The New Cyclical Stocks Bull Market

Stock-Markets / Stocks Bull Market Aug 25, 2009 - 06:13 AM GMTBy: Chris_Ciovacco

Global stock markets remain in a state of positive fundamental and technical alignment, which has bullish implications for the next six to eighteen months. In this article, we will explore:

Global stock markets remain in a state of positive fundamental and technical alignment, which has bullish implications for the next six to eighteen months. In this article, we will explore:

- Positive drivers for GDP and the end of the recession

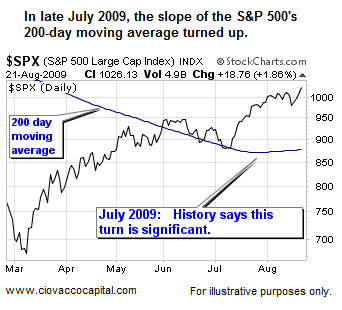

- A historically significant turn in the S&P 500’s 200-day simple moving average (SMA)

- Corrections within the context of a bull market

Improving Fundamentals: Last week, leading economic indicators (LEIs) posted their fourth consecutive monthly gain. Global LEIs recently posted their biggest monthly gain since 1975. Going forward, low earnings expectations (relative to the prior year), which we have now, often result in positive earnings surprises as we leave a recession. Positive earnings surprises can help push markets higher.

Strong Technicals and Historical Support (1929-2009): In an August 2, 2009 article, New Bullish Signals Emerge, we suggested it was significant when the slope of the S&P 500’s 200-day moving average turned up on July 29, 2009. In order to better understand how significant the turn in the 200-day might be, we studied market history going back to 1929.

The 2007-2009 bear market ended after a 57% decline which took 517 calendar days to complete. In order to understand the historical significance of the recent turn in the S&P 500's 200-day SMA, we studied turns in the 200-day following bear markets similar to our recent experience. We studied prior bear markets in the Dow (1929-1950) and S&P 500 (1950-2003):

- Lasting at least 515 calendar days

- With declines of at least 35%

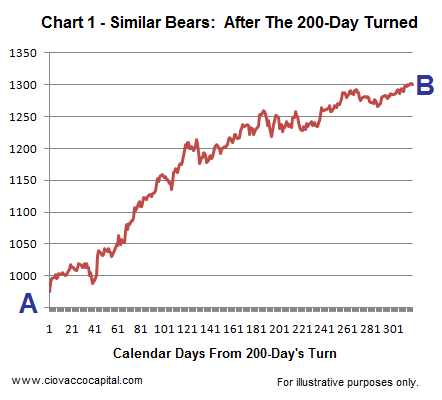

Five cases meet the criteria above since 1929; following the lows in 1932, 1942, 1970, 1974, and 2002. Chart 1 shows the composite performance 315 trading days after the 200-day moving average turned up in the Dow (1929-1950) or S&P 500 (1950-2009) following bear market declines of 35% or more. The composite graph below shows the average path of the five cases cited after the 200-day moving average turned up, NOT from the market bottom. The study assumes you "missed the bottom" and entered the market after the 200-day moving average turned up. In 2009, the 200-day moving average turned up on July 29th when the S&P 500 was trading at 975, which is represented hypothetically by Point A below. If the market follows the historical composite, Point B hypothetically would occur in the fall of 2010.

As shown in the composite graph above (chart 1), it can be rewarding to be invested after the slope of the 200-day moving average turns positive following a major bear market. Note the correction in the composite graph just prior to the strong rally. We may experience a similar "shake out" correction in August or in the fall of 2009, where the market shakes out investors just prior to a big move. More detailed information cocerning this study and the transition from a bear to a bull can be found in Evidence of New Bull Markets & Favored Asset Classes.

Positive GDPs Numbers On The Way?

Weekly jobless claims can help us possibly spot the end of a recession. Initial claims peaked in the first quarter of this year and have since declined significantly. Businesses reduced inventories at a record pace in the last two quarters. Rebuilding of inventories in the coming quarters will add to GDP. Car and truck sales were hit hard during the recession. Increased sales helped by the clunkers program will also be a positive for GDP. Government spending, one of the few bright spots in GDP in recent quarters, should continue as planned stimulus spending hits a high water mark in 2010. Housing has been a negative component of GDP for numerous quarters. Recent data suggests housing’s drag on GDP should lessen or even become additive in future quarters. From a historical standpoint, steep economic downturns are usually followed by better than expected recoveries. The recent financial meltdown certainly qualifies as a steep downturn.

"The worst recession since the Great Depression is likely coming to an end," says Sung Won Sohn, economics pro-fessor at California State University. Friday's better-than-expected July jobs report fanned hopes for a recovery, as did a report a week earlier showing the economy shrank less than expected in the second quarter.

And that bodes well for stocks, if history is any guide. Following recessions in the post-World War II era, stocks have posted positive returns in nine of the 10 cases both six months and 12 months after the end of the recession, says Ned Davis Research (NDR). The Standard & Poor's 500 has gained an average 9% six months after recessions and 14% a year after them, NDR says. If the recession ended now, the average 9% and 14% gains would put the S&P, at 1010 on Friday, at roughly 1100 in six months and 1150 in a year.

USA TODAY August 19, 2009

Corrections Are A Part Of All Bull Markets

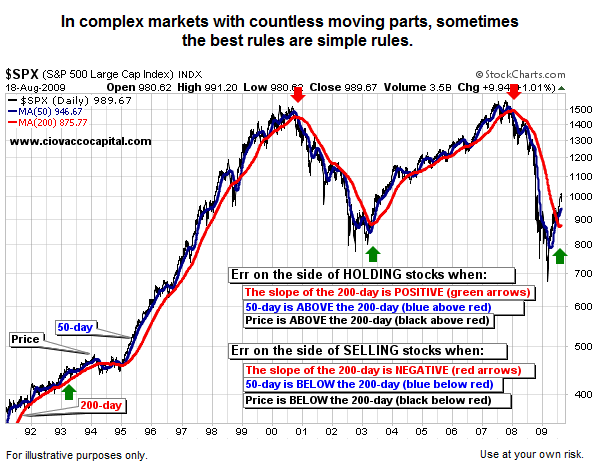

When corrections are in full swing, it always makes sense to review the big picture. We have covered the topics below numerous times in the past, but we will do so again because they remain important and they can help us deal with our biggest enemy – our emotions. The rules below are far from the only way to make buy and sell decisions, but they do serve as a big picture framework to help us make better calls during corrections. The final chart will show the state of the current financial landscape within the context of the rules.

We used these rules to transition away from risk beginning in early 2008. We are using them now to transition back toward risk in 2009.

Currently, we are experiencing volatility within the context of a bull market, just like the red circles above.

The chart above can help us control our fear and avoid making emotional decisions. The results support erring on the side of holding as long as bull market conditions exist (as they do today). If conditions change, we will adjust accordingly. Until they do, we will remain in the mindset of longer-term investing. The evidence continues to support higher stock prices in the months ahead. There is no compelling reason to believe that recent corrections have been anything more than that - normal corrections within a bull market (see red circles in chart above).

While it has little impact on the primary trend, the S&P 500 looks a little tired as of August 24, 2009.

Above are excerpts taken from the August 2009 - Asset Class Outlook, which is available for download. The comments above and those in the outlook are intended for CCM clients, and thus investments or strategies described may be inappropriate for some investors based on their own individual situation and risk tolerance.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.