Which Commodity ETF to Trade, Gold, Crude Oil or Natural Gas?

Commodities / Commodities Trading Aug 03, 2009 - 01:15 AM GMTBy: Bill_Downey

In the markets of today, investors and speculators alike have the ability to participate in a lot more than company stocks. With the advent of ETF’s, market participants can now diversify into the realm of currencies, gold, crude oil, grains, agriculture and a host of other avenues. In the past if one wanted to play the above commodities he/she would pretty much have to purchase a futures contract or an option on the futures. And that is the world of high leverage and high risk/reward.

In the markets of today, investors and speculators alike have the ability to participate in a lot more than company stocks. With the advent of ETF’s, market participants can now diversify into the realm of currencies, gold, crude oil, grains, agriculture and a host of other avenues. In the past if one wanted to play the above commodities he/she would pretty much have to purchase a futures contract or an option on the futures. And that is the world of high leverage and high risk/reward.

For any of you who have ventured into this arena, you know all to well it takes a sophisticated investor to be able to handle such leverage and come out a winner. Many have tried, and most but a few have failed. Yet for many the lure to these areas are highly desired as the potential gains can be incredible.

Enter the ETF. A way to participate without all the leverage and the time factor associated with futures and options. In the ETF world, one can buy gold or silver without having to leverage, and without having the product expire as do options. This also removes the risk of getting wiped out on a 10-20% move as you would in futures as there need not be any leverage. And an investor can hold out as there are no time limits like an option. In fact, if one wanted to invest in say Silver for example he/she could initiate an average down strategy for long term accumulation or a monthly purchase plan. With some patience and discipline, one could build up a nice position. For when the day comes and such a commodity as silver has a substantial up move, the investor stands a good chance of making a good profit if he has carefully crafted a plan of action.

The ETF is the perfect vehicle for investors and speculators alike who want to participate. For the long term investor, it is a great way to build over time a sizeable position at a reasonable price if he/she were to initiate the average down or monthly buy program. Why there are even ETF’s that will allow the long term investor to hedge his position………by buying another ETF. One that increases in price as the commodity goes down.

For the speculator, ETF’s are a great way to play short term rallies and selloffs. And there’s even a little for the sophisticated investor in ETF world. For instance, the gold ETF also comes with OPTION capabilities. During long sideways markets, put and call options can be sold on these ETF’s allowing the individual to profit and pull in money while he is waiting for the gold to start trending again. Can you imagine someone who wrote out of the money (above 1000) covered calls in the gold ETF he owns over the past 18 months every time gold moved to the 930 area for instance?

Alas it sounds so easy thus far doesn’t it? But it isn’t. Why is that?

Well for one thing, not all ETF’s offer the same advantage. Some are so stacked against you that you have to time the market just as well as if you were playing futures. And the reason is simple on those. In essence, you ARE playing the futures market. If you invest in Natural Gas by buying the natural gas ETF, symbol UNG, then you are playing the futures market. This is because the issuer’s of UNG must purchase a futures contract in order for you to participate in a natural gas rally.

UNG is a great example of what can happen if you are not aware how the ETF works in conjunction with the futures markets. For example, one look at the tremendous volume in UNG suggests that everybody and his brother have jumped aboard due to the fact that we are at extreme lows in the natural gas market. One participant told me that he went long and plans to ride it out until December/January where he postulates that there’s a good chance the price of natural gas will double as we get into the cold heating months. And you know what, he’s absolutely right. Price has a very good chance of doubling. Let’s look at the description of UNG.

United States Natural Gas Fund, LP (USNG) is a limited partnership. The Company is a commodity pool that issues units that may be purchased and sold on the NYSE Arca, Inc. The investment objective of USNG is for the changes in percentage terms of its net asset value to reflect the changes in percentage terms of the price of natural gas delivered at the Henry Hub, Louisiana, as measured by the changes in the price of the futures contract on natural gas as traded on the New York Mercantile Exchange (the NYMEX) that is the near month contract to expire, except when the near month contract is within two weeks of expiration, in which case the futures contract will be the next month contract to expire. USNG invests in futures contracts for natural gas, crude oil, heating oil,

Gasoline, natural gas and other petroleum-based fuels that are traded on the NYMEX, ICE Futures or other United States and foreign exchanges. The Company’s general partner is United States Commodity Funds LLC.

So what’s the problem? The problem is that the December contract has already discounted the increased winter demand and the associated costs of storing the product until then. While the nearby spot month is trading at the $3.75 area, December’s contract is trading at $5.47. And that is down from a price of $6.40 at the end of June. If UNG buys futures contracts, and the January price is already $5.58 and say for example, we get to December and the price is still $5.47, how much do you think the ETF for UNG is going to go up? Why, it won’t go up at all. Yet the price reflected will be a 40% rise in natural gas prices. If anything, with cost and overhead, it may go down a bit. Take a look at these two charts for the upcoming month (Sept) and the December month. If UNG uses futures to track the price of Natural Gas and January is already trading at $5.58 vs. September’s $3.57, should we expect UNG to go up 40% to reflect the prices in January? I don’t see how since the contract they purchase will reflect the premium already imposed on January delivery. The only way they will make money is if natural gas goes up higher than the $5.58 price. While that is possible, it still takes away any gains if Natural gas goes up 40% from here. You see, UNG cannot buy the product now at $3.57 and store it. They have to go to the futures. And that’s the problem.

