Gold and Silver Analysis - Precious Points: Don't Fear the Repo

Commodities / Gold & Silver May 13, 2007 - 02:28 PM GMTBy: Dominick

Joe Nicholson writes “Even if the Fed ignites a rally on Wednesday, as it has in recent months, profit-taking, instead of frenetic new buying, is still the most probable ultimate result.” ~Precious Points: The Ennui on the Way , May 6, 2007

After starting off the week with a bit of a haircut, metals traded in a tight range until Wednesday afternoon, when the Fed statement sparked a rally that was soundly sold off the next day. Stocks ultimately closed roughly flat for the week, but on top of a rally that seems to have inspired new hope for Monday. The question is whether or not to believe the hype.

Well, the last two updates stressed the Fed's open market activities ahead of their latest statement. For three weeks now, reverses have removed dollars from the money markets and, at least temporarily, propped up the dollar. Not surprisingly, Thursday's M2 report showed a decline in broad money. The Fed has to remove this money to compensate for decreasing demand and to maintain the federal funds rate.

Last week's reverses continued this trend, ending the week with a net reduction of $6.25 billion. Rather than suggesting the potential future of monetary policy, these transactions are essentially concurrent indicators suggesting a downturn in the economy. Certainly that's the suggestion of the latest economic data.

Because it's used in GDP calculations, the trade balance figure in particular raised some eyebrows. Consider also that Friday's PPI came in as expected and, even though the Fed didn't explicitly change their focus from inflation to slowing growth, the prerequisite conditions for a cut are beginning to materialize. The Fed's statements have kept the door open for a rate cut, but last week's refunding held bond yields higher and a resilient consumer kept the bond market from moving toward pricing in a cut – even as stock markets and mainstream analysts seemed to conclude rate cutting is inevitable.

Despite the conviction of some high-profile commentators, a rate cut is not a foregone conclusion. But, with the domestic economy clearly slowing, M2 on the decline, China taking steps to slow its own growth, and Europe and London set for further rate hikes, perhaps measured inflation will at least get back to comfortable levels. “Stagflation” is starting to be murmured again in some circles, but the recent trend has been toward less not more inflation. Still, the total picture is far from black and white. Friday's data suggested a new wave of price inflation could be on the way, though probably not in next week's numbers.

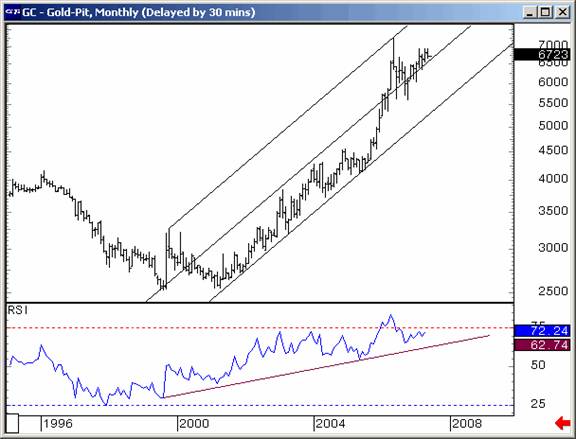

Nonetheless, history suggests that if the Fed is indeed gearing up for a cut this year, metals probably won't bottom until shortly thereafter, an outlook reflected in the chart below. The limit line above $720 is the point at which this pattern, and its anticipated decline to about $600, is negated.

(chart by Dominick)

Of course, at the same time, the fundamentals of the precious metals have never been better. Supply, in particular, is becoming an issue as accessible high grade ore is harder and harder to find as production costs continue to climb and refuse to abate. Failure to make a new high on any rally from here continues to be a major technical obstacle for gold and silver, but the updated chart from last week shows growing support for gold at these levels.

(chart by Dominick)

Platinum has fared much better than gold and silver, probably on supply factors, and has a much cleaner chart. Last week's close at the May 2006 highs could either confirm the end of corrective wave 4, or simply be the corrective B of its ABC down. The target area for the B wave is marked on the chart below.

The pair of gold charts and the platinum chart suggest two possible paths, either of which could materialize depending on the future of the U.S. and global economies and central bank policy. What gold needs to get its groove back is a rebound in the economy with an uptick in inflation… though senseless and mind-numbing debasement of the U.S. currency would probably work just as well. Waiting for the Fed to announce their decision is one option, but probably an even more useful measure to watch is the Fed's daily open market transactions.

A resumption of daily repos would essentially confirm renewed demand for money, and with it, a rebound in the U.S. economy. A continuation of reverses (signaling continued weakness) would most likely continue to trigger liquidation of large gold positions and put downward pressure on metals. If the economy doesn't completely go down the proverbial tubes, the Fed could decide to forgo an outright rate cut, which would probably do little to help the housing market anyway, and return to flooding banks and broker/dealers with cash – which should again be visible in the daily repos.

Obviously, new money from the Fed tends to stimulate buying. On the other hand, if we're headed toward rates cuts through an economic crisis and dollar collapse, the intermediate term will probably be more of this blasé rangebound trading… at best.

by Joe Nicholson (oroborean)

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.