Depression or Recession as GE Price Crashes to 12 Year Low

Stock-Markets / Financial Markets 2009 Jan 24, 2009 - 10:34 AM GMT

As GE goes, so does the nation? There is (or was) a saying in Michigan, “As GM goes so goes Michigan.” We might want to modify that phrase for General Electric and the country. Profit from continuing operations declined 43 percent to $3.87 billion, or 36 cents a share, amid the global credit crisis that eroded income at the finance segment.

As GE goes, so does the nation? There is (or was) a saying in Michigan, “As GM goes so goes Michigan.” We might want to modify that phrase for General Electric and the country. Profit from continuing operations declined 43 percent to $3.87 billion, or 36 cents a share, amid the global credit crisis that eroded income at the finance segment.

GE this week traded the lowest since 1996 as investors questioned the ability to protect both the AAA credit rating and the dividend amid a deepening recession. GE's President, Jeffrey Immelt is shrinking the finance unit to 30 percent of profit from more than half in 2007. The company added to reserves and tripled cash on the balance sheet to $48 billion. Orders in the infrastructure divisions slipped in the quarter even as the total backlog rose last year.

Fannie and Freddie facing new restrictions.

The Federal Housing Finance Agency plans to propose new financial requirements next week for Fannie Mae, Freddie Mac and the 12 Federal Home Loan Banks. Washington-based Fannie and McLean, Virginia-based Freddie, the two largest sources of mortgage money in the U.S., were placed under federal control in September after regulators said the two were at risk of failing. The Treasury Department, which pledged as much as $100 billion for each company to keep them solvent, pumped $13.8 billion into Freddie in November.

“They will be reporting numbers in mid- to late-February and, yes, I think everybody would expect that there would be a draw on Treasury,” Lockhart said of the prospect that one or both of the companies will need federal aid after they announce fourth-quarter earnings. This will be another of a series of tests for the new administration.

Are stocks only retesting their lows or failing?

-- U.S. stocks slid, extending the market's third straight weekly loss, as earnings reports by companies from General Electric Co. to Xerox Corp. spurred concern the profit slump is worsening. Profits have decreased 60 percent for the 69 companies in the S&P 500 that have released fourth-quarter results since Jan. 12. Analysts now estimate a 28 percent drop in profits for the entire index, which would mark the fifth straight quarter that earnings slumped. In March 2008, analysts projected that income would rise as much as 55 percent in the fourth quarter, according to data compiled by Bloomberg. Those expectations are dashed.

-- U.S. stocks slid, extending the market's third straight weekly loss, as earnings reports by companies from General Electric Co. to Xerox Corp. spurred concern the profit slump is worsening. Profits have decreased 60 percent for the 69 companies in the S&P 500 that have released fourth-quarter results since Jan. 12. Analysts now estimate a 28 percent drop in profits for the entire index, which would mark the fifth straight quarter that earnings slumped. In March 2008, analysts projected that income would rise as much as 55 percent in the fourth quarter, according to data compiled by Bloomberg. Those expectations are dashed.

Bonds are rapidly giving back their gains.

-- Treasuries fell, with 30-year bonds headed for the biggest weekly loss in 26 years, on concern that debt sales will increase as the government boosts spending to ease the deepening economic slump. The speculation among traders is that the new administration may borrow more than $2.5 trillion this year as it attempts to stabilize the banks. The Treasury will attempt to sell $78 billion of short term notes and Treasury Inflation Protected Securities next week while selling another $66 billion of longer-term notes and bonds in February.

-- Treasuries fell, with 30-year bonds headed for the biggest weekly loss in 26 years, on concern that debt sales will increase as the government boosts spending to ease the deepening economic slump. The speculation among traders is that the new administration may borrow more than $2.5 trillion this year as it attempts to stabilize the banks. The Treasury will attempt to sell $78 billion of short term notes and Treasury Inflation Protected Securities next week while selling another $66 billion of longer-term notes and bonds in February.