In early July I wrote an article called “What’s up with Natural Gas.” It was an article which covered the outlook for natural gas over the coming months. At the time, there was some interest that had come about when the price jumped about 10%. Many viewed it as a potential bottoming in price. However in the previous article, I postulated that the price was not ready to make a bottom just yet. More importantly the article highlighted the potential problems with purchasing UNG as a bet on natural gas. It is probably available in the archives on this website for those of you who are interested in reading more about UNG and how it might not perform as well as investors think when natural gas prices do rise. If it is no longer available here in the archives a simple internet search will lead you to it.

But what about when participants see the price of natural gas trade at the $5.47 area in December and look at their UNG stock and see it is unchanged what do you think they are going to do? I would think “sell it” and move on, Right? What type of pressure would be put on the gas price if investors sell UNG during that timeframe? There are articles on the internet on how this situation with UNG is manifesting itself in the natural gas market.

But it gets worse.

The demand was so great for UNG recently that they ran out of stock to issue and had to seek approval of the SEC to issue more shares. They were rejected. Now what does that mean for investors of UNG? Here is a recent article from http://etfdailynews.com/blog/?p=4661

Natural Gas ETF-UNG Continues To Trade at a Premium

The Natural Gas ETF has failed to receive regulatory approval to issue new shares which has prevented the exchange-traded fund from buying new contracts. While natural gas prices have plummeted, the ETF has gone the opposite way as demand for the ETF has increased. “On Wednesday, at the New York Mercantile Exchange, natural-gas prices dropped 4.3% to settle at $3.283 per million British thermal units. As of July 3, natural-gas inventories were 27.4% higher than a year ago, as demand was weighed down by the declining industrial activities and weaker air-conditioning use in the Northeast,” WSJ Reports.

“Regulators have increased scrutiny over exchange-traded funds that are invested in commodities, leaving UNG and other funds hamstrung at a time when investors are craving for hard assets. The $4.3 billion UNG fund was forced to close its doors to new investors a week ago as it maxed out its shares and failed to win regulatory approval in time to issue additional ones,” WSJ Reports.

The hiatus has led the fund to disconnect from its underlying assets. On Wednesday, the fund fell 2.3%, a much smaller drop than natural-gas futures, leaving the fund to trade at a premium to its assets. “That’s a big disparity,” Gary Gordon, president of Pacific Park Financial Inc., a financial adviser.

Take a look at this chart of UNG and look at the volume below the chart.

The surge in the May/June time frame had some daily trades of almost 100 million shares. What happens when those futures contracts are rolled over into January where the price of natural gas is already at $5.47? Will shares go up?

Again, since the lack of shares is causing a disconnect a premium has occurred in the price of UNG.

I will be the first to admit I do not know all of the implications, but investors should beware of the implications associated with owning UNG.

An alternative way to invest in natural gas would be to buy companies associated with a natural gas price rise. But now you’re investing in a company and the risks associated with that company. A second way would be to invest in The First Trust ISE-Revere Natural Gas ETF (FCG). (FCG) is suited for investors who wish to invest in an ETF tied closely to natural gas stocks. The largest holdings in FCG include Quicksilver Resources (KWK), Linn Energy (LINE) and Petrohawk Energy (HK). This would at least spread the risk by having more than one company in the portfolio.

The bottom line to UNG is in order to make a good profit, your “TIMING” is going to have to be right on and the natural gas market is going to have a big rally to offset the premiums already associated with the forward months in futures.

Barring a hurricane that wipes out the Gulf again, the best time to invest in natural gas and the various plays is when inventory finally peaks, and we see a rise in the amount of natural gas rigs being used. If you’re still undeterred, then the August/September timeframe is usually when prices on average bottom and begin to rise.

What about Crude Oil and their ETF’s ?

Here we have the same problem. The premium’s associated with crude oil futures. And the premiums (contango) are severe here as well. I have heard that some contracts have a $10 dollar premium in some future months. While this does not remove the potential of profit, it limits it. If you are in ETF’s that track crude like UNG tracks natural gas, expect the gains to be less than the appreciation of price.

