Category: Gold and Silver Stocks 2019

The analysis published under this category are as follows.Thursday, August 22, 2019

Gold Price Trend Validation / Commodities / Gold and Silver Stocks 2019

By: Denali_Guide

So who is on First, or Are we there yet ?

So who is on First, or Are we there yet ?

Either addresses the current CUT 2 CHASE question.

Blind faith can be good or bad, but tempered with some evidence, might be a good thing. Lets look at several categories of evidence concerning the position and trend of Gold and Gold Stocks.

Read full article... Read full article...

Tuesday, August 06, 2019

There’s More Upside in Gold & Gold Stocks / Commodities / Gold and Silver Stocks 2019

By: Jordan_Roy_Byrne

After a major trend change, it can be difficult for the majority of investors and market watchers to shift and adjust accordingly to the new trend.

After a major trend change, it can be difficult for the majority of investors and market watchers to shift and adjust accordingly to the new trend.

It’s no different in the current case of precious metals which, other than a huge rally in the first half of 2016 have been dead money for the majority of the current decade. Despite the newfound bullish fundamentals and bullish technical action, plenty of worry remains that the breakout in Gold could fail.

Conventional wisdom argues the sector has run too far too fast and needs to correct. Technical and sentiment indicators are showing extremes (but only when judged against recent, bear market years).

Read full article... Read full article...

Saturday, August 03, 2019

Gold Stocks Seasonal Autumn Rally / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The gold miners’ stocks have surged dramatically this summer, catapulted higher by gold’s major bull-market breakout. That atypical strength bucking the normal summer-doldrums slump has carried this sector right back to its traditional strong season. That begins with a robust autumn rally starting in late summers. This year’s autumn-rally setup is very unusual, but investment buying could still fuel further gains.

The gold miners’ stocks have surged dramatically this summer, catapulted higher by gold’s major bull-market breakout. That atypical strength bucking the normal summer-doldrums slump has carried this sector right back to its traditional strong season. That begins with a robust autumn rally starting in late summers. This year’s autumn-rally setup is very unusual, but investment buying could still fuel further gains.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behavior driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Read full article... Read full article...

Monday, July 29, 2019

Gold ETF That Obliterates its Competition / Commodities / Gold and Silver Stocks 2019

By: The_Gold_Report

Bob Moriarty of 321Gold profiles a precious metals ETF that has "absolutely obliterated its main competition." The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) just had its two-year anniversary at the end of June, and since inception, the fund has absolutely obliterated its main competition.

Bob Moriarty of 321Gold profiles a precious metals ETF that has "absolutely obliterated its main competition." The U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU) just had its two-year anniversary at the end of June, and since inception, the fund has absolutely obliterated its main competition.

GOAU delivered a remarkable 41% since inception through July 24, crushing the hugely popular VanEck Vectors Gold Miners ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ), which were up 32.7% and 27.6% over the same period.

Read full article... Read full article...

Thursday, July 25, 2019

The Third World Is Imploding: An Argument for Investment in Gold Stocks / Commodities / Gold and Silver Stocks 2019

By: The_Gold_Report

In this interview with Maurice Jackson of Proven and Probable, Jayant Bhandari presents his world view and discusses how it meshes with investment in the precious metals markets.

In this interview with Maurice Jackson of Proven and Probable, Jayant Bhandari presents his world view and discusses how it meshes with investment in the precious metals markets.

Maurice Jackson: Joining us for a conversation is Jayant Bhandari, the founder of the world-renowned Capitalism and Morality seminar, and a highly sought-out advisor to institutional investors. Mr. Bhandari, welcome to the show, sir.

Jayant Bhandari: Thank you very much for having me, Maurice.

Maurice Jackson: Always glad to have you on our program, sir. We have a number of topics to address that are important for members of our audience to be aware of that may have an impact on their investment decisions. I would like to begin our discussion by addressing geopolitics in areas of the world that many investors and those in the media identify as emerging economies. But in previous interviews you've pointed out that these are not emerging economies but they're Third World economies, and they will remain Third World economies. Let's began in Latin America and go to Venezuela. What has your attention there and why?

Read full article... Read full article...

