The Fate of Paper Money, Fiat Currency

Currencies / Fiat Currency Jan 07, 2009 - 10:22 AM GMTBy: Mike_Hewitt

"Paper money eventually returns to its intrinsic value - zero." (Voltaire, 1694-1778)

"Paper money eventually returns to its intrinsic value - zero." (Voltaire, 1694-1778)

The first well-documented widespread use of paper money was in China during the Tang (618-907 A.D.) dynasty around 800 A.D. [1] Paper money spread to the city of Tabriz, Persia in 1294 and to parts of India and Japan between 1319 to 1331. However, its use was very short-lived in these regions. In Persia, the merchants refused to recognize the new money, thus bringing trade to a standstill.

Figure 1. This Kuan note is the oldest known banknote in the world. It was made in China circa 1380.

By 1455, after over 600 years, the Chinese abandoned paper money due to numerous problems of over issuance and hyperinflation. An in-depth description of China's first experience with money can be found here .

Paper Money in Europe

The first instance of paper money in Europe allegedly occurred in Spain in 1438 during a Moorish invasion. A Spanish military leader issued paper notes to his soldiers that circulated around the city. No known notes have survived.

In 1574, the Dutch city of Leyden issued cardboard coins made from the cover of prayer books while Holland was trying to regain its independence from the invading Spanish.

The Italian city of Candia later issued paper money of different denominations until a shipment of coins arrived from Venice. All notes were fully reimbursed.

In 1633, the earliest known English goldsmith certificates were being used not only as receipts for reclaiming deposits but also as evidence of ability to pay.

In 1656, the Bank of Sweden was founded with a charter that authorized it to accept deposits, grant loans and mortgages, and issue bills of credit.

By 1660, the English Goldsmiths' receipts became a convenient alternative to handling coins or bullion. The realisation by goldsmiths that borrowers would find them just as convenient as depositors marks the start of the use of banknotes in England.

In 1661, the Bank of Sweden became the first chartered bank in Europe to issues notes known as the paper daler.

Figure 2. A 50-Daler note from the Bank of Sweden issued in 1666.

By the 1680's, the use of paper money began to take place in other European countries and the New World. Circulated notes on playing cards were used in the French colony of Lower Canada. Other colonies soon developed their own paper notes.

Existing Currencies in Circulation

At present there are 176 currencies in circulation in the world. Not all currencies are widely used and accepted, such as the various unofficial banknotes of the crown dependencies (Isle of Man and the Balliwicks of Jersey and Guernsey).

The median age for all existing currencies in circulation is only 39 years and at least one, the Zimbabwe dollar, is in the throes of hyperinflation. The twenty longest running currencies are listed below.

| Currency | Inception | Years of Circulation | Status |

| Pound Sterling (GBP) | 1694 | 315 | In circulation |

| Scotland Pound (SSP) | 1727 | 282 | In circulation* |

| US Dollar (USD) | 1792 | 217 | In circulation |

| Netherlands Guilder (NLG) | 1814 | 188 | EURO (2002) |

| Swiss Franc (CHF) | 1825 | 184 | In circulation |

| Guernsey Pound Sterling (GGP) | 1827 | 182 | In circulation* |

| Mexico Silver Peso (MXP) | 1822 | 170 | Hyperinflation |

| Canadian Dollar (CAD) | 1841 | 168 | In circulation |

| Belgian Franc (BEF) | 1835 | 167 | EURO (2002) |

| Cuban Peso (CUP) | 1857 | 150 | In circulation* |

| India Rupee (INR) | 1861 | 148 | In circulation |

| Manx Pound (IMP) | 1865 | 144 | In circulation* |

| Austrian Paper Gulden (ATP) | 1753 | 139 | Replaced for 1:2 Austria-Hungarian Kronen in 1892 |

| Japanese Yen (JPY) | 1871 | 138 | In circulation |

| Haiti Gourde (HTG) | 1872 | 137 | In circulation |

| Swedish Krona (SEK) | 1874 | 135 | In circulation |

| Danish Krone (DKK) | 1875 | 134 | In circulation |

| Spanish Peseta (ESP) | 1874 | 128 | EURO (2002) |

| Peru Sol (PEH) | 1864 | 121 | Destroyed by hyperinflation in 1985 |

| Italian Lira (ITL) | 1882 | 120 | EURO (2002) |

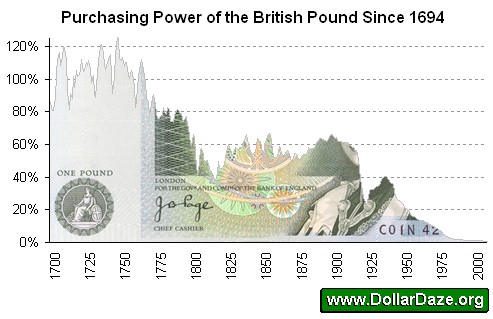

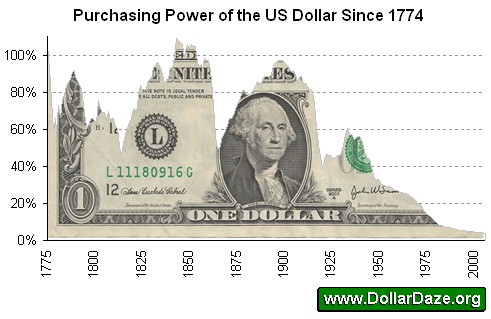

Below are charts showing the declining value of the two longest running currencies - the British pound sterling and the United States dollar, considered to be the most successful paper currencies of all time.

