Inflation and Precious Metals, Gold and Silver

Commodities / Gold & Silver May 12, 2007 - 07:09 PM GMTBy: Paul_Saxena

"In an ideal world with a stable monetary base (zero monetary inflation), prices of almost everything (with a few exceptions) would be in decline. That would be a sign of real economic progress…"

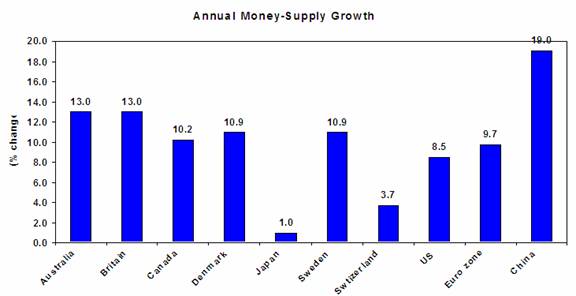

INFLATION/DEFLATION - Analysts and economists seem to be divided over this issue. According to some market observers (including me), we are living in a highly inflationary environment. After all, money supply growth is extremely strong in most countries (Figure 1) and this represents inflation.

Figure 1: Explosive Inflation!

Source: The Economist

The other camp argues that since prices of certain consumer goods are either stable or in decline, we are indeed witnessing genuine deflation. In my view, these "deflationists" seem to miss the point that falling consumer prices (due to improvements in technology or the relocation of manufacturing to relatively inexpensive developing nations) have nothing to do with deflation and everything to do with economic progress. In fact, I would argue that in the current economic environment; due to technological advances, rising productivity, free trade and cheap labour, prices SHOULD be declining. After all, this is the whole point of genuine economic development!

In an ideal world with a stable monetary base (zero monetary inflation), prices of almost everything (with a few exceptions) would be in decline. That would be a sign of real economic progress as people's savings would buy them more goods with every passing year. In our far from ideal world however, the factor preventing this from occurring IS monetary inflation. Due to central-bank sponsored inflation, prices of assets (whose supply is relatively limited when compared to money) are going through the roof! As a result of the ongoing inflation, even basic commodities which are critical for human survival (land, energy and food) have become very expensive, hence scarce for the average person. So, next time when someone tells you that we are witnessing deflation, tell them to look no further than the escalating cost of housing, energy, food, education and medical care.

Finally, if we were indeed witnessing genuine deflation (contraction in the money-supply), all asset-prices would be declining rather than flirting with multi-year highs!

PRECIOUS METALS - We are in a primary bull-market which is currently undergoing a healthy medium-term correction - everything else is "noise". Such corrections are normal and serve the purpose of shaking out the latecomers and the "weak hands". More importantly, such periods of weakness give us the ideal opportunity to increase our positions. I am not sure about you, but I always prefer to buy assets when the sentiment is negative and there is widespread fear amongst the investing public. Furthermore, I never purchase anything after a big rally. This is the reason why despite the brutal sell-off in commodities over the past several months, our managed accounts have held up reasonably well.

I have no doubt in my mind that both gold and silver will appreciate considerably over the coming years. Here are the reasons why:

Terminally-ill US Dollar

Rampant monetary inflation equals debasement of currencies

Record-high US trade and current-account deficits

Major top in the US bond-market and rising interest-rates (which will hurt housing)

Sky-high debt levels in developed nations; only option is to inflate the currencies

Rising geo-political tensions and increasing resource wars

A major bull-market in crude oil due to rising demand and tight supplies

Gold and silver are inexpensive in real-terms (inflation-adjusted basis)

Extremely cheap in comparison to financial assets (stocks and bonds)

As I explained in my previous reports, I do not expect gold and silver to surpass their May 2006 highs in the near future. I am of the opinion that both gold and silver are likely to decline into the summer months before embarking on a huge rally towards the end of this year. This action will shake out more weak hands and set the stage for a big advance.

However, if we do get a major conflict in Iran, you will be really glad that you own precious metals.

At present, Asian central banks hold a miniscule 1.5% of their total reserves in gold (Figure 2). You can imagine what will happen to the price of gold when Asian countries start diversifying into the yellow metal. Recently, China announced that it plans to invest US$200 billion of its US$ 1 trillion reserves in strategic assets. So, this move out of "paper" is already underway.

Figure 2: Asian Reserve Holdings

Since the commencement of this bull-market, precious metals mining shares have provided a leverage of 300% compared to physical bullion. However, over the past few months, physical bullion has outperformed the mining shares. These changes in relative strength are normal and I would advise you to utilise any near-term weakness in mining stocks and invest heavily.

By Paul Saxena

www.purusaxena.com

Puru Saxena is the editor and publisher of Money Matters, an economic and financial publication available at www.purusaxena.com. An investment adviser based in Hong Kong, he is a regular guest on CNN, BBC World, CNBC, Bloomberg TV & Radio, NDTV, RTHK Radio 3 and writes for several newspapers and financial journals.

www.dailyreckoning.co.uk Information in The Daily Reckoning is for general information only and is not intended to be relied upon by individual readers in making (or not making) specific investment decisions. Appropriate independent advice should be obtained before making any such decision. The Daily Reckoning and its staff do not accept liability for any loss suffered by readers as a result of any such decision.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.