Gold, Metals and US Dollar Analysis : Got Discipline?

Commodities / Gold & Silver Apr 15, 2007 - 07:17 PM GMTBy: Dominick

Joe Nicholson writes “Whether the Federal Reserve tightens incrementally to look tough on inflation for which it is almost entirely responsible, or whether it makes a small cut to support a busted housing market for which it is entirely responsible, precious metals are poised to be the long term beneficiaries of either policy choice.”

~ Precious Points: All I Really Need to Know About the Economy I Learned in Kindergarten , April 01, 2007

The last few updates essentially took the position that the short term fundamental outlook was muddled, but that, nonetheless, precious metals stood to benefit in any likely event. Despite the ebb and flow of rate cute expectations, gold and silver (and platinum, too!) indeed extended their rallies over the past two weeks on steady declines in the dollar and persistent inflation data. An 11.9% increase in M2 over the last six weeks probably hasn't hurt either.

On Friday, the metals understandably had a strong initial reaction to the headline inflation number, but when the dollar reversed against the Euro and strengthened, perhaps on the misguided attempt to paint the PPI as anything other than what it is – a clear sign that producer prices are high and headed higher – gold and silver gave back some of their gains. When the Euro recovered later in the day, metals were able to take better advantage of the inflation data.

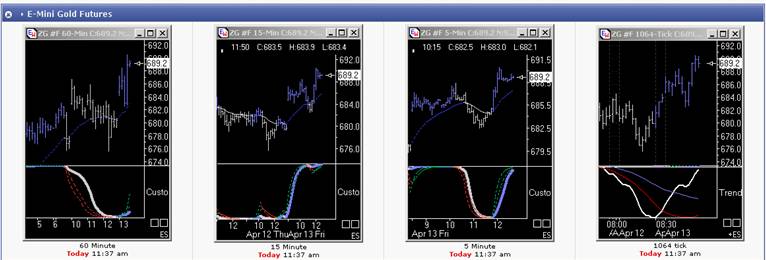

Notice how well the Trend Cycle charts, in particular, captured the intraday moves. At 10:00 the 5min curled down and made a full cycle concurrent with a rally in the dollar. The 60 and 15 min chart, though, was clearly not fooled by the drop, and, as the 5min turned up again just before noon , it turned positive and signaled the beginning of a new upside swing. Soon after, the 5min reached the top of its range and curled back, warning of another downside attempt. But, with the tick chart wanting to stay long all day, and all the other charts indicating an overall upward trend, the late move down proved limited.

Friday's action pivoted around a crucial reversal in the recent EUR/USD trend that further confirmed the inverse relationship between the dollar and gold. Remember that metals had been trading in sympathy with the dollar in the aftermath of the February selloff and the sharp appreciation of the yen, but over the past month have reverted back to a more traditional relationship with the greenback. While this flexibility is a testament to the resilience of the rally in metals, it is also a warning that a corrective dollar rally, as short-lived as it might be, could become a hurdle for metals going forward. Conversely, a bond rally that exerts pressure on the dollar at this position of weakness, could give dramatic lift to metals!

Most traders can connect the dots between a sinking dollar, rising inflation, Fed rate cuts. . . and much higher gold! Of course, with the clarification of Bernanke's comments last week and the release of the March minutes, odds of a rate cut have diminished significantly and have been deferred to later and later in the year. But that hasn't stopped the rise in metals.

While some believe the Fed's rate hike talk is not credible, and that this is the explanation for the strong performance in metals and stocks over the last half of the week, this update has repeatedly made a case that a rate hike bias works in favor of stronger metals. So let's connect the dots.

The inflation which is the explicit concern of the Fed and the drive behind their hiking bent is largely due to their vastly understated expansion of the money supply, but a considerable amount is also legitimate global growth, or “resource utilization” as the Fed calls it. Essentially, lending rates can move higher without becoming restrictive if they do not overshadow growth. And, while the Fed has kept rates steady, the trend globally has been towards higher rates. Though the pace of growth in key countries like China and India may have peaked, they remain at significant levels which will continue to drive demand for commodities higher in the intermediate term.

As of late March, the dollar index has been negative for the year, and this weakness has come despite very recent decisions not to hike rates in London , Tokyo and Mumbai. But the trend globally is still towards higher rates and inevitably these foreign central banks will hike again. Thus, while rates have been steady domestically, in the global market they've become increasingly accommodative, fueling the rally in metals. Correspondingly, though bond yields have been rising, which should make the dollar potentially more attractive to currency investors, the dollar has been sinking.

So, the resurgence of confidence that's lifted stocks, and metals from the March lows have made sellers out of the bond traders, but has not created dollar buyers. Now, any weak economic data could spark a corrective rally in bonds that would hardly benefit the dollar. Clearly there's sufficient reason for traders to be pricing down odds of any rate cut soon.

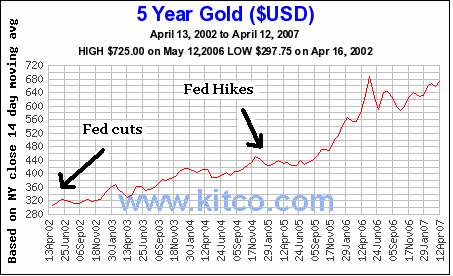

Consider also gold relative to key changes in the Fed funds target rate. Metals made some increases on Greenspan's cuts, but it was during his incremental hiking that the rally really accelerated. It's impossible to argue the promise to continue rate hikes during that time was not credible – it was probably the most transparent move of his tenure! But, though rates were rising, they were moving at a pace inadequate to reign in the rate of inflation and economic expansion generated by his dive to negative real rates and thereby guaranteed a rally in metals.