The British Pound originally represented one troy pound of sterling silver back in 1560. Sterling silver is 92.5% pure silver and there are 12 troy ounces in a troy pound. Elizabeth I and her advisor Sir Thomas Gresham (of Gresham's Law fame) established the new currency to bring about order created by the "Great Debasement" of 1543-51 when Henry VIII sought to finance his costly wars with both France and Scotland.

Paper banknotes were issued shortly after the establishment of the Bank of England in 1694.

As of Feb 23, 2007 it now takes 86.2 GBP to purchase that same troy pound of sterling silver - a loss of 98.8%!

Under the US Mint Act of 1792, the dollar was pegged at 24.75 grains of gold. There are 480 grains in a troy ounce. Thus it took 19.4 US dollars to purchase a single troy ounce of gold. As of Feb 23, 2007 it takes nearly 863 US dollar to purchase that same troy ounce of gold, representing a 97.8% drop in value!

Currencies No Longer in Circulation

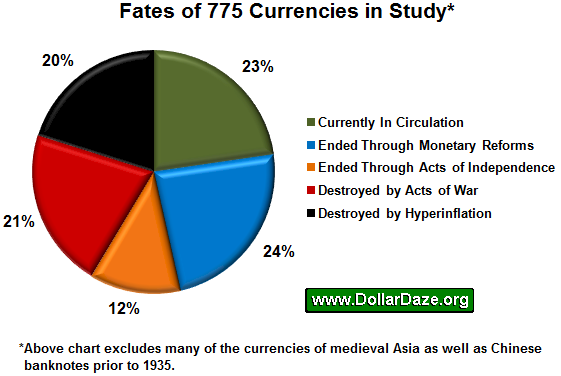

This analysis includes 599 currencies that are no longer in circulation . The median age for these currencies is only fifteen years! [2]

The following table below groups the fates of these currencies.

| Currency was... | No. Of Currencies | Description |

| Ended through monetary unions, dissolution or other reforms | 184 | Voluntary monetary unions such as the Euro in 1999, or creation of the US dollar in 1792. |

| Ended through acts of independence | 94 | Acts of former colonial entities renaming or reforming their currency |

| Destroyed by hyperinflation | 156 | Currency destroyed through over-issuance by the government. |

| Destroyed by acts of war | 165 | Currency deemed no longer valid through military occupation or liberation. |

The Second World War saw at least 95 currencies vanish as nations were conquered and liberated.

Hyperinflation is one of the greatest calamities to strike a nation. [3] This devastating process has destroyed currencies in the United States, France, Germany, and many other countries .

Recent Expansions to the US Monetary Base

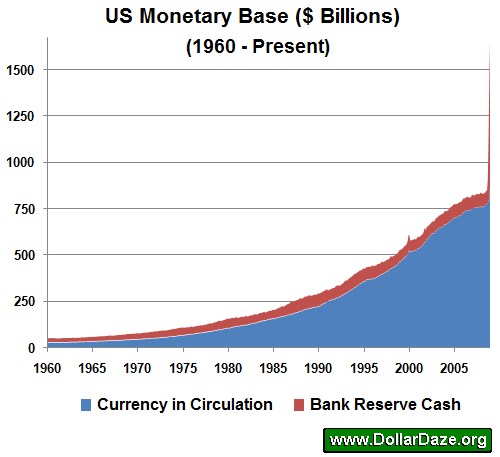

The monetary base comprises of currency in circulation (banknotes and coins) and the commercial banks' reserves with the central bank. Recently, there have been unprecedented increases to the bank reserve portion of the US monetary base .

Up until August 2008, the portion of the monetary base that consisted of bank reserves was between 8 - 12%. In December 2008, that proportion had risen to 47%! This drastic increase was due largely in part by the unwillingness of the banks to lend recent 'liquidity injections' from the Federal Reserve.

The following table shows the increases to the monetary base, as measured in US$ billions for the last six months of 2008. These actions by the Fed are responsible for the large spike on the right side of the above chart.

| Date | Currency in Circulation (M0) | Cash Held as Bank Reserves | Total Monetary Base |

| Jul-08 | 774.8 | 71.7 | 846.5 |

| Aug-08 | 775.4 | 71.9 | 847.3 |

| Sep-08 | 776.8 | 131.2 | 908.0 |

| Oct-08 | 793.8 | 338.7 | 1132.5 |

| Nov-08 | 806.5 | 634.6 | 1441.1 |

| Dec-08 | 882.0 | 782.3 | 1664.3 |

These massive expansions to the US monetary base increase the probability of a complete collapse in the confidence of the value of the US dollar. This shift in sentiment would spark a hyperinflationary fate to the world's de facto reserve currency .

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of www.DollarDaze.org , a website pertaining to commentary on the instability of the global fiat monetary system and investment strategies on mining companies.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

Mike Hewitt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.