Gold and Financial Markets- A Nova-view

Stock-Markets / Financial Markets Nov 23, 2008 - 05:02 AM GMTBy: Brian_Bloom

The jump in the gold price on Friday November 21st 2008 may be the harbinger of a sea change in attitudes in the markets in general. To understand the implications of this it is probably appropriate to take a step back and take a fresh look at the Big Picture.

The jump in the gold price on Friday November 21st 2008 may be the harbinger of a sea change in attitudes in the markets in general. To understand the implications of this it is probably appropriate to take a step back and take a fresh look at the Big Picture.

The chart of the ratio of the gold price to the commodities index enables us to monitor whether the markets are viewing gold as just another commodity or, perhaps, something other than a commodity. Below is a 3% X 3 box reversal Point and Figure chart of this ratio (courtesy stockcharts.com).

Clearly, gold has been in a bull trend relative to commodities and, if the double top resistance level at 231.55 is penetrated on the upside, then all hell could break loose and the price of gold might explode upwards, given the shortages of physical gold that have been building behind the scenes. (See: http://www.theaustralian.news.com.au/business/story/0,28124,24687337-643,00.html )

A few days ago I happened to spot some downside gaps in the Bond Yield charts. One example – a Bar Chart of the 10 year yield – is shown below (courtesy Decisionpoint.com)

Let’s examine this particular chart in some detail. It may hold some important clues.

- Back in January 2008 there was an exhaustion gap followed by a strong rise (This rise was probably trader driven or caused by other artificial interference).

- Then, in May, the yield pulled back down again – accompanied by a rising bottom in the PMO.

- This latter “non confirming” fact was a signal that the yields may continue to rise; which they did.

- But this time around (November 21st, 2008), the PMO is not yet oversold. Yields “may” continue to fall as investors continue their rush to safety.

- Importantly, the rush to safety is showing no technical signs of abating yet. It follows that this latest gap may turn out to be significant. It is very likely evidencing a build up of “fear”.

Of course, this fear may abate. If it does, the PMO may show a similar non confirmation to that which occurred in May. But it’s too early to make the call.

What could cause the fear to abate? Well, the Fed may decide to throw yet more money at the markets. After all, with a propensity of the authorities to “bail out” everything that moves in this so-called capitalist society, it appears that obtuseness knows no depths. So we shouldn’t rule out the possibility that the markets may experience a temporary respite.

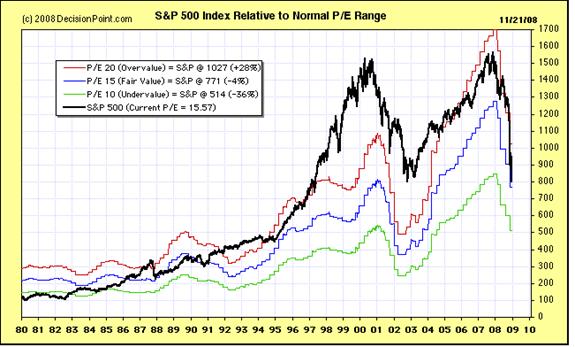

On the other hand, dear reader, you and I need to face up to the realities of life and deal with them. One “real” reason for this fear may lie in the chart below – of the S&P Price Earnings multiples.

We should bear in mind that the black line (actual) is derived from the current share prices divided by historical earnings. The fact that the black line is now resting at the same level as the blue line needs to be carefully considered. “Fair Value” is a misleading concept in context of corporate earnings which are expected to continue falling for the foreseeable future. In short, the equity market is still fundamentally overvalued.

It follows that any technical support levels on the S&P Index should be treated with circumspection.

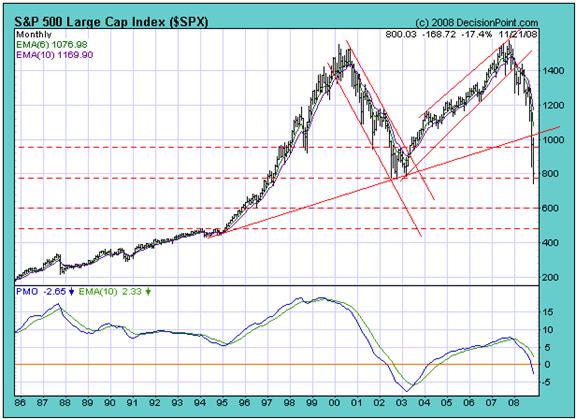

The chart below is a monthly chart of the $SPX.