Is there ever a great time to invest in these vehicles? I will not venture to say great, but the best time might be when futures prices are in backwardation. This means that the price of futures in the out months is LESS than the spot price. This would at least provide opportunity to profit should the price of the commodity stabilize in the spot months and then begin to rise. Finally, I mentioned the “timing” aspect earlier. There is no doubt that hurricanes and geopolitical events could trigger spikes in these commodities. In fact the long term charts of crude oil and natural gas are ripe with spikes. It is these times when the investment into these ETF’s have their greatest potential to appreciate. Have a look for yourself. Note how natural gas has a lot more spikes than crude oil. Crude tends to trend much more than natural gas. However, there have only been 5 spikes in the last 10 years. See what I mean about timing? The lows in natural gas tend to be at this time of the year. Crude also follows this, but a much less consistency. In fact gas shows NO DECLINE during the fall months in price over the past 10 years in its spot price. But the problem still lies with the premiums involved in the futures prices. This suggests that investors wanting to play natural gas and crude oil might best be served by playing the companies involved with these markets rather than the underlying commodity.

What about Gold?

Here at last we find some relief for investors. First off, storing gold can be accomplished by investors. That is not the case with crude oil or natural gas. Thus the storage cost factor is greatly reduced, and the ability to take delivery of a commodity is a great advantage. There has been a lot written about the gold ETF. Particularly is whether the funds actually have the gold in storage. While that is not the basis for this article it is a very important fact. The good news is that some of the vehicles out there do have the actual gold (and in some cases Silver) to back up their funds/ETF’s. In addition, there is a great argument for gold being real money and not pieces of paper. Should there be a collapse in the global realm of things, gold has the potential to provide a basis of purchasing power and a medium of exchange.

The advantage is that investors and speculators can buy (for now) physical gold and/or silver. But even with the ETF, there is a marked advantage. The gold market of the past has not had the issue of contango and backwardation. Yes, there is a premium for December gold vs. spot. But that premium is only $2 right now, and gold’s premiums do not swing as wildly as the other commodity. That is not to say that it will remain so, but right now that is reality.

Finally, let’s look at the Gold Chart

While some contend that gold swings wildly and cannot be trusted, I challenge anyone to find a less volatile mainstream investment vehicle that returns 300% this decade. In fact when the collapse of 2008 occurred, gold was the LEAST affected financial instrument. But what about bonds? Surely they must be less volatile than GOLD !!!

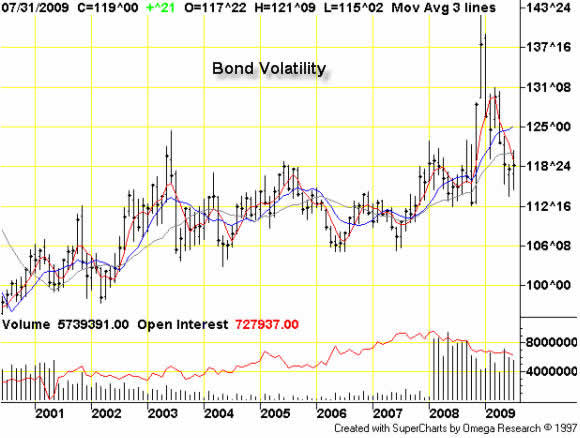

Let’s take a look at the chart.

Here is the Bond chart below:

Does that look less volatile to you? It doesn’t to me.

Even with its interest payouts of 5% per year, gold is the absolute winner in terms of volatility and return on investment. Seeing is believing. With the current conditions that have beset this nation odds have shifted drastically.

Now this brings us to the last portion of this week’s article. I would pose to you, how well have you done in your gold investments? Have you kept up with the metals appreciation? If you have, you are to be commended. If not, you might want to look at establishing a game plan that will help you accomplish this task. Whether you’re a trader or investor, everyone needs a game plan. Have you got your game plan together?

There has been a lot of talk about inflation and/or deflation and each side puts up a pretty good argument. However, the reality of the situation is that your government is not worried about inflation. They are worried about deflation. Don’t you think that would tilt the odds of gold moving higher? Some will counter that gold is being manipulated and not allowed to move higher. While that may be true, take a good look at the last 18 months. Do you see where gold has knocked on the door of $1000 on four different occasions? And after 18 months gold is less than $50 dollars below $1000. What does that tell you? It tells me that the manipulators are barely holding on, and once gold begins a move above $1100, it is going to be impossible to contain it.

How will you preserve your wealth and purchasing power in the coming years?

Do you still feel goosy about investing in gold? Do you have an outlook and plan? Maybe what you need is another voice to assist you in managing the upcoming storm in the world markets.

When a person is ill, he may know a lot about his condition. But he still see’s a doctor to address the problem. He doesn’t take it upon himself for the cure. In fact, he may do a lot of research about his aliment, but he will make sure he consults with those in the know about the illness before proceeding blindly.

There will be many opportunities in gold, crude oil, and natural gas in the coming years. Each requires its own set of conditions, plans, and strategies to be successful. Timing and trend direction will be paramount to navigate the hills and valleys of price.

If you would like to receive Free Gold Analysis please visit my site: www.TechnicalCommodityTrader.com

May you all prosper.

William – “The Lone Trader”

http://www.technicalcommoditytrader.com

© Copyright Bill Downey 2009

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.