Euro to Rally on Further ECB Interest Rate hikes and Yen Carry Trade

Currencies / Euro Apr 12, 2007 - 01:22 PM GMTBy: Jim_Willie_CB

Hardly a dull moment in the currency market these days. Much attention centers upon central bank actions. The Bank of Japan held steady, as world speculators thank heavens. The Euro Central Bank held steady, as the US bankers thank heavens. But the ECB aint done hiking. The Bank of England held steady, just like the ECB, but earlier. The Reserve Bank of Australia held steady, from Down Undah. The Bank of Canada held steady, but now markets think they could hike soon. We live in a bond driven world, totally divorced from economic fundamentals, trade deficits, mismanaged economies, and bankrupt policies.

Some brief points are provided on currency matters, each detailed more fully in the April Hat Trick Letter due out over next weekend, the US income tax deadline. They all are pertinent to gold. From the other side of the chasm is the housing & mortgage crisis, another impetus for gold. Let it be known we have a 3-SIGMA event on our hands, a credit derivative early stage in the meltdown.

With the rising euro currency will come massive shock waves to the FOREX markets and to precious metals. The euro is the lever placed at the fulcrum of the gold and silver prices. As the euro breaks out, the $700 mark for gold and the $15 mark for silver will be surpassed. The breakout will cause problems for the European economy, as competing currency wars ratchet up dangerously.

SIGNALS FROM JAPAN & CHINA

A good forward indicator for the Japanese yen currency, and its associated Yen Carry Trade unwind, is the Nikkei stock index of major Japanese stocks. A highly bullish triangle has shown itself, undeterred by the recent late winter shock. The Bank of Japan cannot deliver a series of shocks. The BOJ and other central bankers must weigh the risks of continued easy money in Japan where domestic risks are mounting, versus the pain of more shock waves to the global financial market. Let it be known the Nikkei index is saying “yen will remain weak” in clear fashion. Stocks are forward signals. This is a big flashing green light for continued Yen Carry Trade, a crucial ingredient to global market speculation, of which gold is part (hard to admit).

Central banks clearly hold the levers in the global financial game, which increasingly resembles the Competing Currency Game described and warned by Von Mises. The wild card in the equation stands as trade war between the United States and China , my longstanding call. The USDollar stands as vulnerable as the USGovt busily, fruitlessly, and mindlessly files complaints against China to the World Trade Organization. Sure, China violates free trade, but WTO complaints don't fix anything. Movie and software DVD's were publicly smashed and destroyed in Beijing last week, only to go back on sale in back alleys the very next day. Trade war is mutually destructive, and that is the path we are on. Next up is politicians running for Congress in the Untied States on a platform of trade sanctions against China . The trade conflict will again be on the G8 Meeting agenda, when finance ministers meet in Washington on April 13-th.

The grand weapons to be wielded by China is their $1200 billion reserves account, including the $300 billion direct investment account. They are dead set on investing in commodity stockpiles like oil and metal ores, as well as acquiring strategically important foreign companies who own mineral and resource properties. Their buying spree will keep a strong bid under commodities, and sustain its mighty bull. Calls by Wall Street of a dead commodity bull are like harlots urging for virtue.

SIGNALS FROM EUROPE

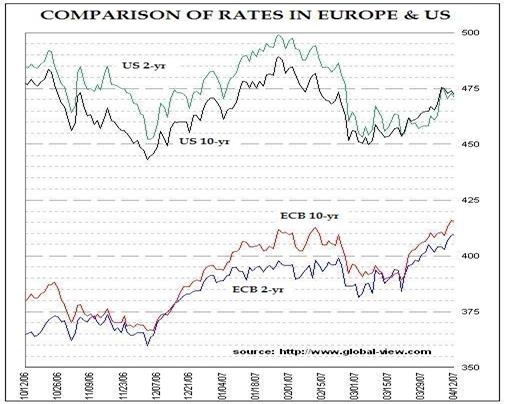

The Euro Central Bank affects the all important euro currency exchange rate versus the US $. The official ECB interest rate is 3.75%, but is certain to rise. Consensus is loud and firm, that more rate hikes lie ahead. The bond yield differential will continue to drive the euro up. See the excellent chart provided with permission ( http://www.global-view.com ) which shows the yield spreads between the 2-year and 10-year Govt bond yields, from USTreasurys and EuroBonds.

The euro peak of 136.6 at the end of December 2004 will be shattered, and soon, likely to whiz past 140 before the autumn trees change leaf colors. The European interest rate futures contract places the June2007 ECB rate at 4.14%, the Sept2007 rate at 4.25%, and the Dec2007 rate at 4.30%, signaling at least two more 25 basis point hikes. With each ECB rate hike will come a lift in the euro currency. New highs are a certainty, and with those highs will come an assault on the $700 gold price. The euro will easily surpass the 136.6 highs from 16 months ago, and in fact soar past the 140 easily. Also, a rise in the British sterling currency will not require higher interest rates in England , but rather the growing certainty of lower US official rates. Tremendous problems are sure to come next from the euro breakout, principally from European manufacturers. Their powerful car makers will also do what they did early in this calendar year, push for pressure on the Bank of Japan to lift interest rates and end their trade subsidies hidden to currency suppression. Expect pressure on the BOJ to mount by early summer into another crescendo.