It is clear from this chart that the 800 level is very significant. If that is penetrated on the downside, then there is minor support at 600 and some fairly significant support at 400. (50% fall).

However, the 50% principle to which Richard Russell has been referring recently is critically important. The commencement point of the Bull Market is not visible on this chart (it predates 1986) and it is not immediately available to me. However, for the sake of argument, let’s assume that the starting point was around 40. Given that the peak was at around 1560, then the halfway mark would be around 800. Under these circumstances it would follow that, if the 800 level was to be penetrated on the downside, the market could pull all the way back to the level which prevailed when Ronald Reagan took the decision to turn the USA into a deficit country in order to drive the world economy.

That outcome – should it occur – will represent bullet proof evidence that markets cannot be “managed” in the long term. The market has a life of its own and it is more powerful than the combined might of those who would seek to control it. In turn, if the 800 level is penetrated on the downside, this single event will invalidate the logic of the very existence of the United States Federal Reserve System.

Now, regular readers will be aware that whilst I am absolutely a long term bull on the gold price, I am very skeptical regarding the potential for the world’s financial system ever again to become governed by a gold standard. To me, the practical issues outweigh the theoretical arguments. Having said this, “the markets” seem to be signaling that gold is being viewed as a safe haven and I have just got through explaining how powerful the collective will of the markets is. I’m not about to argue with the markets.

In the very first article I ever published on the internet on the subject of gold, on August 6th 2002, (see http://www.gold-eagle.com/editorials_02/bloom080502.html ) , I made the following statement:

“I put it to you here that the collective intellect of the people who recognise that all is not well would be more fruitfully devoted - not to finding reasons to justify an upward explosion in the Gold Price - but to finding ways and means of preventing this from happening.

Just as aspirin will take away the symptoms of a headache, suppression of the gold price is not the way. We need to be applying our minds to how we can accelerate the march to market of the new, employment generating technologies. The politicians should be lobbied - not with wild eyed validations of gold price suppression - but with constructive suggestions of what should be done to avoid the growing threat of an implosion of the debt mountain.”

Conclusion

The US Federal Reserve System is not operating in the real world. Its very existence is a function of the fantasies of a group of men who aspired to the impossible – to gain supremacy over the economic environment. If the 800 level on the $SPX is penetrated on the downside, the opportunity to avoid a world depression will almost certainly have been lost. Yes, the gold price will very probably explode upwards, but what benefits will that bring to society as a whole? Solutions to the world’s economic problems have never lain in monetary policy. Solutions lie in wealth generating activities which are socially desirable because they address real needs. We can either face the reality of that now, or we can continue to suffer until such time as we finally do face it.

Post Script

Whilst public projects such as dams, roads, bridges, etc. are employment creating activities they are not wealth generating activities. That, ultimately, is why World War II broke out – which “forced” the world to focus on developing more powerful (energy oriented) technologies. Ultimately, wealth generating activities are facilitated by energy dependent technologies. For example, one cannot till the land, sow the seeds, harvest the crops, store them and deliver them to market without horsepower or its modern day equivalent. For example, one cannot mine the earth’s mineral resources or manufacture products or build roads or dams or bridges or buildings – or fly to the moon – without horsepower or its equivalent.

Economics has always been driven by “energy” and always will be. Fossil fuels have passed their use-by date and – for various reasons – nuclear fission is not the way to go. In a recent poll across 20 countries, the public voted. (See: http://www.worldpublicopinion.org/pipa/articles/home_page/570.php?nid=&id=&pnt=570&lb= ) The greater public wants more solar and wind energy and less fossil fuels and nuclear fission energy. Are the politicians listening?

And then of course, there is always the possibility that electromagnetic energy scavenging may hold the “final” key. But the public hasn’t yet been introduced to that possibility and the scientists believe it’s a nonsense idea – which is another reason I wrote Beyond Neanderthal. There is no place for prejudice in today’s world. All options need to be seriously examined.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.