Worldwide Stock Market Crash - Time to Get Liquid?

Stock-Markets / Global Stock Markets May 09, 2007 - 07:30 PM GMTThe story today is a world financial bubble. Aside from a possible attack on Iran – The story right now is a world financial bubble. This article will discuss it in very broad terms. The thesis is that maybe you should right now be thinking about getting liquid – gradually. I consider our time right now, May 07, to be a time just like before the world stock crash of ‘29.

Imagine what people would have thought, if, after the stock market crashed in successive waves over a period of a year into 1930 – what they would have though it they could have gotten out of those markets in say, Feb 29…..and not ridden stocks down 50% .. and later 90%, in the several years following the '29 crash.

If you wanted to sell stocks or whatever, it makes sense to sell in liquid markets that are going up right?

Or would you rather wait, and sell in falling markets after they had peaked? That is what greedy people do.

On the other hand, the ‘insider' types usually sell in the last stages of a bull market, and we see ‘distribution' patterns that precede stock crashes. Only this time, we are looking at a world stock crash – as if the world stock markets together were one market. The present world bubble is an unprecedented world financial mania, never seen before, and at least 1000 times the money value of the 1929 world stock market. It is synchronized. It will all crash on one swoop eventually.

We have record insider selling right now, just like on 2000. This is distribution. They are selling you their shares, getting out, and knowing the market is rising. They are cashing out.

In any case, I have now decided that, although markets everywhere may now turn up more, maybe even make another 100% gain, I think prudent people should use this last phase of the parabolic markets to start getting out…. I am not an investment advisor, and this is just my personal opinion/comments.*

China- world bubble exhibit number one

Tuesday in Asia, the Chinese Shanghai market rose another 2.8% to 3950. In last weeks, we saw that market rising often 1 or 2 % a day…day after day.

Chinese Banker Zhao, governor of the PBOC said this week that he is concerned about the stock bubble in China. In the last few weeks, Vice Char Gao, China's social security chief said the Chinese stock bubble has been rising too long. Premier Wen has stated recently that China's economic and financial booms are out of control and unsustainable.

The last time that particular market crashed badly, there were two weeks of scary market drops world wide. Feb 27. I have asked my readers, how many drops of this type do you need to realize a great crash is getting ready to happen?

I look at the China stock market as the poster child of today's financial mania world wide.

There is no way that China's stock bubble can continue rising 1,2,3% day after day… it is parabolic and stock valuations are at the highest in the world.

A big crash there is due. We will then see another round of Asian stock crashes, and likely the US and EU markets crashing as well.

But, my overall concern is that all markets are now in a synchronized world finance bubble , and everything from stocks, to bonds, to commodities, to include precious metals, is infected with speculative froth. Speculative froth is something that I define as price excesses created as people like hedge funds make leveraged positions in markets for short term gains.

One year max

These speculators are not interested as much in long term fundamentals, but only want to ride the present parabolic rises up in the markets everywhere. When that peaks, they will unload, and the fall will be swift and hard. Well, I personally believe we are within a year of the peak.

Every market is now infected with – hedge funds, record margin leverage by individuals, and record lows of roughly 3% of general investment funds cash balances. Every ‘dollar' out there, and more borrowed on leverage, is invested into markets world wide. The Yen carry trade is one prime example, of many examples of massive world leverage in markets of every type. I am just broad brushing this. Don't want to have to write a 100 page article.