EURO/YEN CROSS CONTINUES UP

The triangle of currencys consists of the US $, the Euro, and Yen. The euro is rising against both its competitors. Sure, the yen is down, sporting an 83 handle, exactly as forecasted here following their March Repatriation. The yen has lost almost all of its mojo in the last few weeks, no longer even in the news much. The anticipated move to the sidelines by the Bank of Japan on the official interest rate was also expected. They did not act in the past week.

Without a doubt, heavy pressure came from the United States , where Wall Street bankers are probably the largest yen carry trade participants. The yen is best seen in the euro/yen cross. That all important cross has broken out to even higher highs, even after a March jolt of major proportions. The trendline in the cross offered solid support, more than expected by me, further assisted by the 20-week moving average. The cross might seem obscure to North Americans, but to Europe and Japan the cross is a direct translation of currencys. Trading and speculation bear direct relevance. Japan still has a near 0% yield, and European yields are almost certainly to rise. Case closed.

THIRD WORLD FINANCES

A remarkable embarrassment is revealed by a close look at national reserves. The low puny US $41 billion in reserves leaves the US vulnerable to a currency attack, but then again, the alchemists at the USGovt and Dept of Treasury can easily print ample amounts of money secretly, from which to support the USDollar. If the US reacts to a run on the USDollar by printing money in its support, then merciless FOREX traders will jump on the USDollar and attack it in round after round, just on the dilution basis. The USGovt saw fit recently to slap a tariff on Chinese coated paper. Next targets are textiles, electronics, and toys. Other trade friction has cropped up against Japan , accused by US Congressional members as illegally subsidizing trade with a suppressed currency. So the USGovt is picking fights with their greatest USTBond supporters. They should be thankful their lands have not been occupied by US Military forces. Sorry, could not resist. USGovt leaders are horrendously misguided in believing that yuan currency appreciation will fix anything. These issues are analyzed in the report, and the actual major unresolvable problem is cited, labor cost.

The embarrassment comes from comparisons. China has $1200 billion with latest updates. Japan has $884 billion. Lowly Third World nations have more than the United States ! See Malaysia at $82B, Poland at $49B, Indonesia at $46B, and Nigeria at $42B. Such numbers reinforce the notion that the US has Third World characteristics.

The US and Europe cannot have it both ways, requiring a low Japanese interest rate for bond speculation, and objecting about trade subsidy. The USGovt has lost control of the USDollar, at a time when trade war is escalating, trade deficits continue unabated, the US grows increasingly isolated, and a costly unpopular war festers.

Trade friction has arrived, on a grand scale. Heck, it has been a problem all along, even during the years when moronic justification was calling it a “low cost solution” for cheaper consumer products to hungry American consumers. Can anyone remember that moronic economic mythology premise relied upon as a pillar of globalization and trade just a few short years ago? It was mocked by me, and now has curiously vanished as a claimed pillar. Short memory, scapegoating, atrocious economic stewardship.

LOONIE REVIVES

The intermediate correction in the Canadian Dollar appears to be behind us. The factors behind it are technical, economic, and commodity related, in my view, discusses in more detail in the report. The immediate cause which many seem to point to is the growing likelihood of another rate hike by the Bank of Canada. Currently at 4.25%, the official interest rate is still 100 basis points below the benchmark USFed rate. What is called the banker acceptance futures contract, which reflects likelihood of official rate, has lifted from 4.05% on March 5-th to 4.37% suddenly by April 10-th. Thus a 50% chance is perceived for a rate hike next. The differential can improve with a cut in US rates, or even such an expectation. My view is that two other factors are strongly affecting the loonie, details provided. Next resistance is in the 88 to 89 cent range.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“I think you bring the most refreshing voice to our hard asset community that I have experienced in a long time. Your unique blend of erudition and irreverence have kept me most engaged. Your newsletter is remarkable in its scope about all things worldwide that effect our financial well-being. I think you are totally brilliant, the new Doug Casey on the scene.”

(Lori B in Washington )

“As an old time subscriber, congratulations on your newsletter. It stands outside of the crowd like the Dow Theory Letter from the famous Richard Russell. Keep up your excellent work which is worth a thousand times the subscription price.”

(Peter O in Austria )

“I have spent some time lately reading the special reports. Your work is brilliant, the depth of what you are doing is titanic. It is an incredibly complex and dense world that we live in. You are penetrating the fog, the lies, the misconceptions, and the poppycock. It is going to be amazing to watch it all unfold, and your commentary along the way will be the sizzle on the steak.”

(Gregg F in Illinois )

“I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.”

(Gabriel R in Mexico )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

The golden jackass is designed to inform and instruct in the complex ways of gold, currencies, bonds, interest rates, stocks, commodities, futures, derivatives, and the world economy, with no respect shown for inept bankers and economists, whose policies and practices contribute toward the slow motion degradation, if not destruction, of the financial world ~ Jim Willie CB, aka "The Golden Jackass" www.GoldenJackass.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.