The Next Financial Markets and Real Earthquake

Stock-Markets / Financial Markets Nov 22, 2008 - 02:36 PM GMT

The next shoe to drop…synthetic CDOs. In an article by Alan Kohler of the Business Spectator we find the following observation, “As the world slips into recession, it is also on the brink of a synthetic CDO cataclysm that could actually save the global banking system. It is a truly great irony that the world's banks could end up being saved not by governments, but by the synthetic CDO time bomb that they set ticking with their own questionable practices during the credit boom.

The next shoe to drop…synthetic CDOs. In an article by Alan Kohler of the Business Spectator we find the following observation, “As the world slips into recession, it is also on the brink of a synthetic CDO cataclysm that could actually save the global banking system. It is a truly great irony that the world's banks could end up being saved not by governments, but by the synthetic CDO time bomb that they set ticking with their own questionable practices during the credit boom.

In other words, the bankers who created the synthetic CDOs knew exactly what they were doing. These were not simply investment products created out of thin air and designed to give their sales people something from which to earn fees – although they were that too. They were specifically designed to protect the banks against default by the most leveraged companies in the world. And of course the banks knew better than anyone else who they were.

Here are some of the companies that are on all of the synthetic CDO reference lists: the three Icelandic banks, Lehman Brothers, Bear Stearns, Freddie Mac, Fannie Mae, American Insurance Group, Ambac, MBIA, Countrywide Financial, Countrywide Home Loans, PMI, General Motors, Ford and a pretty full retinue of US home builders.”

I may be wise to read the article in full to get the full impact of this event.

What's next, earthquakes?

FEMA predicts that a large earthquake may cause "widespread and catastrophic physical damage" across Alabama, Arkansas, Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee -- home to some 44 million people. This is known as the New Madrid Seismic Zone.

Experts have long tried to predict the likelihood of a major quake like those that struck in 1811 and 1812. These shifted the course of the Mississippi River and rang church bells on the East Coast but caused few deaths amid a sparse population. Something to consider.

A retest of a retest…Déjà vu all over again?

( Bloomberg ) -- U.S. stocks swung between gains and losses a day after the Standard & Poor's 500 Index slid to its lowest level in 11 years as growing concern over the survival of Citigroup Inc. offset a rally in commodities producers. Citigroup tumbled 17 percent to an almost 16-year low after people who listened to a conference call with employees said Chief Executive Officer Vikram Pandit has no plans to break up the company. JPMorgan Chase & Co. sank 11 percent as the S&P 500 Financials Index dropped to the lowest level since 1995.

( Bloomberg ) -- U.S. stocks swung between gains and losses a day after the Standard & Poor's 500 Index slid to its lowest level in 11 years as growing concern over the survival of Citigroup Inc. offset a rally in commodities producers. Citigroup tumbled 17 percent to an almost 16-year low after people who listened to a conference call with employees said Chief Executive Officer Vikram Pandit has no plans to break up the company. JPMorgan Chase & Co. sank 11 percent as the S&P 500 Financials Index dropped to the lowest level since 1995.

Sliding market trumps debt issue.

( Bloomberg ) -- Treasuries fell, with 10-year notes eroding the biggest weekly gain since the stock market crash of 1987, as Asian shares advanced and Standard & Poor's 500 futures rose. Notes slid after Federal Reserve Bank of St. Louis President James Bullard said the central bank has limited room to cut interest rates and downplayed the risk of deflation. Yields rose from record lows, after the five-year rate dropped to levels not seen since 1954, as the gain in shares curtailed demand for the relative safety of sovereign debt.

( Bloomberg ) -- Treasuries fell, with 10-year notes eroding the biggest weekly gain since the stock market crash of 1987, as Asian shares advanced and Standard & Poor's 500 futures rose. Notes slid after Federal Reserve Bank of St. Louis President James Bullard said the central bank has limited room to cut interest rates and downplayed the risk of deflation. Yields rose from record lows, after the five-year rate dropped to levels not seen since 1954, as the gain in shares curtailed demand for the relative safety of sovereign debt.

