Gold Forecast - The Short-Term Prospects for Gold

Commodities / Gold & Silver Apr 21, 2007 - 06:30 PM GMTBrown Again ?  Two of the chief qualifications for a Minister of the Crown in the U.K. are a complete disregard for the opinions of others and absolutely no regard for the consequences of his actions. Mr. Brown is superbly qualified to be Prime Minister in this regard.

Two of the chief qualifications for a Minister of the Crown in the U.K. are a complete disregard for the opinions of others and absolutely no regard for the consequences of his actions. Mr. Brown is superbly qualified to be Prime Minister in this regard.

Despite the overwhelming evidence of the foolishness of the sale of half Britain 's gold in a manner to guarantee a low price, Mr. Brown unashamedly continues to press for the sale of other people's gold.

More support now exists for the International Monetary Fund to sell part of its gold reserves to meet its future financing requirements, U.K. Chancellor of the Exchequer Gordon Brown said. “What I found encouraging today was that there are countries which previously had not been prepared to consider gold sales but were prepared to do so now," Brown said, adding there was "no doubt" that gold sales were potentially part of the I.M.F.'s likely future financing. Brown said that an independent report into future IMF financing had recommended that any gold sales should take place in a "measured way."

IMF Managing Director Rodrigo Rato said the more efficient use of existing Fund resources would form part of a package of proposals on future financing it is now preparing. But Rato said that any gold sales would be limited to around one-eighth of the Fund's total gold resources. "I have to say that some of the gold-producing countries have expressed that this is a way (of future financing) that could be seen as constructive, but nobody has yet given a final position," Rato said.

According to the IMF's Web site, the Fund holds 103.4 million ounces (3,217 metric tons) of gold, valued on its balance sheet at a historical cost of about $8.8 billion. The I.M.F.'s holdings were valued at $68.4 billion at market prices at the end of March.

According to the IMF's Web site, the Fund holds 103.4 million ounces (3,217 metric tons) of gold, valued on its balance sheet at a historical cost of about $8.8 billion. The I.M.F.'s holdings were valued at $68.4 billion at market prices at the end of March.

Let's see if the Members of the I.M.F. buy this? We think not.

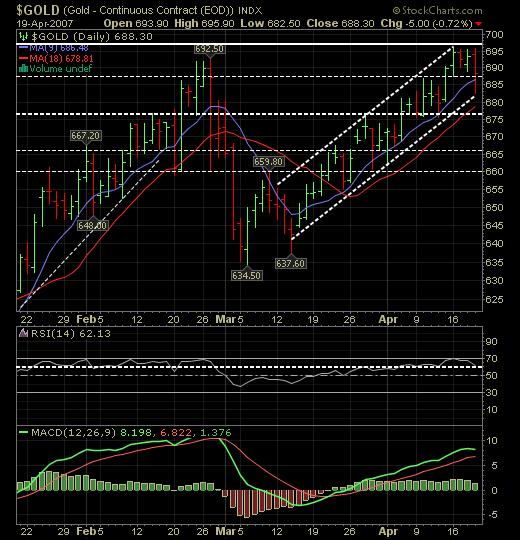

$695-700, $730, $750 – Marching Higher

The gold market continues to show great strength pushing $690-700 ($692.50 peak high). Good support below is seen along the 50 DMA, now holding at $668 and moving higher along with the channel support now in the lower $680's.

$690-700 then $730 remain upside targets and with the action over the past few months, the market is showing us that it is only a matter of time. With this steady march higher here, gold is looking quite healthy. Few factors to consider here. Resistance is quite heavy around $690-700 while the U.S. Dollar is nearing a series of very strong multi-decade supports. It should be expected that there should be a battle before the inevitable fall in the US Dollar support comes bringing in another large impetus into the gold rally. Therefore, conservative investors could play the $700 resistance by selling into this strength and wait for a pullback or buy back into the market on the break of the $700 mark.

That said, the growing recognition that the US Dollar may move significantly lower is generating more interest in gold and a temporary bounce in the US Dollar may not cause gold to retrace. In fact, gold may continue to move past $700 on its way to $730, $750, $800 in the process. The market is prime to make the move higher.

Repeating form past issues, “The gold market looks like it wants to move higher at this time, but we may need to do some more base building around the mid to upper $600's first before we see the next move higher – which is likely to bring $800+ gold. I do believe we are drawing closer to the point where gold will take its next rally higher though. This is a time to continue to position yourself and ensure the core positions are solidified.”

Pullbacks are very attractive at this time!

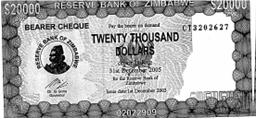

Zimbabwe fails to pay the miners for their gold

The Bank note to your right is no longer acceptable currency having ‘expired' when the Reserve  Bank of Zimbabwe , withdrew this currency in December 2005, it being replaced by new notes [enlarge it by stretching it to see vaguely, the expiry notice of the money].

Bank of Zimbabwe , withdrew this currency in December 2005, it being replaced by new notes [enlarge it by stretching it to see vaguely, the expiry notice of the money].

Runaway inflation, currently at 1700% annually , has decreased the value of the central bank's payments and resulted in constant and large increases in the costs of labor and supplies. The concept of the Bearer cheque is still in Zimbabwe but two or more noughts have been added. Shopping has to be done daily, not only to spend the depreciating money, but the search for needed items in the shops is never ending.

Reserve Bank of Zimbabwe (RBZ) is allegedly failing to pay for gold remitted to Fidelity Printers and Refiners, resulting in most gold producers not receiving payment for gold remitted in January.

Since October last year, the Reserve Bank of Zimbabwe has been experiencing severe difficulties in paying gold producers for gold lodged with Fidelity Printers and Refiners," the report said. "As of the beginning of April, most gold producers were not paid for gold lodged in January. The delays have impacted negatively on production."

The chamber reported that delayed payment and a misaligned exchange rate had "understandably combined to create a viability crunch that is threatening the very existence of the gold industry in Zimbabwe ".

Available statistics show that gold remitted to the RBZ in February declined to 768kg from 819kg in January. Murangari said owing to delays in payment, both local and foreign suppliers were now demanding cash upfront for goods and services provided to miners.

“At the current exchange rate, we have a big mismatch between operating costs and returns. The price of Z$15 000 per gram has to be reviewed upwards if miners are to benefit from the international price of US$650 per ounce," he said.

The Z$15 000/gram price has been in place since last October despite the increase of "basically everything" on the local market.

The RBZ referred all questions to Fidelity Printers and Refiners, who, when contacted for comment, referred all questions back to the central bank.

Gold production currently accounts for over half of the country's mineral production, one third of the country's GDP and is one of the few remaining sources of access to foreign currency. As a result, the industry is key to Mugabe's continued ability to provide key elites with all their wants, plus more. Consequently, the new Platinum mines have to be a target too, for Mugabe at some point too.

Gold production currently accounts for over half of the country's mineral production, one third of the country's GDP and is one of the few remaining sources of access to foreign currency. As a result, the industry is key to Mugabe's continued ability to provide key elites with all their wants, plus more. Consequently, the new Platinum mines have to be a target too, for Mugabe at some point too.

We hear much external talk of how Zimbabwe will improve once Mugabe is dead, but we are saddened to report that the whole political system from top to street level has been corrupted, with Zanu PF unashamedly persecuting opposers. Investors have to ask, from where will a new leader come and to serve whose interests? The political scene is entirely inept at changing the situation in that country. South Africa has no interest in stepping in to change matters either, so who will? We continue to say this is not a home for a wise investor's money.

Please subscribe to: www.GoldForecaster.com for the entire report.

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2007 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.