Tuesday, July 23, 2019

Gold & Gold GDX Stocks Ripping. What’s Next? / Commodities / Gold and Silver Stocks 2019

By: Jordan_Roy_Byrne

It was a huge week for the gold stocks. GDX gained nearly 7% while GDXJ surged over 10%.

It was a huge week for the gold stocks. GDX gained nearly 7% while GDXJ surged over 10%.

Gold hit $1450/oz after Thursday before selling off Friday. Silver met the same fate on Friday but managed to close the week up over 6% and at a new 52-week high.

Let’s take a look at the current technicals.

Gold closed the week just below $1427/oz. If it remains above $1420-$1425, then it is likely to trend towards $1475/oz, which is the only resistance between $1425 and $1525.

Read full article... Read full article...

Saturday, July 20, 2019

Gold Mining Stocks Q2’19 Results Analysis / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The gold miners’ stocks continue to rally on balance, after a major upside breakout extended their strong upleg. That’s driving mounting interest in this recently-forsaken sector. With the latest quarterly earnings season underway, traders will soon enjoy big fundamental updates from the gold miners. They are likely to report good Q2 results, with improving operational performances supporting further stock-price gains.

The gold miners’ stocks continue to rally on balance, after a major upside breakout extended their strong upleg. That’s driving mounting interest in this recently-forsaken sector. With the latest quarterly earnings season underway, traders will soon enjoy big fundamental updates from the gold miners. They are likely to report good Q2 results, with improving operational performances supporting further stock-price gains.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Companies trading in the States are required to file 10-Qs with the US Securities and Exchange Commission by 40 calendar days after quarter-ends. The gold miners generally release their quarterly reports in the latter half of that window. So Q2’19’s will arrive between late July to mid-August.

After spending decades intensely studying and actively trading this contrarian sector, there’s no gold-stock data I look forward to more than the miners’ quarterly financial and operational reports. They offer a true and clear snapshot of what’s really going on, shattering the misconceptions bred by ever-shifting winds of sentiment. Nearly all fundamental analysis is based off the data gold miners provide in quarterlies.

Read full article... Read full article...

Tuesday, July 16, 2019

Elliott Wave Analysis of DUST (Gold Miners Bear 3x Shares ETF) / Commodities / Gold and Silver Stocks 2019

By: WavePatternTraders

The strong decline over the last few weeks appears to argue for an impulse wave, I suspect it's close to ending a 3rd wave, so an up-down sequence is still favored before it completes 5 waves from the May 2019 high.I favor its very close to seeing a bounce for wave [iv], although I am still expecting to see further weakness for wave [v] thereafter once wave [iv] ends, however, I do think a new high on the GDX needs to be watched, as it too can end wave [iii] of an impulse wave, although in the opposite direction.

Read full article... Read full article...

Tuesday, July 16, 2019

Gold Stocks Forming Bullish Consolidation / Commodities / Gold and Silver Stocks 2019

By: Jordan_Roy_Byrne

Gold and gold stocks especially continue to shrug off bits and pieces of bad news.

Gold and gold stocks especially continue to shrug off bits and pieces of bad news.

No escalation in the trade war? The selloff lasted one day and the sector rebounded strongly the following day.

Strong headline jobs number? Again, the weakness was a buying opportunity.

This past week there was more.

Read full article... Read full article...

Thursday, July 11, 2019

Mining Stocks Flash Powerful Signal for Gold and Silver Markets / Commodities / Gold and Silver Stocks 2019

By: MoneyMetals

The second half of the year is setting up favorably for the precious metals sector, which was led in the first half by gold and gold mining stocks.

The second half of the year is setting up favorably for the precious metals sector, which was led in the first half by gold and gold mining stocks.

Of course, the Wall Street-beholden financial media is largely ignoring metals and mining – preferring instead to give celebratory coverage to every move toward new highs in the Dow and S&P 500.

“The Dow Jones Industrial Average rallied 7.2% this month [June], notching its best June performance since 1938,” CNBC reported. “The S&P 500 posted its best first half of a year since 1997, soaring 17.3% and reaching an all-time high.”