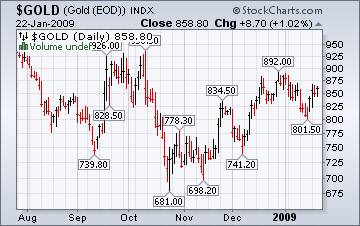

Gold may be under deflationary pressure.

Gold prices rose to a two-week high on demand for a haven as global equities tumbled amid the recession and a slump in corporate earnings. There is a lot of fear about the world economy, especially in Europe. Short-term money markets have no yield, while longer-term bonds are in a serious decline, so money appears to be going toward assets that seem to have held their value recently. Gold is such an asset. But can the price get back above the important 900 level?

Gold prices rose to a two-week high on demand for a haven as global equities tumbled amid the recession and a slump in corporate earnings. There is a lot of fear about the world economy, especially in Europe. Short-term money markets have no yield, while longer-term bonds are in a serious decline, so money appears to be going toward assets that seem to have held their value recently. Gold is such an asset. But can the price get back above the important 900 level?

Japanese stocks nearing the tipping point.

-- Japanese stocks dropped, deepening the longest weekly losing streak in more than three months, as Sony Corp.'s loss forecast and worsening economic figures stoked concern the global recession will be prolonged. The Nikkei lost 5.9 percent this week and the Topix dropped 5.4 percent, capping third-straight weekly drops for both gauges, the longest since Oct. 10. This week, Royal Bank of Scotland Group Plc's loss forecast sparked concern the global financial crisis will deepen, overshadowing the Bank of Japan's plan to buy corporate debt in an effort to ease credit markets.

-- Japanese stocks dropped, deepening the longest weekly losing streak in more than three months, as Sony Corp.'s loss forecast and worsening economic figures stoked concern the global recession will be prolonged. The Nikkei lost 5.9 percent this week and the Topix dropped 5.4 percent, capping third-straight weekly drops for both gauges, the longest since Oct. 10. This week, Royal Bank of Scotland Group Plc's loss forecast sparked concern the global financial crisis will deepen, overshadowing the Bank of Japan's plan to buy corporate debt in an effort to ease credit markets.

Recovery in the Shanghai Index may be faltering.

-- ( Bloomberg ) -- Stocks will retreat around the world because of shrinking demand from China as growth in the third- biggest economy slows, said Nouriel Roubini , the New York University professor who predicted last year's financial crisis. “Demand is falling in China, they're over-invested in capacity and there's a global supply glut,” Roubini, 50, said in a telephone interview. “It has very, very important implications.”

-- ( Bloomberg ) -- Stocks will retreat around the world because of shrinking demand from China as growth in the third- biggest economy slows, said Nouriel Roubini , the New York University professor who predicted last year's financial crisis. “Demand is falling in China, they're over-invested in capacity and there's a global supply glut,” Roubini, 50, said in a telephone interview. “It has very, very important implications.”

Which is it…the Yuan weakening or the Dollar strengthening?

( Bloomberg ) -- .S. President Barack Obama is wrong to suggest China is manipulating its currency because economic conditions for the yuan to gain “don't exist,” said Hua Ercheng , chief economist at China Construction Bank Corp. The specter of protectionism is rearing its head as the Yuan depreciates against the dollar, making US exports more expensive in China. With the Chinese economy slowing down, there is little to keep their currency up against the Dollar. A look at the chart suggests we are more to blame than the Chinese.

( Bloomberg ) -- .S. President Barack Obama is wrong to suggest China is manipulating its currency because economic conditions for the yuan to gain “don't exist,” said Hua Ercheng , chief economist at China Construction Bank Corp. The specter of protectionism is rearing its head as the Yuan depreciates against the dollar, making US exports more expensive in China. With the Chinese economy slowing down, there is little to keep their currency up against the Dollar. A look at the chart suggests we are more to blame than the Chinese.

