U.S. Treasury Bond Market Massacred; Yield Curve Steepest On Record

Interest-Rates / US Bonds May 28, 2009 - 01:39 AM GMTBy: Mike_Shedlock

Bernanke cannot have his cake and eat it too. If the economy is recovering the yield curve should steepen. And steepen it has. The Yield Curve Is Steepest On Record.

Bernanke cannot have his cake and eat it too. If the economy is recovering the yield curve should steepen. And steepen it has. The Yield Curve Is Steepest On Record.

The difference in yields between Treasury two and 10-year notes widened to a record on concern surging sales of U.S. debt will overwhelm the Federal Reserve’s efforts to keep borrowing costs low.

The so-called yield curve steepened to 2.75 percentage points, surpassing the previous record of 2.74 percentage points set on Aug. 13, 2003.

Ten-year notes have lost 10.3 percent this year, according to Merrill Lynch & Co. indexes, while 30-year bonds have lost 27.5 percent. Two-year notes have gained 0.2 percent.

Rising 10-year Treasury yields are pushing yields on mortgage bonds higher, prompting holders of the securities to sell government debt used as a hedge to protect portfolios against rising interest rates.

As mortgage rates rise, the expected average lives of mortgage bonds and mortgage-servicing contacts extend as potential refinancing drops, leaving holders with portfolios of longer-than-anticipated durations. Duration is a measure of bond price sensitivity to interest-rate change.

“The back-up is mostly related to convexity selling by mortgage investors,” said Gary Pollack, who helps oversee $12 billion as head of fixed-income trading at Deutsche Bank AG’s Private Wealth Management unit in New York. “This will be a test for the Fed.”

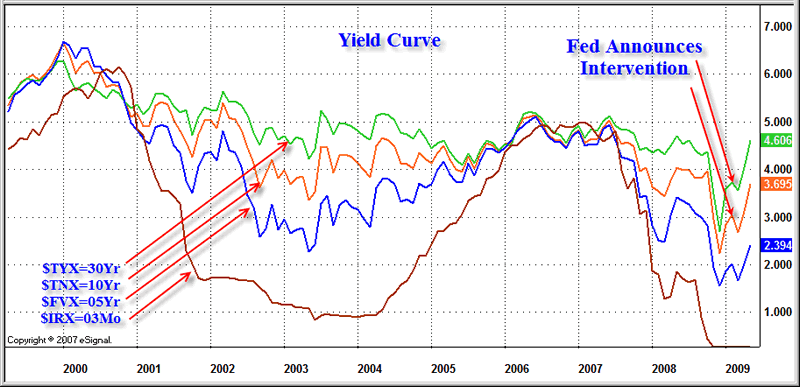

Yield Curve 1999 - Present

If the economy is recovering, the Fed should welcome this steepening. However, what if the yield curve is simply reacting at the thought of Bernanke monetizing Obama's massive deficits and the various stimulus plans?

I doubt the economy is recovering but it is may be getting worse at a lesser rate. Moreover, if the curve flattens, it sure will not be because of intervention, it will be because the so-called recovery has stalled. Heaven help Bernanke if the economy worsens and the yield curve continues to steepen.

Regardless why the yield curve is steepening, Bernanke's belief that he can control both the long and short end of the curve is seriously misguided. The fact is he cannot really control either, at least for long.

Twilight Zone Treasuries

Flashback April 23 2009: Twilight Zone Treasuries

The Fed said at its last meeting it intends to buy $300 billion in Treasury securities over six months in a bid to lower long-term borrowing costs and revive economic growth.

$TNX - 10 Year Treasury Note Yield

Professor Fil Zucchi on Minyanville had this succinct comment:

"Today the Federal Reserve printed $7 billion dollars and used it to buy an equivalent amount of 7 and 10 year Treasury bonds. As I publicly asked before, if Mr. Fed can't rig the price of an asset by buying it with printed money, why should anyone else buy it?"

Those wishing to keep an eye on these price rigging attempts can follow the Federal Reserve Bank Permanent OMOs: Treasury link.

Bernanke's Hubris

It is ridiculous for the Fed to think it can control the vast $trillion treasury market with pea shooting efforts at $7 billion a pea. However, as the charts above show, the Fed announcement hugely distorted the market in smaller timeframes.

As Prof. Zucchi says "If Mr. Fed can't rig the price of an asset by buying it with printed money, why else should anyone else buy it?"

Other than the initial pop, the Fed's silly attempt to game the system may have caused so much mistrust that it is putting upward pressure on yields.Treasury Yields Where To From Here?

A couple of people wrote me today saying I have been wrong about treasuries.

Let's backtrack for a moment to set the record straight for those who think I have been bullish on treasuries all year. Although the strength of the selloff this year has been surprising, I stepped aside in December.

Prior to that I was hugely bullish, more so than anyone I know.

Mish Treasury Calls

Sunday, January 20, 2008: Time To Short Treasuries?

