California Debt Default is More Likely than Iceland or Iraq

Interest-Rates / US Debt May 15, 2010 - 09:07 AM GMTBy: Washingtons_Blog

Federal Reserve isn't the only one who owns credit default swaps betting that California will default.

Federal Reserve isn't the only one who owns credit default swaps betting that California will default.

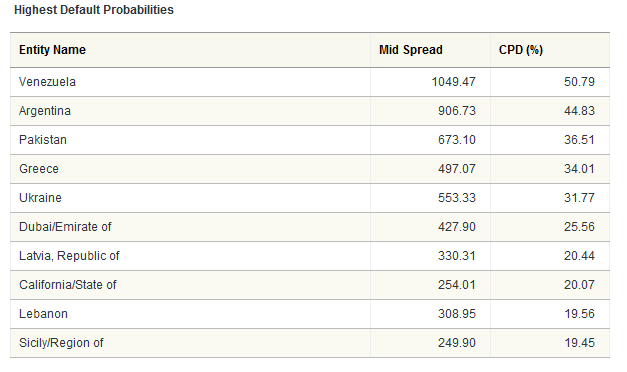

As Ed Harrison points out, credit default traders have now ranked California in the list of top 10 governments most likely to default, with a 20% default probability:

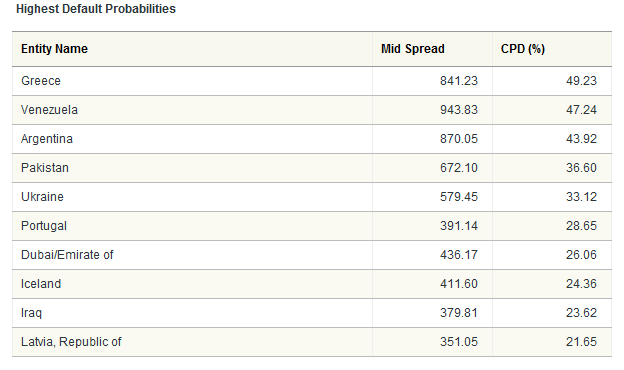

California has pushed ahead of Iceland and Iraq, which were on the top 10 list last week:

Last Week’s Numbers: 06 May 2010

Central banks and other savvy players now look to credit default swaps as the primary economic indicator for judging an entity's health.

And in February, Jamie Dimon - chairman of JP Morgan Chase - warned that American investors should be more worried about the risk of default of the state of California than of Greece's current debt woes.

On the other hand, Dow Jones pointed out in March:

Greece and California face similar challenges: each needs to cut spending and raise taxes to cover a hefty budget shortfall even as their economies are struggling to recover from the sharp global downturn.

But there are significant differences that make California a safer bet for U.S. investors--the key being that California must balance its budget, can't declare municipal bankruptcy and would likely receive support from the federal government as a last resort.

***

"California is a deficit problem, Greece is a debt problem," said Matt Fabian, senior municipal analyst at Municipal Market Advisors. "Greece needs current market access in order not to default on their debt. In California, all the debt is fully funded and debt service is well below 10% of the state's expenses."

Similarly, Michael Connor argues today that California is very different from countries like Greece:

California is so not Greece.

That's the broadly held view in the $2.8 trillion U.S. municipal bond market ....

"It's wacky," said municipal debt analyst Jeffrey Cleveland at Payden & Rygel. "Just look at the ratio of debt to state gross domestic product. It's 10 percent for California and somewhere between 104 percent and 150 percent for Greece."

California's economy, at $1.845 trillion, dwarfs Greece's and on a stand-alone basis and would be the world's eighth-largest. It is the biggest borrower in the U.S. municipal market, which states and local governments use to fund roads, sewers and other infrastructure

Most muni debt comes with tax-free interest and is often bought by rich Americans looking for tax savings.

***

Munis, whose total returns have smartly outperformed U.S. Treasuries in the last half year, have also become increasingly attractive to foreign institutional investors since 2009's roll-out of Build America Bonds and their fatter taxable yields.State governments in the United States, from tiny Rhode Island to huge California, do face daunting yearly budget crises and long-term pension and health care obligations that may require $1 trillion or more to fund over time.

***But institutional investors, analysts, ratings agencies and finance officials say a Greek-style collapse of a state government in the United States is immensely remote, despite some parallels in exploding pension obligations and aging populations.

"California is not Greece," said Tom Dresslar, a spokesman for California's state treasurer. "Greece's budget deficit in 2009 was 13.6 percent of its GDP. Our budget deficit, at $20 billion, was 1.1 percent of our GDP."

LAST STATE DEBT DEFAULT DURING GREAT DEPRESSION

No state, including California, with $83 billion of general obligation, lease-based revenue and other long-term debt, has defaulted on interest payments or principal of municipal debt since Arkansas did during the 1930s, according to Payden & Rygel's Cleveland.

Overall default rates by U.S. municipal issuers between 1970 and 2009 totaled just 0.06 percent, according to a study by Moody's Investors Service, the same agency that rattled global markets last week with a report saying some European banks would be weakened by the Greek debt crisis.

That 0.06 percent 10-year cumulative default rate included no state general obligation stumbles, versus a 2.50 percent default rate over the same four decades among issuers of investment-grade corporate debt.

Then, too, many of the commonly taken routes to relief from debt commitments are barred to state governments. With the exception of Vermont, they cannot legally run deficits like the U.S. federal government and are prohibited from filing for Chapter 9 bankruptcy petition, a rarely used U.S. legal tactic open to some municipal issuers.

"It is not possible for the plight of one state to take down the rest," Peter Hayes, a managing director at BlackRock Inc, said in a newsletter. "We would also argue that the current fiscal crisis is not a debt problem."

Debt service, such as interest payments among the 50 U.S. state governments, typically runs at just 3 percent of each state's annual expenditures, according to the U.S. Bureau of Economic Analysis.

"California debt is different from Greek debt," said Kenneth Naehu, a managing director at Bel Air Investment Advisors in Los Angeles. "Our debt service is so small a part of our budget that it is minuscule, and it gets a top priority. For California, restructuring debt is not possible, but for Greece it may be the best thing."

In any event, Governor Schwarzenegger is enacting "terrible" budget cuts to try to close the budget gap.

But forming a public bank would be the best way for California to be able to dig its way out of the hole. .

Global Research Articles by Washington's Blog

© Copyright Washingtons Blog, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.