Student Credit Cards – Handle With Extreme Care!

Personal_Finance / Student Finances Aug 15, 2007 - 11:33 AM GMTBy: MoneyFacts

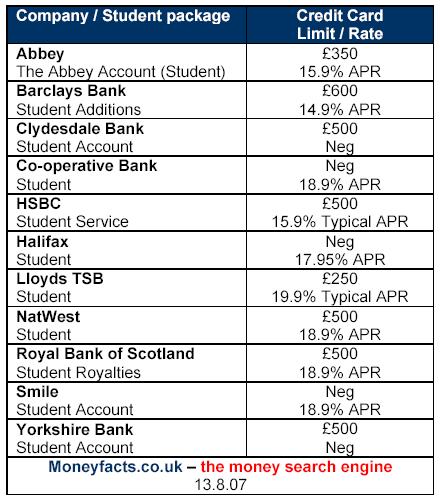

Lisa Taylor, analyst at Moneyfacts.co.uk – the money search engine, comments:“Most banks will offer you a student credit card, which in some cases will be a specific student card, while others will provide you with one of their standard cards.

“While the spending limit you will be offered will usually be fairly low, (typically around £500), the interest rate charged will not be – in some cases almost 20%.

“While the limits may be small, even a few hundred pounds can prove a struggle to repay with no regular income. And if you find yourself with a balance you cannot repay in full, and can only afford the minimum repayments, this debt could still be with you long after you graduate.

“While the limits may be small, even a few hundred pounds can prove a struggle to repay with no regular income. And if you find yourself with a balance you cannot repay in full, and can only afford the minimum repayments, this debt could still be with you long after you graduate.

“Take the example of a £500 credit card balance with an interest rate of 18.9%; assuming you are only able to afford the minimum repayment of 2.5% / min £5. This original £500 debt would take you 12 years to repay and cost £487.27 in interest, meaning you would repay virtually double what you originally borrowed.

“Even during your three years of study, this balance would cost you over £200 in interest charges and still leave a balance to repay of almost £340.

“Credit cards can be a great way to get the best online deals and can be ideal to use in emergencies or when travelling, but they should be handled with care. Don’t spend on your card what you can’t afford to repay. If you do you could be faced with a hefty interest bill and what will seem like a never ending debt.

“Students needing to borrow should always first look to their student overdraft, as all providers with the exceptions of Clydesdale and Yorkshire Bank will offer an interest free overdraft facility. If you are getting close to your overdraft limit, speak to your bank as they may be able to offer you either a permanent or temporary extension to your limit – if you don’t ask you don’t get. Don’t just bury your head in the sand and opt for the ‘plastic option’. Whilst it may help you in the short term, if you are on a tight budget, it could prove to be a millstone around your neck for some time to come.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.