Monday, July 01, 2019

Gold Huge Upside if Breakout Holds / Commodities / Gold and Silver Stocks 2019

By: Jordan_Roy_Byrne

As I pen this article, Gold is set to close the month and the quarter above $1400/oz and holding the majority of its recent gains. That does not necessitate continued strength but it is a good sign.

As I pen this article, Gold is set to close the month and the quarter above $1400/oz and holding the majority of its recent gains. That does not necessitate continued strength but it is a good sign.

The technicals and fundamentals are finally in place for Gold.

It is outperforming all major currencies and the Federal Reserve is weeks away from beginning a new cycle of rate cuts. The US Dollar has broken its uptrend.

The near-term outlook is very strong but if the Federal Reserve cuts three or four times and Gold strongly outperforms the stock market then this move can go to $1900/oz.

Read full article... Read full article...

Saturday, June 29, 2019

Gold Stocks Decisive Breakout! / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The gold miners’ stocks just blasted higher to a major decisive breakout this week! Driven by gold’s own huge bull-market breakout, the gold stocks surged well above vexing years-old upper resistance. The resulting new multi-year highs are a game changer, starting to shift long-apathetic sector sentiment back towards bullish. This will increasingly attract back traders, with their buying unleashing a virtuous circle of gains.

The gold miners’ stocks just blasted higher to a major decisive breakout this week! Driven by gold’s own huge bull-market breakout, the gold stocks surged well above vexing years-old upper resistance. The resulting new multi-year highs are a game changer, starting to shift long-apathetic sector sentiment back towards bullish. This will increasingly attract back traders, with their buying unleashing a virtuous circle of gains.

Traders usually track gold-stock fortunes with this sector’s most-popular exchange-traded fund, the GDX VanEck Vectors Gold Miners ETF. Launched in May 2006, this was the original gold-stock ETF. That big first-mover advantage has helped propel GDX to sector dominance. This week its net assets of $10.5b ran 44.6x larger than the next-biggest 1x-long major-gold-miners ETF! GDX is this sector’s leading benchmark.

And as recently as late May, neither speculators nor investors wanted anything to do with gold stocks. GDX slumped to $20.42 on May 29th, down 3.2% year-to-date. That was much worse than gold’s own slight 0.2% YTD decline then warranted. The gold stocks were really out of favor, largely ignored by apathetic traders. What a difference a month makes though, as their fortunes changed radically in June.

Read full article... Read full article...

Friday, June 28, 2019

Gold Stock Launch in the Books; What’s Next / Commodities / Gold and Silver Stocks 2019

By: Gary_Tanashian

You may know me as the…

…guy.

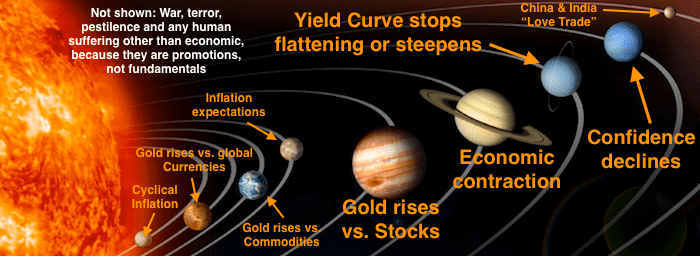

The guy using the planets of an imaginary gold sector Macrocosm with proper fundamentals that are decidedly not imaginary but rather, are necessary to call a real bull phase or even bull market. By managing a strict set of macro and sector fundamental inputs (to the sound of crickets and little else in the sector) NFTRH and its subscribers had a front row seat to the now obvious gold mining launch as first the fundamentals came in line, followed by the technicals.

Read full article... Read full article...

Tuesday, June 25, 2019

GDX Gold Stocks ETF / Commodities / Gold and Silver Stocks 2019

By: Nadeem_Walayat

This article in my Gold analysis series takes a look at GDX the Gold stocks ETF:

- Current State

- Trend Analysis, MACD, Trend Channels Support / Resistance

- Seasonal Analysis

- US Dollar / Gold

- Gold Price Trend Forecast Conclusion

- Gold Stocks

Friday, June 21, 2019

Potential Upside Targets for Gold Stocks / Commodities / Gold and Silver Stocks 2019

By: Jordan_Roy_Byrne

Gold has finally broken out to the upside.

