XAU Gold Stocks Rising Wedge False Breakdown?

Commodities / Gold & Silver Stocks Mar 15, 2009 - 01:04 AM GMTBy: Brian_Bloom

This analyst has been watching the markets in the past couple of weeks with a fascination akin to that associated with watching a snake charmer in action. In particular, he has been watching the rising wedge on the chart of the $XAU which caught his eye a few weeks ago and gave rise to an article with the same title as above, published on February 23rd. (See http://www.marketoracle.co.uk/Article9090.html )

This analyst has been watching the markets in the past couple of weeks with a fascination akin to that associated with watching a snake charmer in action. In particular, he has been watching the rising wedge on the chart of the $XAU which caught his eye a few weeks ago and gave rise to an article with the same title as above, published on February 23rd. (See http://www.marketoracle.co.uk/Article9090.html )

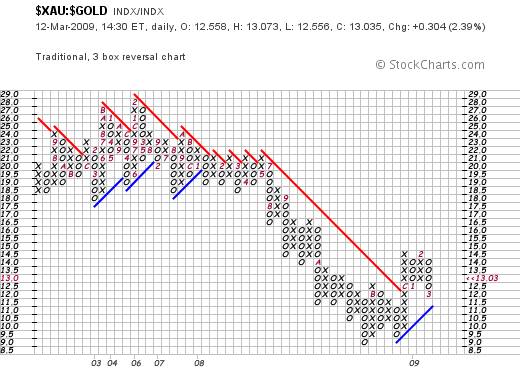

Typically, rising wedges break down. Sometimes (under a combination of special circumstances) they break up. The chart below (courtesy decisionpoint.com) “appears” to have broken down.

Of particular interest is the green Relative Strength line at the bottom of the chart above. Not how, although the $XAU index itself penetrated below the lower rising trend line of the wedge, the rising trend line of the relative strength chart remained intact.

This can be more clearly seen by reference to the following Point and Figure RS chart (courtesy stockcharts.com)

Note how the ratio of the $XAU to Gold is still above its rising blue trend line.

Now look at that green line in the first chart once again. It is giving a tentative buy signal flowing from two facts:

1. It is peeking up above its 20 day moving average

2. It has evidenced a saw tooth pattern of rising bottoms and rising tops over the past four days.

Why would the $XAU reverse from a “false” breakdown and then move to break up? At face value that would make no sense. Surely, if it has broken down then it has broken down; end of discussion?

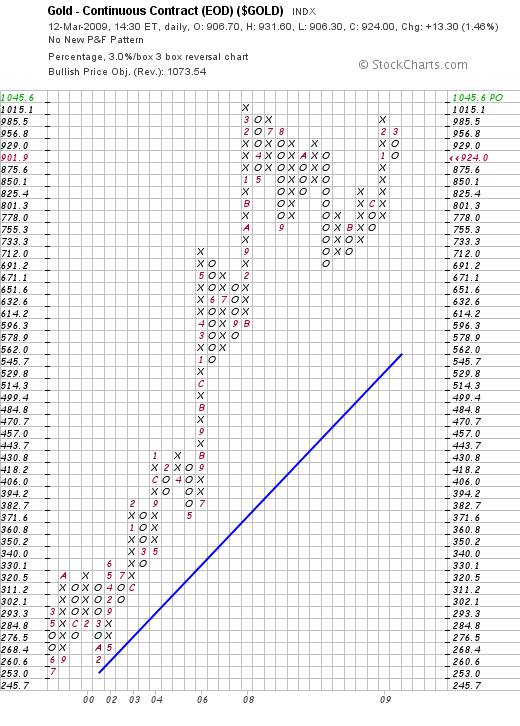

One possible reason might flow from the chart below which shows that whilst there may be room for further consolidation of the gold price, the target of $1045.60 per ounce is yet to be met. The reader should also bear in mind that if that target is eventually met, it will represent a strong incremental buy signal because the price will have risen to a new high. Such a breakout will likely presage the commencement of another run-up; but the reader is cautioned to recognize that this chart offers no clues as to timing.