Kass Says Sell Bonds Short.

Kass: The bond market is in a bubble that is reminiscent of (and quite possibly as extreme as) other bubbles during previous eras. From my perch, the only issue is the timing of this trade.

Mish: Timing is indeed everything and perhaps there is a temporary selloff. But the primary trend is for lower yields. Perhaps much lower yields. There is no bubble in bonds. Not yet.

...

Anyone who wants to short treasuries with impunity on this economic backdrop can be my guest. For the record, I have no grudge against Kass. He puts out a good column that I frequently agree with. However, I take the other side of this debate.

There is no bubble in treasuries if you look closely at the fundamental issues. Those who want to see how low treasury yields can get and stay there, need to look at Japan. Yields in the US are going to go far lower and stay lower longer than nearly everyone thinks.Thursday, June 26, 2008: Is The Inflation Scare Over Yet?

Those focused on the CPI failed to see any chance of the Fed Fund's Rate at 2.00 again. On the other hand, those focused on the destruction of credit from an Austrian economic perspective got this correct. That is just one reason why it makes more sense to watch the credit markets than the CPI. The second is the CPI is so distorted it is useless.

In my opinion, it is very likely new all time lows in the 10-year treasury yield and 30-year long bond are coming up.Wednesday, November 19, 2008: Misguided Bets On The Yield Curve

Someone from one of the big brokerage houses emailed me last week saying the yield curve would steepen. My response was "Why should it?"

A bet on the yield curve to steepen is a bet the economy improves. Why should it? An even better question is "How low do 10 year and 30 yields go?" Certainly 3% or lower on the 10 year and even 30 year are in the realm of possibilities. That's how nasty this recession is likely to get.Tuesday, January 06, 2009: Reflections On 2008, Themes For 2009

It is quite possible the lows in treasury yields are in. Unlike 2008 where I was constantly beating the drums for lower yields, 2009 could be different. Here are the facts: 3 month and 6 month yields hit 0% and the 10 year came close to hitting 2%. Could there be lower yields still? Yes, quite easily. Is it worth playing for other than as a hedge or part of an overall investment strategy? No.

Thursday, March 26, 2009 Quantitative Easing Begins; "Operation Twist" Revisited

Appearance vs. Reality

Yields may drop. If they do it will not be because quantitative easing is working. If yields drop from here, in spite of the massive supply of treasuries stemming from Obama's sky high budget, it will be because the economy is in worse shape than anyone thinks.

Those hoping for a second half economic recovery should be hoping yields rise, not sink.

"Operation Twist" failed. So will "Operation Twist Again" in one way or another, or perhaps multiple ways. For example there is no specific reason mortgage rates will drop even if [treasury] yields do. Default risk is simply too high.

Are Yields Going Up Or Down From Here?

Yes they are. I guarantee it. If you want to know which way short term, I do not know, nor does anyone else.Monday, April 06, 2009: Fed's Effort To Roll Snowball Uphill Is Failing

Bernanke thinks he can manipulate treasury yields by purchasing long dated treasuries. He can't. The market is simply too big.

The Fed's problem is that it cannot force rates where it wants no matter how many treasuries it buys, short of owning them all. If the Fed is buying treasuries at an unnatural price, supply will be unlimited.Friday, May 15, 2009: Nonexistent "pre-recovery" in Manufacturing Suggests US Treasuries a Buy

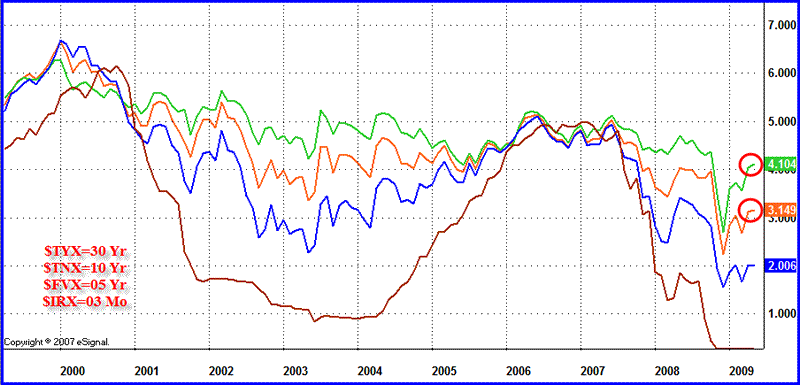

Yield Curve as of 2009-05-15

Treasuries Are A Buy

I went cautious on treasuries in December, but it's now time to become bullish again. Talk of "green shoots" and "pre-recoveries" is way overdone. Let's come back to this chart in September and October. My bet is the yield curve will be flatter and yields on the high end (10 year and 30 year) will be lower than today.

In September and October we will see if I was right or wrong, but looking back I am quite pleased with 2008 calls culminating with taking the treasury chips off the table in December 2008 (via public blog comments) and officially posted January 6, 2009.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.