Gold has finally broken out to the upside.

In Asia trading on Thursday, Gold exploded through the $1360 to $1370 resistance zone and was able to hold the gains throughout the day, closing above $1395/oz.

As we pen this article, Gold has to chance to break $1400/oz by the weekend. The close of the month (and quarter) next week will provide an additional clue as to the sustainability of this strength.

The gold stocks meanwhile have been on an absolute tear. GDX is up 16 of the past 17 trading days and has gained 23% over that period. GDXJ is up 13 of the past 17 sessions and has also gained 23% during that period.

GDX closed right at resistance at $25. It could blow through it and reach a multi-year high at $27 or it could first correct and consolidate around $25.

Read full article... Read full article...

Thursday, June 20, 2019

Gold Mining Stocks Waiting on This Chart / Commodities / Gold and Silver Stocks 2019

By: Gary_Tanashian

It’s not a chart of nominal HUI with upside technical targets. We’ll do that in NFTRH this weekend, along with the usual individual miners. Rather, it’s a companion to other charts we’ve been reviewing over the last several months showing the under valuation of the gold stock sector relative to gold’s performance vs. cyclical assets/markets. For example, gold has risen strongly vs. the CRB index and that is a sector fundamental under valuation.

It’s not a chart of nominal HUI with upside technical targets. We’ll do that in NFTRH this weekend, along with the usual individual miners. Rather, it’s a companion to other charts we’ve been reviewing over the last several months showing the under valuation of the gold stock sector relative to gold’s performance vs. cyclical assets/markets. For example, gold has risen strongly vs. the CRB index and that is a sector fundamental under valuation.

Sunday, June 16, 2019

Gold Stocks Bull Upleg Mounting / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The gold miners’ stocks have surged powerfully over the past few weeks, challenging upleg highs. Traders started returning to this small contrarian sector as gold blasted back above the psychologically-crucial $1300 line. While such early-summer strength is atypical, gold miners’ technicals, sentiment, and fundamentals all support more gains to come. Gold stocks need to mean revert to much-higher price levels.

The gold miners’ stocks have surged powerfully over the past few weeks, challenging upleg highs. Traders started returning to this small contrarian sector as gold blasted back above the psychologically-crucial $1300 line. While such early-summer strength is atypical, gold miners’ technicals, sentiment, and fundamentals all support more gains to come. Gold stocks need to mean revert to much-higher price levels.

Traders usually track gold-stock fortunes with this sector’s most-popular exchange-traded fund, the GDX VanEck Vectors Gold Miners ETF. Launched in May 2006, this was the maiden gold-stock ETF. That big first-mover advantage has helped propel GDX to sector dominance. This week its net assets of $9.7b ran 46.5x larger than the next-biggest 1x-long major-gold-miners ETF! GDX is this sector’s leading benchmark.

And it sure didn’t look pretty in May, with traders wanting nothing to do with gold stocks. GDX spent the great majority of last month languishing near its 200-day moving average. Just a few weeks ago on May 29th, GDX closed at $20.42. That was down 3.2% year-to-date, much worse than gold’s own slight 0.2% YTD decline. The gold stocks were really out of favor, just like the metal they mine which fuels their profits.

Read full article... Read full article...

Thursday, June 06, 2019

Torrid Advances in Gold ETFs Stocks Warrant Caution / Commodities / Gold and Silver Stocks 2019

By: The_Gold_Report

Michael Ballanger explains how he is reacting to the advances in the gold ETFs. Given the torrid advance in gold (GLD [SPDR Gold Shares]) and the leveraged miner ETFs (NUGT [Direxion Daily Gold Miners Index Bull 3x]/JNUG [Direxion Daily Junior Gold Miners Index Bull 3x]), it is of note that RSI readings have screamed northward to the point where I don't think I can recall a shift in momentum quite this quickly or with such torque. Now, it doesn't automatically follow that these ETFs are going to crash. In fact, long after RSI readings topped out in February 2016, NUGT and JNUG continued to make new highs for the move. However, today's set-ups appear to be similar to 2016 so caution is warranted in both exiting too soon and staying too late, so how I deal with that is to take down a portion of the risk and that is precisely what we did yesterday.

