Dollar Yuan Exchange Rate Issues to Dominate China U.S. April Summit Visit

Economics / US Economy Apr 06, 2010 - 01:32 AM GMTBy: Paul_L_Kasriel

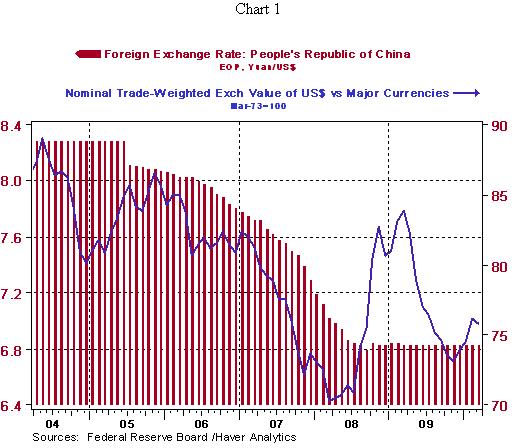

Chinese President Hu Jintao will attend the Nuclear Security Summit in Washington, D.C. on April 12-13. One of the main agenda items of this summit is to fashion a multilateral strategy to deal with Iran's suspected nuclear weapons development program. But the announcement of President Hu's attendance at this summit has set off speculation that the Chinese government is prepared to let the yuan appreciate versus the U.S. dollar. From about July 2005 through June 2008, the yuan was allowed to slowly appreciate versus the dollar. But in July 2008 as the global financial crisis was intensifying, the Chinese government stabilized the yuan/dollar exchange rate. (See Chart 1.)

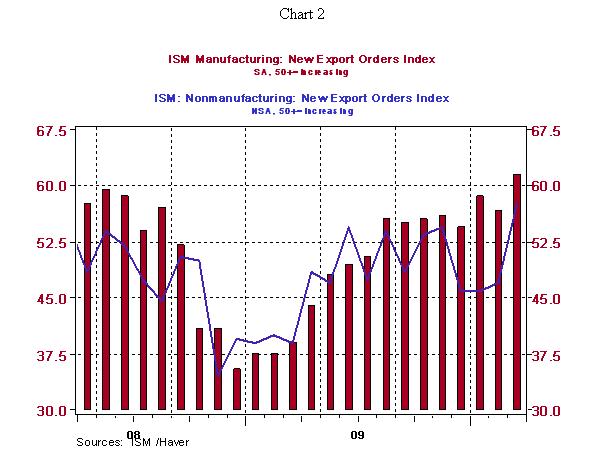

Despite the fact that U.S. export growth soared in the second half of 2009 and appears to remain strong in early 2010 (see Chart 2), some in Congress want to brand China as a currency manipulator and impose protectionist penalties against the Middle Kingdom.

There is little doubt that the Chinese monetary authority takes actions to keep the yuan/dollar exchange rate where they want it. Prima facie evidence of this can be gleaned from Chart 1. The yuan/dollar exchange rate since July 2008 has exhibited much more stability than the trade-weighted U.S. dollar index. This would appear to be an implausible outcome unless the Chinese monetary authority was intervening in the foreign exchange market.

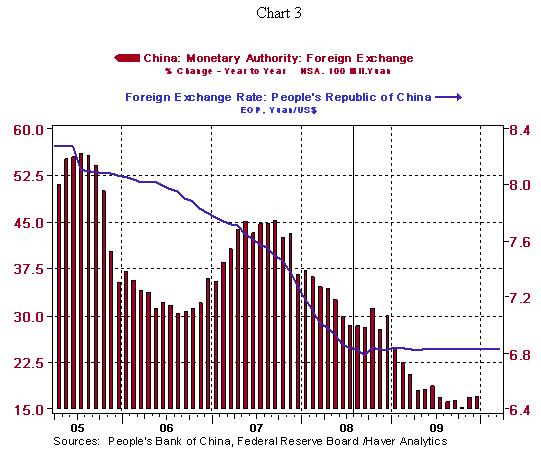

The question is, has the Chinese monetary authority in the past two years been taking extraordinary measures to keep the yuan/dollar exchange rate stable? One way to answer this question is to examine the behavior of the Chinese monetary authority's balance sheet. If left to its own devices the yuan would have appreciated versus the dollar in the past two years, i.e., it would take fewer yuan to purchase one dollar, then in order to keep the yuan/dollar exchange rate stable, the Chinese monetary authority would have had to "print" more yuan to purchase more dollars in the foreign exchange market. If this were the case, we would observe increases in the yuan value of the Chinese monetary authority's foreign exchange holdings.

So, let's look. It is shown in Chart 3 that the year-over-year growth in the yuan value of foreign exchange holdings of the Chinese monetary authority slowed significantly in 2009. To wit, in the 12 months ended December 2009, growth in the yuan value of foreign exchange reserves was 17.1% vs. 29.9% in the 12 months ended December 2008. Now, 17.1% is no small growth. But it pales in comparison to the growth in earlier years. For example in mid 2007, when the Chinese monetary authority was allowing the yuan to appreciate versus the dollar, 12-month growth in the yuan value of foreign exchange reserves was 45%. This suggests that if left to its own devices in mid 2007, the yuan would have appreciated even faster versus the dollar. This is not to say that the Chinese monetary authority has maintained a hands-off policy with regard to the value of its currency versus the dollar. But last year's behavior of the Chinese monetary authority's balance sheet does not suggest extraordinary foreign exchange intervention.