When Bernanke paused in August '06, metals were set for a tumble. Essentially, the Fed does not change rates lightly and the conditions for a pause or a cut are bearish for metals. Though the effect a rate hike might seem negative, the conditions that provoke a rate hike are very bullish for metals. Such conditions exist today and, as in 2005, the Fed is far behind inflation, but unable to raise rates quickly. The expectation, therefore, should be for gradual, token moves upward that will utterly fail to compensate for already existing inflation. This is the scenario that created last May's peaks, and it could be shaping up to happen again.

Bernanke's comments on Wednesday regarding the role of “discipline” in overall regulation all but put the nail in the coffin of rate cut expectations. Speaking in regard to hedge funds and commercial banks, he said, “In particular, private investors must be sophisticated enough to understand and monitor the financial condition of the firm and be persuaded that they will experience significant losses in the event of a failure. When these conditions are met, market discipline is a powerful and proven tool for constraining excessive risk-taking.”

If it sounds harsh, that's because it is! Bernanke has essentially promised the Fed will not intervene to rescue housing speculators and insolvent fund managers, will not destroy the dollar to kickstart capital expenditure, or undermine the global tightening campaign to edify bond traders who do not require adequate return on their longterm investment risk. In resonance with sentiments previously mentioned in this update, Bernanke's sense of the Fed's interest rate power seems to take a global context, while domestic exigencies are met with open market activities and invisible market forces like “discipline”.

So, in keeping with Bernanke's sentiment, disciplined metals traders should be aware of the risk to their positions over the next several months. First, despite what many believe they might see in their lifetimes, the dollar is probably not going to zero in the near term. When support finally kicks in, as it may have on Friday, there could be some correction and consolidation in metals.

Given the real rates of inflation of all currencies, though, a steady ascent in metals for many years to come is reasonable. Experience tells us, however, that rather than move in a straight line, metals tend to make a series of dramatic rises and falls. If the dollar were to be wiped out, or if metals contracts were to fall into default due to vanishing supply, then a parabolic ascent, the last contango, could be trusted. But, the more likely scenario is that traders who bid up the metals on speculation or diversification or war will move to other sectors or asset classes on their first sign of strength.

Further, despite the major world stock indices recovering from the February selloff, the possibility remains for another steep correction in U.S. stocks. As happened earlier this year, metals can remain resilient at first, but once margin calls and liquidity issues in general become a factor, even gold and silver succumb to the selling. Both metals and stocks are approaching the period of the year where seasonality is no longer in their favor, and so will be facing potential selling pressure regardless. If the yen should reverse against the Euro, or the Bank of Japan tighten once more, another round of liquidity selloffs, even more severe than the last, could send metals far lower than most traders are probably willing to think about today.

(chart by Dominick)

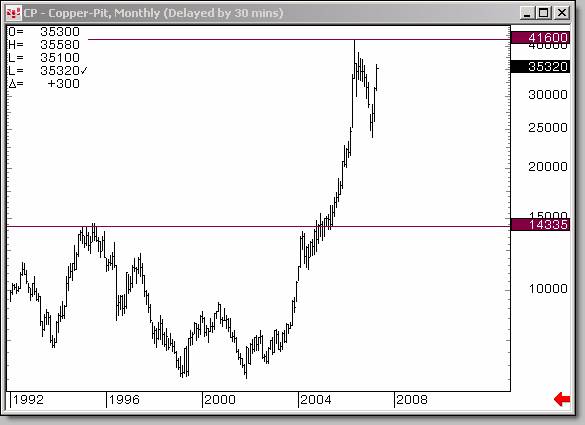

Ongoing structural changes in China also pose a potential threat to the metals bull market. The country that represents the largest demand for commodities in the world is not entirely without its own natural resources. In recent years, China 's economy has relied on importing raw materials and exporting finished products. China makes headlines as it institutes responsible policies to curb runaway growth and limit its trade surpluses, which will prove positive for metals in the long run. But it is not as widely publicized when China raises export rates on its domestic metal production, as part of its shift towards a consumer-driven economy.

Like a large hedge fund, China 's own prodigious demand creates huge purchases which have driven up the prices of the very resources it needs. It has already dramatically increased its domestic production of metals and reduced export credits on precious and base metals. By focusing its mining industry inwards and relying more extensively on its own resources, China may put significant downward pressure on metals in coming years. If China follows through on eliminating the subsidy for copper exports this year, the red metal could be facing a stiff headwind after what's been an impressive recovery.

(chart by Dominick)

While the overall outlook in metals is very positive, with a retest of the February highs becoming increasingly likely, the head of the Fed has called for discipline and that usually means pain for someone. At the very least, it's time to evaluate some risks to the rally, because if it fails to retake the May highs from here, there could be significant correction before the rally resumes. Look for the short term action to be guided by the dollar and the EUR/JPY, in addition to economic and inflation data. Inflation is still the driving catalyst, but manage the potential for a struggle over the CPI data as we saw on Friday with PPI. Longer term, monitor factors that could curtail the outsized gains metals have seen in recent years such as global growth versus interest rates and China 's demand contribution. And of course, use the members-only trend cycle charts on TTC, for all the best entry and exits points on the best risk/reward trades available.

By Joe Nicholson (oroborean)

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.