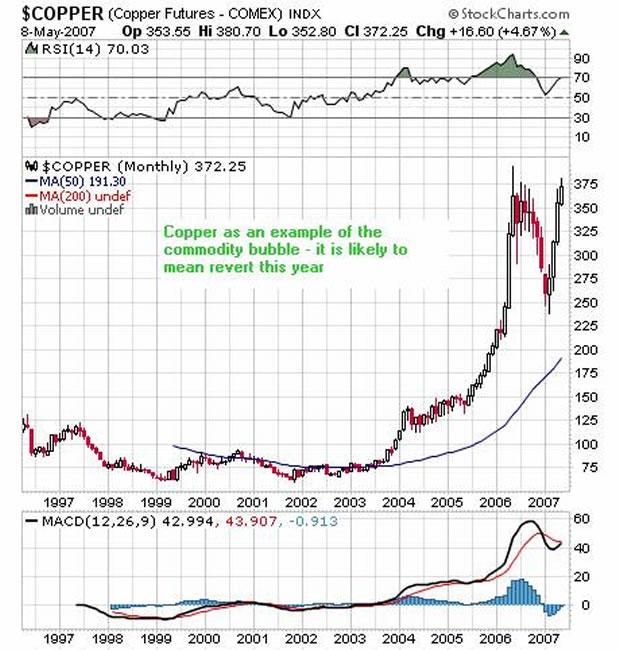

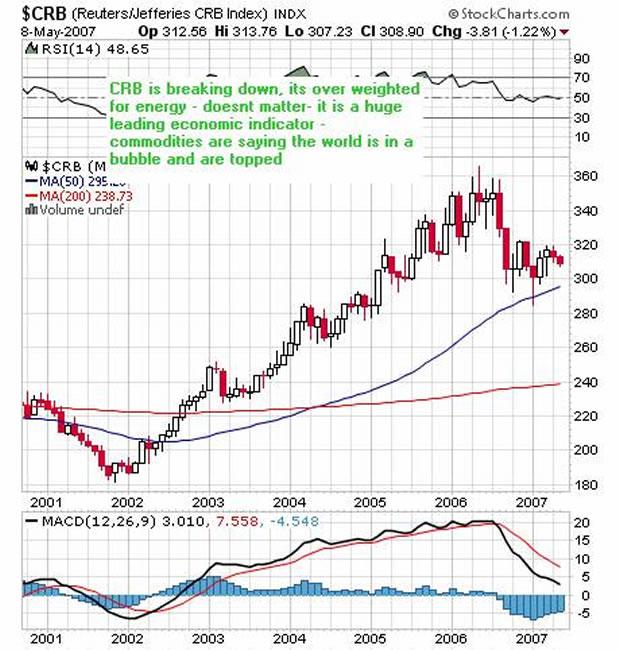

I don't usually use charts, but they can be very illuminating, and I don't want to say that all chart experts are wrong. Here are some nice charts that suggest you may want to consider going into liquidity. I will discuss the liquidity issue after these charts – gold, cash, bonds, savings accounts, currencies… But here are a few charts I want to present – these charts suggest the massive speculative froth in markets today, and why you might want to start considering getting liquid:

Charts

Types of liquidity

You know, after several years of this newsletter, and even before, there is one primary problem that I have been working on. It is, ‘how does one save his wealth, even if there is a currency crash, even if there are financial market crashes, even if there is a deflationary depression?'

Well, what I find out is, there are different types of liquidity. I am working on this in more detail, but let me broad brush this:

If financial crashes are coming, you need to be liquid before the crashes – that is obvious.

There are different types of liquidity. These depend on the currency they are in as well as things like interest rates.

If you have decided to get liquid and out of paper markets then, you need to consider currency risk and interest rates, and liquidity. I do not consider ETFs or electronic gold to be serious candidates for crisis survivable liquidity.

To be liquid in a financial crash, you need to sell assets and go to – say – cash. What you do with your cash comes into two categories.

First, you go into a currency and say, take an insured CD with 5% interest. That is liquid.

Or, on the same vein, you can use an insured savings account and get maybe 4% with no timeline.

If you really want to get liquid, you can buy precious metals and things that central banks use to back their currencies. These pay no interest, but they are immune – more or less- from currency crises. I do not consider any paper metal vehicle to be metal. It is paper only, and depends on the viability of the market and normal market operations.

The cost of being immune from a currency crisis is that you lose interest.

If you want interest, you have to be in a currency….

Anyway, these are things I am working on.

There is more to this story, and I think it will be further elaborated in the coming PS newsletters. But, in any case, I do believe very strongly that now is the time to start getting liquid, even if only 10% a month.

The Prudent Squirrel Newsletter is my macro economic gold newsletter. I am not an investment professional/advisor. The newsletter is macro economic research that looks to gold as a measure of what is happening. My subscriber base has grown constantly….and renewal rates are about 70% which must be at the top rate of this field.

Stop by and have a look.

Footnotes

*I want to say, I have been following a few guys that I consider to be conservative and informed newsletter writers. Basically, I don't follow many writers, but I have to follow a few that I like, or I risk getting out on a tangent.

Without naming names, these guys have changed to becoming bullish – at a time that I am absolutely certain, is a time that people should be getting into liquid positions. My basis of that view is based on many things, to include the charts I just listed. But...

What bothers me is that, my main amigos- that I feel are in general agreement with my very conservative views, are all now writing bullish articles – something that I am horrified to see.

I have not exactly made a reputation being in agreement with the general conservative newsletter writers… to my surprise. But, I do think that I am one of the most conservative gold/economic writers out there, very paranoid about saving people from market drops. I do not try to make people scads of new money, my total focus has been about being conservative. In this world market mania, that does make me unique, as far as I can tell.

Therefore, it is totally in my nature, to suggest that, in these parabolic markets – to start taking profits. Maybe not all profits, but incrementally. What would be wrong with the idea--- which is what this article is about --- to decide to agree that these markets are indeed parabolic, and that, at the minimum, to liquidate 10% of your stock positions each month, for the next ten months?

I talked to a very knowledgeable investor, about my recent previous articles that warn of a stock crash and a commodity complex crash. He mentioned that it was hard for him to stay in commodities right now, that they are indeed parabolic, and also hard to stay in stocks, as they are indeed parabolic…

But, he actually warned me, and said, ‘Chris, these parabolic market surges can go on up another 100%, easily'.

And, I do agree.

He suggested to be a bit more delayed in telling readers to get liquid, otherwise they could miss the next 100% gain.

And, in a way I say, I agree, but that is not what I personally would think one should do. But, I do understand what he is saying. But he is right, but this is not for me.

I, personally, don't want to try and say in the last stages of a parabolic market in everything – stocks, bonds, commodities, to get the last surge. I recognize the parabolic behavior, and I just want out. I'll take what I got so far.

By

Christopher Laird

PrudentSquirrel.com

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.