diary , with more than 70,000 subscribers. His specialty is blending fundamental analysis of the economy with technical analysis of stocks, markets, commodities and currencies. Focusing on the role of the Fed and banking credit as primary drivers of the economic cycle, Colin successfully forecast the October 2007 bear market — eight months ahead of the sub-prime crisis.

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use .

© 2008 Copyright Colin Twiggs - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Colin Twiggs Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.