People are scrambling into what seems to be rising.

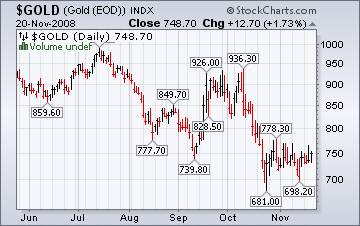

( Bloomberg ) -- Gold was the biggest gainer today, followed by silver, among 19 commodities on the Reuters/Jefferies CRB Index. As economies in the U.S., Japan and Europe head into recession, central banks may be forced to lower interest rates and pump more liquidity into the financial system, devaluing their currencies, analysts said.

( Bloomberg ) -- Gold was the biggest gainer today, followed by silver, among 19 commodities on the Reuters/Jefferies CRB Index. As economies in the U.S., Japan and Europe head into recession, central banks may be forced to lower interest rates and pump more liquidity into the financial system, devaluing their currencies, analysts said.

But is this the real trend?

Do Japan's investors think stocks are cheap enough?

( Bloomberg ) -- Japan stocks rose, reversing a morning drop and paring a weekly decline, after investors pounced on shares trading near the lowest in almost three decades and a newspaper reported Citigroup Inc. may be sold. The Nikkei had fallen by 48 percent this year as the credit crisis triggered by the collapse of the U.S. housing market prompted banks to tighten lending. Japan will likely have its longest recession in a decade with gross domestic product falling the next two years, according to economists surveyed by Bloomberg.

( Bloomberg ) -- Japan stocks rose, reversing a morning drop and paring a weekly decline, after investors pounced on shares trading near the lowest in almost three decades and a newspaper reported Citigroup Inc. may be sold. The Nikkei had fallen by 48 percent this year as the credit crisis triggered by the collapse of the U.S. housing market prompted banks to tighten lending. Japan will likely have its longest recession in a decade with gross domestic product falling the next two years, according to economists surveyed by Bloomberg.

Is the rally over for Chinese stocks?

( Bloomberg ) -- China stocks fell, sending the benchmark CSI 300 Index to a weekly loss, on concern a deepening global recession will stifle profits. “Investors are concerned about the global economy and bad corporate profit prospects,'' said Philippe Zhang , chief investment officer at AXA SPDB Investment Managers in Shanghai, which oversees about $150 million. ``Measures by China's government are helpful in preventing a hard landing for the economy, but lower growth and corporate profit is a sure thing.''

( Bloomberg ) -- China stocks fell, sending the benchmark CSI 300 Index to a weekly loss, on concern a deepening global recession will stifle profits. “Investors are concerned about the global economy and bad corporate profit prospects,'' said Philippe Zhang , chief investment officer at AXA SPDB Investment Managers in Shanghai, which oversees about $150 million. ``Measures by China's government are helpful in preventing a hard landing for the economy, but lower growth and corporate profit is a sure thing.''

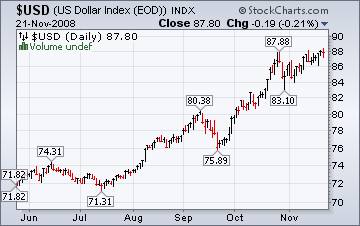

How high can the dollar go?

( Bloomberg ) -- The dollar was poised for a third weekly gain against the euro as a plunge in global stocks increased demand for the safety of U.S. government debt. “It's all about risk in this emotional market,” said Jacob Oubina , a currency strategist at FOREX.com, a unit of online currency trading firm Gain Capital in Bedminster, New Jersey. “Risk aversion is still prevalent.” In other words, the dollar may go higher.

( Bloomberg ) -- The dollar was poised for a third weekly gain against the euro as a plunge in global stocks increased demand for the safety of U.S. government debt. “It's all about risk in this emotional market,” said Jacob Oubina , a currency strategist at FOREX.com, a unit of online currency trading firm Gain Capital in Bedminster, New Jersey. “Risk aversion is still prevalent.” In other words, the dollar may go higher.