Michael Ballanger explains how he is reacting to the advances in the gold ETFs. Given the torrid advance in gold (GLD [SPDR Gold Shares]) and the leveraged miner ETFs (NUGT [Direxion Daily Gold Miners Index Bull 3x]/JNUG [Direxion Daily Junior Gold Miners Index Bull 3x]), it is of note that RSI readings have screamed northward to the point where I don't think I can recall a shift in momentum quite this quickly or with such torque. Now, it doesn't automatically follow that these ETFs are going to crash. In fact, long after RSI readings topped out in February 2016, NUGT and JNUG continued to make new highs for the move. However, today's set-ups appear to be similar to 2016 so caution is warranted in both exiting too soon and staying too late, so how I deal with that is to take down a portion of the risk and that is precisely what we did yesterday.

GLD is somewhat more overbought than the miners so having pitched 50% of the June $120 calls yesterday (@ $5 plus), I am jettisoning the rest in order to leg out to the September calls at some point in the future. The preferable entry point will be in late June or early July or if the RSI numbers can get back to around 30 and preferably the 20s so as to reflect an oversold condition rather than the current overbought condition we have today.

Read full article... Read full article...

Saturday, May 25, 2019

Gold Mining Mid-Tier Stocks Fundamentals / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The mid-tier gold miners’ stocks in the sweet spot for price-appreciation potential have been struggling in recent months, grinding lower with gold. Their strong early-year momentum has been sapped by recent stock-market euphoria. But gold-mining stocks are more important than ever for prudently diversifying portfolios. The mid-tiers’ recently-reported Q1’19 results reveal their fundamentals remain sound and bullish.

The mid-tier gold miners’ stocks in the sweet spot for price-appreciation potential have been struggling in recent months, grinding lower with gold. Their strong early-year momentum has been sapped by recent stock-market euphoria. But gold-mining stocks are more important than ever for prudently diversifying portfolios. The mid-tiers’ recently-reported Q1’19 results reveal their fundamentals remain sound and bullish.

The wild market action in Q4’18 emphasized why investors shouldn’t overlook gold stocks. All portfolios need a 10% allocation in gold and its miners’ stocks! As the flagship S&P 500 broad-market stock index plunged 9.2% in December alone, nearly entering a new bear market, the leading mid-tier gold-stock ETF surged 13.7% higher that month. That was a warning shot across the bow that these markets are changing.

Four times a year publicly-traded companies release treasure troves of valuable information in the form of quarterly reports. Required by the US Securities and Exchange Commission, these 10-Qs and 10-Ks contain the best fundamental data available to traders. They dispel all the sentiment distortions inevitably surrounding prevailing stock-price levels, revealing corporations’ underlying hard fundamental realities.

Read full article... Read full article...

Friday, May 24, 2019

Powerful Signal from Gold GDX / Commodities / Gold and Silver Stocks 2019

By: P_Radomski_CFA

Gold and silver declined a bit yesterday, but mining stocks reversed and closed the session higher. It seems that the miners showed strength, especially that they formed a bullish reversal candlestick. But did they? The reversal candlesticks should be confirmed by strong volume and what we saw in the GDX ETF yesterday was the lowest daily volume of the year. In fact, the GDX volume was lower than any volume that we saw in 2018. And 2017. And 2016. And even 2015. The last time when we saw as low a volume was on May 21, 2014 (yes, exactly 5 years earlier). So, how should we read this price action?

Gold and silver declined a bit yesterday, but mining stocks reversed and closed the session higher. It seems that the miners showed strength, especially that they formed a bullish reversal candlestick. But did they? The reversal candlesticks should be confirmed by strong volume and what we saw in the GDX ETF yesterday was the lowest daily volume of the year. In fact, the GDX volume was lower than any volume that we saw in 2018. And 2017. And 2016. And even 2015. The last time when we saw as low a volume was on May 21, 2014 (yes, exactly 5 years earlier). So, how should we read this price action?

It is not the reversal or relative strength that is the powerful signal from the GDX. It’s the extremely low volume reading. What makes it so important right now, is that since March 2013 there were only four similar cases and they were all followed by exactly the same thing.

Quick declines.

Read full article... Read full article...