Category: Gold and Silver 2013

The analysis published under this category are as follows.Friday, June 28, 2013

Gold Price Fresh Technical Damage, Mining Industry Faces Losing Money / Commodities / Gold and Silver 2013

By: Adrian_Ash

GOLD and SILVER both bounced in London trade Friday, only to slip back again after recording new 34-month lows overnight.

GOLD and SILVER both bounced in London trade Friday, only to slip back again after recording new 34-month lows overnight.

Asian stock markets closed higher but European equities slipped.

The major currencies held steady, and government bonds were flat overall, as were commodities.

Friday, June 28, 2013

Blood In The Streets Of Gold Market. Repeat Of 1970s Bull Market? / Commodities / Gold and Silver 2013

By: GoldCore

Today’s AM fix was USD 1,203.25, EUR 921.89 and GBP 789.33 per ounce.

Today’s AM fix was USD 1,203.25, EUR 921.89 and GBP 789.33 per ounce.

Yesterday’s AM fix was USD 1,232.00, EUR 945.51 and GBP 806.07 per ounce.

Gold fell $25.00 or 2.04% yesterday and closed at $1,199.10/oz. Silver finished the day with a slight loss of 0.11% at $18.50/oz.

Read full article... Read full article...

Friday, June 28, 2013

Paper, Rock, Silver / Commodities / Gold and Silver 2013

By: Dr_Jeff_Lewis

The silver market has taken a nose dive in recent trading sessions, leaving many of those positioned on the long side underwater.

Taking a deep breath, it may be time to acknowledge the difference between physical and paper

Read full article... Read full article...

Friday, June 28, 2013

Gold and Silver Prices - The Good, the Bad and the Ugly / Commodities / Gold and Silver 2013

By: Dr_Jeff_Lewis

After the recent notable decline in gold and silver prices, many precious metals investors are questioning whether or not to continue to hold their long positions.

At this point, it may make sense to take a step back to gain some perspective on the matter by looking at the past, present and likely projected future for the prices of silver and gold.

Read full article... Read full article...

Friday, June 28, 2013

Gold Heads Towards $1,000 as Forecast 9 Months Ago: So Is The Credit Crunch History? / Commodities / Gold and Silver 2013

By: Andrew_Butter

Last September when gold was $1,850 I wrote on this column: “I wouldn't be surprised to see gold under $1,000 in the next two years, and yes I know that's a real minority view”. http://www.marketoracle.co.uk/Article36370.html

Last September when gold was $1,850 I wrote on this column: “I wouldn't be surprised to see gold under $1,000 in the next two years, and yes I know that's a real minority view”. http://www.marketoracle.co.uk/Article36370.html

I got the usual mildly abusive comments. The kindest was; “This author has written decent articles in the past. I assume he was bored and just wanted some attention”.

Friday, June 28, 2013

The Big Investing Lesson You Must Learn From Gold Today / Commodities / Gold and Silver 2013

By: DailyWealth

Dr. Steve Sjuggerud writes: "I sold my gold," a family member told me a couple weeks ago.

"We probably sold at the bottom," he told me. "But we sold."

He was dejected when he told me this... as if he should have sold closer to the peak in gold. But who knows when the peak is?

Friday, June 28, 2013

Tonnes of Gold Removed From the Major ETFs and COMEX / Commodities / Gold and Silver 2013

By: Jesse

Considering the theory that the purpose of this market operation was designed to take the price of gold lower since the first of the year, and to free up bullion to relieve certain stresses in delivery, I was wondering if we could quantify the results of it in any way.

Considering the theory that the purpose of this market operation was designed to take the price of gold lower since the first of the year, and to free up bullion to relieve certain stresses in delivery, I was wondering if we could quantify the results of it in any way.

With the help of Nick at Sharelynx.com, the keeper of records and master of charts, I was able to calculate the approximate number of tonnes of inventory that were released into the market, or some private storage area perhaps, from the top funds and exchanges in the western world. The time period is from the beginning of this year through 26 June.

Read full article... Read full article...