What Happens When the Reflation Bill Comes Due?

This was the subtitle to the WSJ's April 3 lead editorial, "The 2010 Recovery." The WSJ editorial board wrote: "As we look beyond this year, the bill for this Great Reflation will eventually come due. Coming out of the last steep recession, in 1983, both interest rates and tax rates were coming down. Today, they are both headed up. In 1983, the regulatory state was in retreat. Today, it is expanding across most areas of the economy."

Yes, eventually there will be reflation. But when? The editorial board used to hold in high regard the wisdom of Milton Friedman, may he rest in peace. But apparently no longer. Friedman taught us that inflation was everywhere and always a monetary phenomenon. That is, sharp accelerations in the broad money supply would be followed by sharp accelerations in the price increases of goods and services.

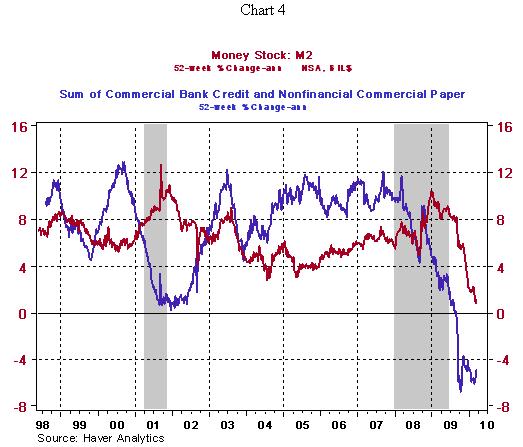

Judging from the current behavior of the broad (M2) money supply and commercial bank credit creation, the reflation bill will not be due for a long time. Plotted in Chart 4 is the 52-week annualized growth in the M2 money supply and the sum of commercial bank credit and nonfinancial commercial paper outstanding. The M2 money supply is growing at an annualized rate of 1.0% -- the slowest rate of growth in years. Not surprisingly then, credit via the commercial banking system and the commercial paper market is showing an annualized contraction 4.9%. The more objective and less partisan editorial board of the WSJ of 25 years ago would know that this current paltry money supply growth and this contraction in bank credit is not the catalyst for reflation anytime soon.

Yes, the recovery of 1983 was characterized by falling bond yields - falling from post-war record highs because of post-war record high inflation (see Chart 5). During this past recession, Treasury bond yields were not far above post-war record lows. Further declines in Treasury bond yields from already very low levels would require that the economy enter a new recession. Is that what the current editors of the WSJ would wish for the U.S. economy?

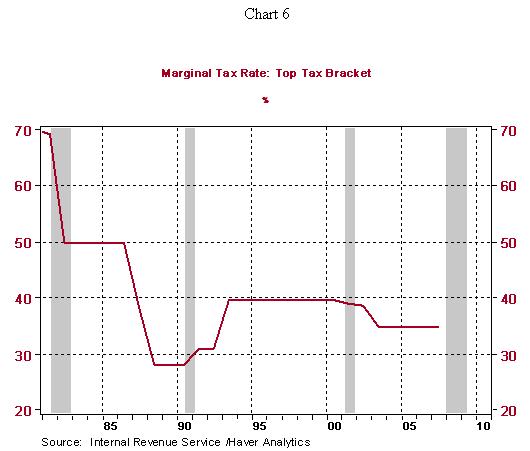

With regard to tax rates, yes, the top marginal tax rate was coming down - coming down from 70% (see Chart 6). And yes, the top marginal tax rate is likely to rise in 2011, but not from 70% but from 35%. All else the same, an increase in marginal income tax rates does have negative consequences for economic performance. But all else seldom is the same. The economy performed pretty well in the eight years ended 2000 even though the top marginal tax rate was higher in these eight years than it was in the prior eight years. The economy did not perform better because of the increase in the top marginal tax rate. Nevertheless, this increase was not sufficient to derail economic progress. In the eight years ended 2008, the economy performed relatively poorly despite the lower top marginal tax rate. The economy did not under-perform because of the marginal tax rate cut. Nevertheless, the cut in the tax rate was not sufficient to enhance economic performance. The point of all this is that although tax rates matter, they are not all that matters.

Neither Snow nor Rain Will Stop Homebuyers, but an Expired Tax Credit Might

Pending sales of existing homes jumped 8.2% in February after January's 7.8% decline. It was thought that the abnormally inclement weather the country experienced in February would keep the bargain hunters away from open houses. But in February, the only region experiencing a decline in sales contracts for existing homes was the West. Although the February level of the sales index is just two ticks lower than the December 2009 level, it is about 13% below its October 2009 high. The tax credit for home purchases is due to expire April 30. This expiration, along with the recent uptick in mortgage rates, will provide a real test for the strength in effective housing demand in the second quarter and beyond. Although I do not anticipate a "double dip" in the residential real estate market, I do anticipate a slow and uneven recovery for the rest of this year.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel and Asha Bangalore

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.