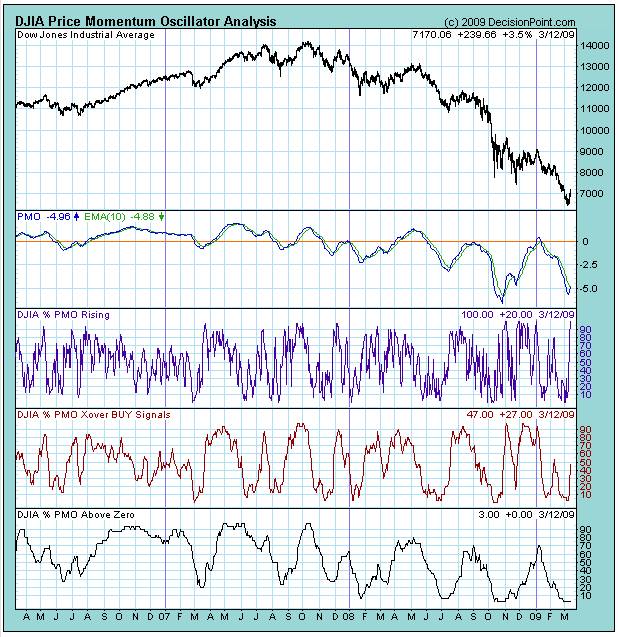

There is possibly another and more far reaching explanation. Whilst the long term impact of the various government stimulus packages is almost certainly going to lead to an aggravation of our economic problems flowing from yet more debt and yet more mal-investment, the short term impact may be that the economy will sputter upwards – as evidenced by the chart of the Industrial Index below and its various Price Momentum Oscillator charts.

The PMO itself is showing rising bottoms (March 2009 relative to November 2008) and over 90% of all underlying PMO’s are rising. Almost 50% of these PMOs have given cross-over buy signals, and 100% of the underlying PMOs are below zero. In combination, this may be interpreted as an oversold market which is wanting to bounce.

But, if the gold universe breaks out to new highs whilst the industrial universe is merely bouncing up from a savagely oversold position, what might this mean?

In this analyst’s view, it will likely mean that the little guy’s skepticism of the Establishment’s ability (fear of its inability) to bring the world economy under control is becoming visible. In a previous article it was articulated that, at around $250 trillion a year, the US$ currency market is roughly twenty times the size of the market for physical gold bullion. The whales cannot possibly be swimming in the gold fishpond and any breakup of the gold price will necessarily have been facilitated by a stampede of smaller investors who will be moving to bypass third party financial advisers and take control of their own financial affairs.

Conclusion

If the breakdown from the rising wedge in the $XAU turns out to have been a false breakdown, and if the $XAU subsequently moves to break up from the rising wedge, then this will likely suggest a growing propensity on the part of small investors to break ranks and to start to play by their own rules. At the point that the gold price breaks to a new high – should that happen – that will be a signal that the world economy is beginning to spiral out of control because the loss of faith in the financial system by ordinary investors will have become visible.

Author’s Note

It is well understood by those whose lives are devoted to problem solving that no problem can be solved unless it is understood (diagnosed) and clearly defined. Once a problem has been defined, its solution will be a function of addressing, neutralizing and/or reversing the causes of that problem.

Many of those in decision making positions who do not fully understand the underlying problems have a propensity to focus on symptoms; and their remedial actions are typically intuitively designed to suppress those symptoms. The reader should understand that this is largely what is happening as our various governments move to “stimulate” the various countries’ economies.

Unfortunately, such behavior can be extremely dangerous because a suppression of symptoms often masks a deterioration of the underlying problem. In turn, if this happens then, ultimately, such ill informed and irresponsible behavior might lead to the death of the patient. To head this possibility off at the pass there needs to be a groundswell of upward pressure from voters on our political leaders to force them to start behaving responsibly. Sometimes, no decision at all is better than an ill-informed and erroneous decision.

In my recently published factional novel, Beyond Neanderthal, (published June 2008), the current financial turmoil (one of several symptoms) was anticipated and its causes (the drivers of the real underlying problems associated with this symptom) are clearly articulated.

Some of these causes are not directly related to economics and finance. In particular, the core underlying problem being faced by the world economy is that that the economic engine is no longer sufficiently powerful to drive the economic vehicle. Fossil fuels and their related technologies have passed their use-by date and the machinations of the world’s most powerful politicians over the past decade or so have blocked the emergence of new replacement energies and associated wealth building technologies. The world is now in catch-up mode and is scrambling when it should be cruising. “Money supply manipulation”, “interest rate manipulation” and “buckshot deficit spending” are symptom focused. Any buckshot actions of this nature are likely to cause more harm than good to the broader population. Only a few pellets are likely hit the target and the balance are likely to pass the target and give rise to enormous collateral damage.

Through its light hearted and entertaining fictional storyline, Beyond Neanderthal seeks to clearly define the problems in a manner which is understandable by the average person and also seeks to put forward one possible open-minded strategic approach to solving all these latter problems. The reader should bear in mind that it was written and published well before the world’s financial markets began to implode. The author began drafting it in October 2005.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2009 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.