Friday, June 28, 2013

Dubai Scrambles to Fly Gold Bullion from West to East / Commodities / Gold and Silver 2013

By: Jesse

Dubai is a hub for gold flowing from West to East.

But no gold for Germany can be found.

Could it be an unofficial bail-in?

Read full article... Read full article...

Friday, June 28, 2013

Gold Stealth Confiscation / Commodities / Gold and Silver 2013

By: Jesse

One remarkable thing about today's market action was the rebound in the miners even as gold underwent another waterfall bear raid of selling down to the 1200 level.

One remarkable thing about today's market action was the rebound in the miners even as gold underwent another waterfall bear raid of selling down to the 1200 level.

While one can assign any motives they wish to the speculation about if and why there is a stealth confiscation happening, I do believe that the trigger for this was the request from Germany to have their sovereign gold returned, and the refusal of the custodian in New York to do so until 2020.

Read full article... Read full article...

Thursday, June 27, 2013

Sour Gold Investment Sentiment Suggests Biggest Quarterly Drop on Record / Commodities / Gold and Silver 2013

By: Ben_Traynor

WHOLESALE gold bullion prices fell back towards $1230 an ounce Thursday morning in London, having ticked higher in earlier Asian trading, as stocks and commodities were little changed on the day and the Dollar was also flat after showing little reaction to yesterday's downward revision for US economic growth.

WHOLESALE gold bullion prices fell back towards $1230 an ounce Thursday morning in London, having ticked higher in earlier Asian trading, as stocks and commodities were little changed on the day and the Dollar was also flat after showing little reaction to yesterday's downward revision for US economic growth.

Gold in Euros traded as low as €940 an ounce this morning, with gold in Sterling dipping as low as £802 an ounce.

Thursday, June 27, 2013

Gold Controls In India as Premiums Double on Strong Demand For Gold and Silver / Commodities / Gold and Silver 2013

By: GoldCore

Today’s AM fix was USD 1,232.00, EUR 945.51 and GBP 806.07 per ounce.

Today’s AM fix was USD 1,232.00, EUR 945.51 and GBP 806.07 per ounce.

Yesterday’s AM fix was USD 1,229.00, EUR 942.85 and GBP 799.97 per ounce.

Gold fell $53.20 or 4.17% yesterday and closed at $1,224.10/oz. Silver slid to a low of $18.421 and finished down 5.46%.

Read full article... Read full article...

Thursday, June 27, 2013

How Europe Will Help Gold Shine Again / Commodities / Gold and Silver 2013

By: Money_Morning

Martin Hutchinson writes: The Good News: The euro crisis has failed to explode in the last three years, in spite of repeated predictions that it would. Many commentators now rejoice that the problem is solved.

Martin Hutchinson writes: The Good News: The euro crisis has failed to explode in the last three years, in spite of repeated predictions that it would. Many commentators now rejoice that the problem is solved.

The Bad News: Don't believe it. While a few of the countries have made steps toward recovery, there are still several that haven't, and, by and large, those that haven't are larger than those that have.

Read full article... Read full article...

Thursday, June 27, 2013

Who Killed the Gold Price? / Commodities / Gold and Silver 2013

By: The_Gold_Report

The gold price may have taken a tumble, but Ian Gordon, chairman and founder of the Longwave Group in British Columbia, is watching for a recovery. As bullishness in gold reaches some of its lowest levels, Gordon, in this interview with The Gold Reportsays he believes that is indicative of a turn and he discusses where he has invested his money to ride the upswing.

The gold price may have taken a tumble, but Ian Gordon, chairman and founder of the Longwave Group in British Columbia, is watching for a recovery. As bullishness in gold reaches some of its lowest levels, Gordon, in this interview with The Gold Reportsays he believes that is indicative of a turn and he discusses where he has invested his money to ride the upswing.

The Gold Report: On April 15, the gold price plunged about 9%—the biggest one-day loss ever for the yellow metal. Many gold investors got "murdered" that day. Has your personal investigation revealed any suspects?

Read full article... Read full article...

Thursday, June 27, 2013

History's Opinion on the Gold Price Crash / Commodities / Gold and Silver 2013

By: Adrian_Ash

This crash in gold is hardly unprecedented. Nor is the likely price action over the next one and 3 months...

