California's Imploding Economy as Billions Disappear into the Budget Black hole

Economics / Recession 2008 - 2010 Mar 14, 2009 - 05:55 PM GMTBy: Mike_Shedlock

California is imploding faster than expected. Let's take a look starting with a flashback to something I wrote on February 16, 2009: California One Vote Shy On Budget Impasse . Here is the key snip.

California is imploding faster than expected. Let's take a look starting with a flashback to something I wrote on February 16, 2009: California One Vote Shy On Budget Impasse . Here is the key snip.

Lost in the spat over this budget impasse are two key words ... "And Counting" as in the following sentence: The California budget gap is $41 billion and counting.

Three months from now the budget gap will be $47-48 billion and counting assuming nothing passes now, or $6-7 billion if they do. Please feel free to come up with your own estimate. Thus, no matter what budget passes now, the California legislature will be back at it three or four months down the road unless the sugar daddies in Congress start passing out more candy to the states.

I clearly should have said " California will be back at it in less than a month. "

As noted by the following headline, my February 16 statement above offers tangible evidence that I have been a blazing optimist.

California Budget Faces New $8-Billion Shortfall

The plan that Gov. Arnold Schwarzenegger and lawmakers approved last month to fill California's giant budget hole has already fallen out of balance with a projected $8-billion shortfall, the Legislature's nonpartisan budget analyst said Friday.

After analyzing recent data showing rapidly rising unemployment and lower-than-expected economic growth, Legislative Analyst Mac Taylor said the state is on track to have even less money than lawmakers anticipated in February.

California's economy in is such bad shape that Taylor's office anticipates that residents' combined personal income will be lower this year than it was last year, leading to fewer tax dollars for state coffers.

"I went as far back as 1950, and I could not find a situation in which personal income had actually declined in the state, so that's a rather unusual event," Taylor said at a news conference Friday.

The dour projection is likely to complicate Schwarzenegger's effort to win voter approval for a package of budget-related ballot measures scheduled for a special election May 19.

Assembly Speaker Karen Bass (D-Los Angeles) said the new estimate made it more imperative that voters approve the May ballot measures. If the package of propositions --particularly the lottery borrowing -- is rejected, the budget gap would increase by $6 billion, she said.

Taylor said the new $8-billion budget hole should not be as difficult to grapple with as was the $42-billion gap. He said the state may be able to tap $3 billion in federal money intended to increase schools spending as part of the federal economic stimulus package passed by Congress.

"We're not that far away if we can use those federal dollars," he said in an interview.

That idea may not fly with California's school leaders. Kevin Gordon, a lobbyist for school districts in Los Angeles, San Bernardino, Riverside, Orange and other counties, said Taylor was proposing to "hijack federal dollars that the president and Congress intended to use to offset cuts that have already been made."

Beyond the short-term problems, Taylor also projected a grim long-term fiscal outlook for the state, with a $12.6-billion shortfall emerging by mid-2011 and growing to $26 billion three years later.

"Given these budgetary pressures, the state could experience recurring cash flow pressures in the coming months and years," Taylor wrote.

California Fiscal Outlook

Inquiring minds are reading the California Fiscal Outlook Under the February Budget Package 2009-10 Budget Analysis Series.

Budget Counts on Nearly $6 Billion From the May Election

The budget package relies on the passage of three ballot measures to provide nearly $6 billion in 2009–10 solutions—$5 billion from the borrowing of future lottery profits (Proposition 1C), about $600 million by redirecting dedicated childhood development funds (Proposition 1D), and about $230 million by redirecting dedicated mental health funds (Proposition 1E). If these measures were to fail, the Legislature would need to quickly develop even more solutions before the start of the fiscal year as alternatives.

How Deep Is The Hole?

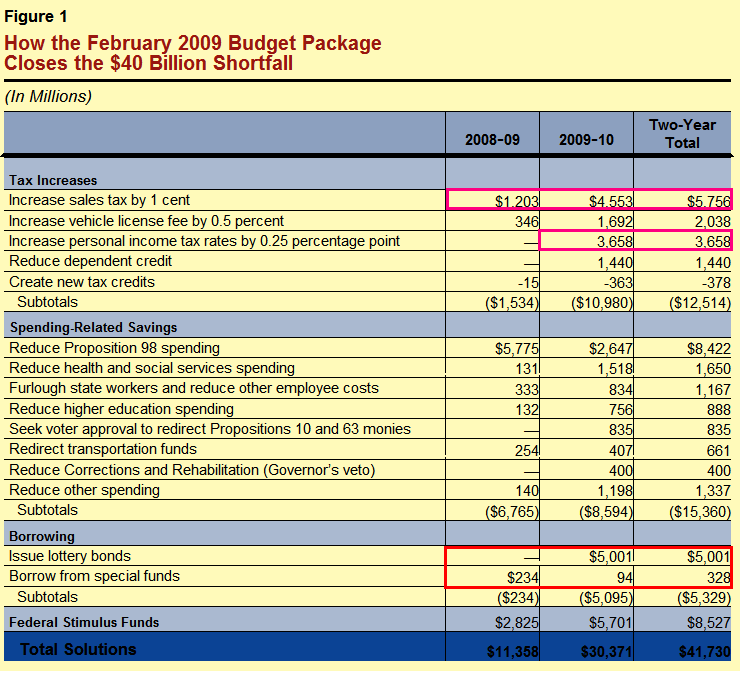

To "balance" the $42 billion shortfall, California is already counting on borrowing $5 billion from lottery proceedings. What kind of fiscal accounting nonsense is that?

The reality is California is now a minimum of $13 billion in the hole ... and counting. Hang on because it gets worse.

Note those areas in the chart above in pink. I strongly suspect that the forecasts for sales tax personal income taxes will fall far short of estimates. For the sake of argument I will take a shot and suggest a $3 billion shortfall. It's not that the increases will fail to deliver, but rather overall sales tax revenues and income tax collections will drop by that much in spite of the increases.

Also note that California is counting heavily on the sugar daddies in Congress to bail them out. " The package also assumes receipt of $8.5 billion in federal funds from the recent economic stimulus law to help balance the budget. " For now, let's assume California gets all of that.

$16 Billion In The Hole

Optimistically, I now have California at $16 Billion in the Hole "and counting".

I highly doubt the Republicans cave in next time on taxes. Perhaps even a few Democrats regain their senses. If so, that means California is going to have to come up with another $8-16 billion in budget cuts quickly ($8 billion if they continue to play fiscal games by borrowing from the lottery and overestimating collections).

If you know the tune, please sing along: California Here We Come, Right Back Where We Started From.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.