Renters getting good deals.

(There's good news in the housing market — for renters. What you pay is on the way down. The average rent in the U.S. fell 0.4% in the last three months of 2008, according to a survey of large apartment buildings in 79 metro markets by real estate analytics firm Reis. Even though landlords often find it tough to raise rent prices in winter months, the fourth quarter's decline is significant for being the first quarterly drop since the beginning of 2003.

(There's good news in the housing market — for renters. What you pay is on the way down. The average rent in the U.S. fell 0.4% in the last three months of 2008, according to a survey of large apartment buildings in 79 metro markets by real estate analytics firm Reis. Even though landlords often find it tough to raise rent prices in winter months, the fourth quarter's decline is significant for being the first quarterly drop since the beginning of 2003.

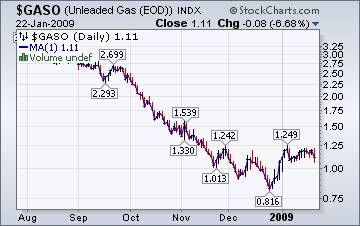

Will gasoline prices continue their rise…or start easing again?

The Energy Information Administration reports that, “For the third consecutive week, the U.S. average retail price for regular gasoline increased, rising 6.3 cents to 184.7 cents per gallon as of January 19, 2009. Prices are 117.0 cents per gallon lower than this time last year. All regions reported price increases. East Coast prices rose 6 cents to 181 cents per gallon. Prices for the Midwest moved 5.1 cents higher to 187.4 cents per gallon, while the largest regional jump was in the Gulf Coast, where prices rose 8.4 cents to 172.9 cents per gallon.”

The Energy Information Administration reports that, “For the third consecutive week, the U.S. average retail price for regular gasoline increased, rising 6.3 cents to 184.7 cents per gallon as of January 19, 2009. Prices are 117.0 cents per gallon lower than this time last year. All regions reported price increases. East Coast prices rose 6 cents to 181 cents per gallon. Prices for the Midwest moved 5.1 cents higher to 187.4 cents per gallon, while the largest regional jump was in the Gulf Coast, where prices rose 8.4 cents to 172.9 cents per gallon.”

The bitter cold winter is having no effect on natural gas prices.

The Energy Information Agency's Natural Gas Weekly Update reports, “ A major arctic air-mass enveloped the eastern half of the country, bringing the lowest temperatures of the season to date as far south as Florida during the report week. Nonetheless, increased space-heating demand in consuming regions was insufficient to reverse a weakening trend in prices. This was most dramatically represented in Northeast markets, where the average spot price declined on the week by almost 55 percent from more than $12 per MMBtu to an average of $5.55, which not only proved a large price swing for a week, but brought the lowest prices in the region in more than a year. Price weakness was widespread.”

The Energy Information Agency's Natural Gas Weekly Update reports, “ A major arctic air-mass enveloped the eastern half of the country, bringing the lowest temperatures of the season to date as far south as Florida during the report week. Nonetheless, increased space-heating demand in consuming regions was insufficient to reverse a weakening trend in prices. This was most dramatically represented in Northeast markets, where the average spot price declined on the week by almost 55 percent from more than $12 per MMBtu to an average of $5.55, which not only proved a large price swing for a week, but brought the lowest prices in the region in more than a year. Price weakness was widespread.”

Is this a recession or a depression?

It's too early to tell, since there seem to be more differences than similarities.

“The difference between a recession and depression is primarily a matter of degree,” said Victor Zarnowitz, a University of Chicago economist and a member of the business cycle dating committee. “The difference between a recession and depression is primarily a matter of degree.” “A depression is much more severe and usually longer than a recession.”

With no set milestones, the term doesn't really apply until after it's clear a downturn is one of the worst in history. As bad as things are today, conditions are nowhere near as bad as they were during the Great Depression. At least not yet.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.