As Greece Goes, So Goes the U.S.?

Economics / US Debt Feb 25, 2010 - 07:30 AM GMTBy: Paul_L_Kasriel

Greece hasn't gotten so much press since 146 B.C. when the Romans took over. Of late, Greece sneezes and investors think the U.S. is going to catch the swine flu. Of course, it is not just Greece. Greece is part of the EU and the EMU. So, it is thought that as goes Greece, so goes Europe. And then, the next step is that as goes Europe, so goes the U.S. But is Europe really where the action is with regard to U.S. economic growth?

Greece hasn't gotten so much press since 146 B.C. when the Romans took over. Of late, Greece sneezes and investors think the U.S. is going to catch the swine flu. Of course, it is not just Greece. Greece is part of the EU and the EMU. So, it is thought that as goes Greece, so goes Europe. And then, the next step is that as goes Europe, so goes the U.S. But is Europe really where the action is with regard to U.S. economic growth?

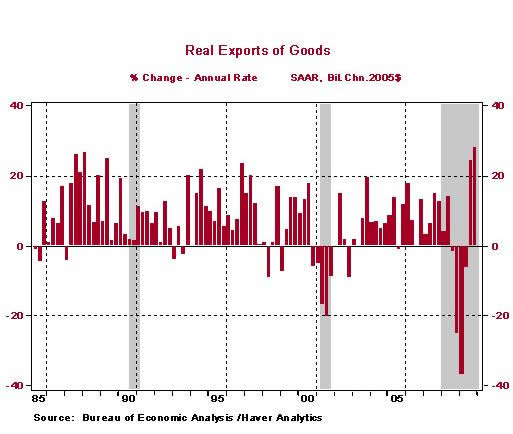

Let us see what has been happening to U.S. exports of late and how Europe relates to that. Chart 6 shows that in the third and fourth quarters of last year, real U.S. exports of goods increased at annual rates of 24.6% and 28.1%, respectively.

Chart 1

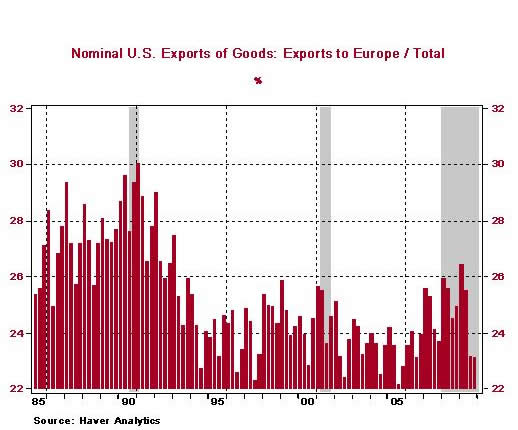

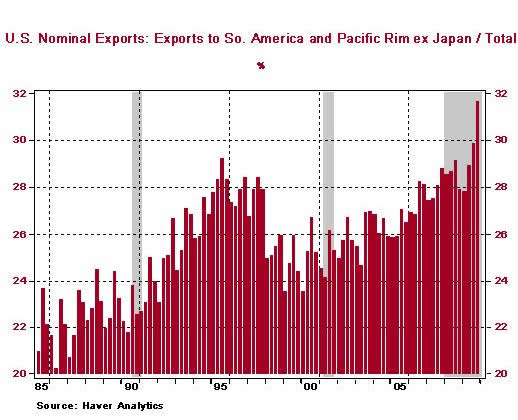

Europe's role in our recent acceleration in export growth has diminished. As U.S. exports increased sharply in the second half of 2009, U.S. exports to Europe as a percent of total U.S. exports fell (see Chart 7). For example, in Q1:2009, Europe's contribution to total U.S. exports was 26.5%; in Q4:2009, it was 23.1%. In contrast, South America and the Pacific Rim excluding Japan have played a more important role in the recent growth in U.S. exports. In Q1:2009, South America and the Pacific Rim ex Japan accounted for 27.8% of total U.S. exports. In Q4:2009, these regions accounted for 31.7% of total U.S. exports (see Chart 8).

Chart 2

Chart 3

The economies in South America and the Pacific Rim excluding Japan are, with the exception of Australia and New Zealand, developing economies. Even before the recession hit, these developing economies accounted for a larger share of total U.S. exports than did European economies. Now that the global economic recovery is underway, these developing economies have increased their share of total U.S. exports. Both because of their absolute size and their growth, the developing economies will play a more important role in the fate of the U.S. economy than will Greece, in particular, and Europe, in general.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel and Asha Bangalore

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.