This crash in gold is hardly unprecedented. Nor is the likely price action over the next one and 3 months...

So over the last three months, gold prices have sunk 25.2% for US Dollar investors. That's some drop - the 40th worst rolling 3-month period since prices were floated during the death throes of the Gold Standard in 1968.

Read full article... Read full article...

Thursday, June 27, 2013

Time for Gold to Climb the Wall of Worry? / Commodities / Gold and Silver 2013

By: PhilStockWorld

Zeroxzero said it best last night: Reading the apocalyptic tone in many of the comments today — the imminent demise of Japan, the imminent demise of France, the inevitable implosion of China, the Demolition Derby of Euro, Yen, Dollar and Swissie, and the collapse of gold — all viewed against the fiery background of a Middle East abandoned to war because we don't need its oil anymore, a Brazil, Australia, Latam & Africa whose commodities are now worthless, and an Asia and India whose cheap labor has become superfluous — I have been given the sense that we are now riding the Fifth Wave up the Limpopo with Yellow Jack.

Read full article... Read full article...

Wednesday, June 26, 2013

Gold's Price Plunge Not Met by Stronger Physical Demand / Commodities / Gold and Silver 2013

By: Ben_Traynor

SPOT MARKET gold fell to its lowest level since August 2010 Wednesday, trading as low as $1224 an ounce, as stocks rallied along with the Dollar following better-than-expected US economic data a day earlier.

By Wednesday lunchtime in London, gold in Dollars was trading around 4% down on where it started yesterday's London session.

Wednesday, June 26, 2013

Gold and Silver Life Cycle Nears End – The Final Stage of Denial / Commodities / Gold and Silver 2013

By: Chris_Vermeulen

The life cycle of most things not matter what it is (living, product, service, ideas etc…) go through four stages and the stock market is no different. Those who recently gave in and bought gold, silver, mining stocks, coins will be enter this stage of the market in complete denial. They still think this is a pullback and a recover should be just around the corner.

The life cycle of most things not matter what it is (living, product, service, ideas etc…) go through four stages and the stock market is no different. Those who recently gave in and bought gold, silver, mining stocks, coins will be enter this stage of the market in complete denial. They still think this is a pullback and a recover should be just around the corner.

Well the good news is a recovery bounce should be nearing, but if technical analysis, market sentiment and the stages theory are correct then a bounce is all it will be followed by years of lower prices and dormancy.

Read full article... Read full article...

Wednesday, June 26, 2013

The Ben Bernanke Gold Correction - Why I Own Gold / Commodities / Gold and Silver 2013

By: Axel_Merk

I am an optimist. I'm no conspiracist. I just happen to think the road to hell is paved with good intentions. As a result, I own gold. Let me expand.

I am an optimist. I'm no conspiracist. I just happen to think the road to hell is paved with good intentions. As a result, I own gold. Let me expand.

Wednesday, June 26, 2013

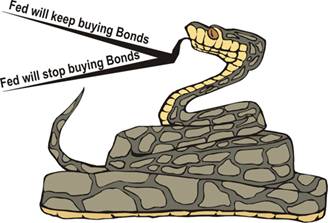

The Fed’s Forked Tongue, Means Gold's Price Rise Will be Explosive / Commodities / Gold and Silver 2013

By: Darryl_R_Schoon

When Helicopter Ben Bernanke

When Helicopter Ben Bernanke

Said the helicopter would descend

The markets reacted and quickly fell

Fearing the party would end

But they forgot that Ben’s a banker

A breed whose trust is low

And they didn’t stop to consider

It might only be part of the show

Wednesday, June 26, 2013

Gold Expected Rally Could Taper off by Mid July / Commodities / Gold and Silver 2013

By: Ed_Carlson

The $88/oz. drop in gold last Thursday surely got the attention of a few - instilling fear in those who are still long the metal and greed in those who are not. While I doubt a final low will be seen in gold until the end of the year (the subject of another commentary) the time for a short bounce appears to be upon us.

Read full article... Read full article...