Subprime lenders still up to their old tricks.

As if they haven't done enough damage. Thousands of subprime mortgage lenders and brokers—many of them the very sorts of firms that helped create the current financial crisis—are going strong. Their new strategy: taking advantage of a long-standing federal program designed to encourage homeownership by insuring mortgages for buyers of modest means. You read that correctly. Some of the same people who propelled us toward the housing market calamity are now seeking to profit by exploiting billions in federally insured mortgages. Washington, meanwhile, has vastly expanded the availability of such taxpayer-backed loans as part of the emergency campaign to rescue the country's swooning economy. This is not a good combination.

As if they haven't done enough damage. Thousands of subprime mortgage lenders and brokers—many of them the very sorts of firms that helped create the current financial crisis—are going strong. Their new strategy: taking advantage of a long-standing federal program designed to encourage homeownership by insuring mortgages for buyers of modest means. You read that correctly. Some of the same people who propelled us toward the housing market calamity are now seeking to profit by exploiting billions in federally insured mortgages. Washington, meanwhile, has vastly expanded the availability of such taxpayer-backed loans as part of the emergency campaign to rescue the country's swooning economy. This is not a good combination.

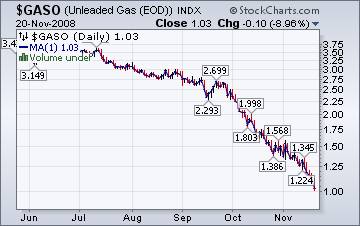

Gasoline may see a bottom soon.

The Energy Information Administration reports that, “For the ninth consecutive week, gasoline prices fell in all regions of the country with the U.S. average price for regular gasoline tumbling another 15.2 cents to reach 207.2 cents per gallon. Not only has the U.S. average fallen 204.2 cents per gallon from the all-time high set on July 7 of this year, the price is now the lowest since March 14, 2005. In the Midwest, the price shrank 12.7 cents to hit 193.3 cents per gallon, the lowest of any region.”

The Energy Information Administration reports that, “For the ninth consecutive week, gasoline prices fell in all regions of the country with the U.S. average price for regular gasoline tumbling another 15.2 cents to reach 207.2 cents per gallon. Not only has the U.S. average fallen 204.2 cents per gallon from the all-time high set on July 7 of this year, the price is now the lowest since March 14, 2005. In the Midwest, the price shrank 12.7 cents to hit 193.3 cents per gallon, the lowest of any region.”

Cole temperatures not affecting natural gas yet.

The Energy Information Agency's Natural Gas Weekly Update reports, “ A major weather front from the north entered the Midwest and the East this week, bringing the coldest temperatures of the season to date . Increased space-heating demand in consuming regions led to gains in prices throughout the country with the benchmark Henry Hub price advancing on the week by 11 cents per MMBtu, or less than 2 percent, to $6.76.”

The Energy Information Agency's Natural Gas Weekly Update reports, “ A major weather front from the north entered the Midwest and the East this week, bringing the coldest temperatures of the season to date . Increased space-heating demand in consuming regions led to gains in prices throughout the country with the benchmark Henry Hub price advancing on the week by 11 cents per MMBtu, or less than 2 percent, to $6.76.”

The Nest, once empty, is full again.

Many parents and grandparents are now finding their once quiet homes being filled with old, familiar sounds again. Babies crying, televisions blaring and the front door being left open as a younger generations find the old empty nest a safe haven from the tempestuous economy. While some look at this as a disaster, many find that there are unforeseen benefits, including a sense of worth and community not found while living alone. The L.A. Times has an article that gives us some insight into the new living arrangements.

"I feel I can help out with the hardest stage of life -- when you're raising young children," she says. "As grandparents we need to feel we're valuable, and while I'm not perfect, I'm a lot better than I was when my kids were little. The one skill we grandparents can claim is that we know something about child nurturing and the value of family. This is what we did 200 years ago, and it made total sense."

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.