U.S. Treasury Bonds Set to Rally

Interest-Rates / US Bonds Feb 11, 2011 - 11:24 AM GMTBy: Joseph_Russo

When planning trips or special events, it is wise to check the weather forecast to make certain that conditions are expected to be suitable for those plans.

Likewise, when planning investments or shorter-term trades, it is also prudent to gain access to a reliable market forecast that is suitable to ones interests, timeframes, and objectives.&

One should strive to acquire forecasting guidance that is technically grounded, accurate, disciplined, bias-free, and void of consistently WRONG, story-based, or fundamentally-driven determinations, all of which are riddled with egotistical subjectivity and intellectual hubris.

Akin to Hosni Mubarak’s 30-year regime of self-anointed dictatorship, the time has come for forecasters and analysts with aging guru status, who bear gifts of story-telling or intellectually stimulating arguments, to step aside.

The masses are not buying into your BS anymore, and they want the straight up truth.

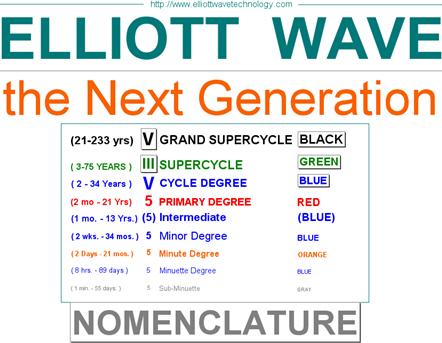

This article illustrates Elliott Wave Technology’s unique brand of straight forward, no BS best-practice market forecasting.

Without further ado, we present the past, current, and future price action forecast for the US Long Bond as presented in our Near Term Outlook charting publication.

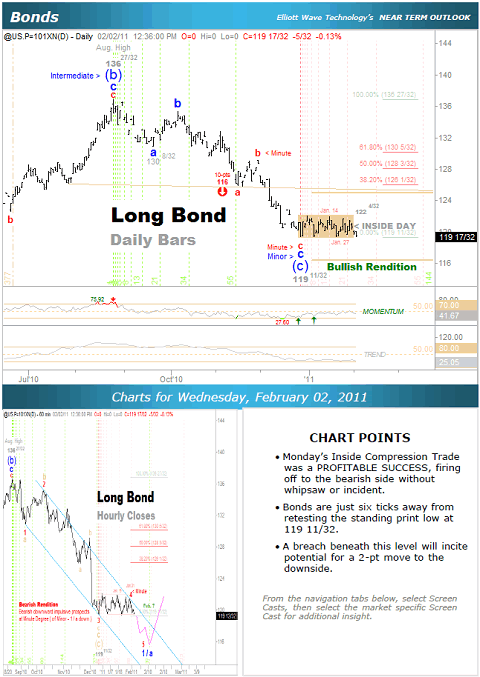

…US Long Bond > Hourly Close Chart: past (1/19/2011)

Previous Assessment | Near Term:

On January 19 we presented Near Term Outlook subscribers with a bearish rendition of the short-term price action in Bonds.

Specifically, we suggested that bearish forces may achieve short-term victory following the completion of the minute degree 4th wave advance that we were observing at the time.

We further stated that if correct, once the fifth wave down is complete, a commensurate retracement rally would then be expected to ensue.

As we all know, there are two sides to every argument. The same is true in financial markets. As such, our unbiased disciplines require us to recognize and define all arguments relative to each market covered.

This usually involves a bullish and bearish rendition of the price action. Often, both can be quite similar over the short-term, and differ only in the medium to longer-term course price will eventually take.

Hence the bearish rendition above, which cites a minor degree 1 or –a- wave terminal to the forecasted move down, and the bullish rendition below citing an Intermediate (c) wave terminal to the very same move down.

…Bonds Daily Bar/Hourly Close Charts: (2/2/2011)

Side-bets & price targets:

It is common practice as diligent market forecasters, to provide our subscribers with the occasional unbiased short-term trade set-ups we see unfolding in real time.

Above, our CHART-POINTS from February 2 reported a profitable outcome to a previously noted short-term speculative “inside compression trade” set-up.

We have coined these particular set-ups as “inside compression trades”.

Compression trades are straight forward side-bets presented with clearly defined entry points, stops, and exit targets. Each have a buy side and sell side component, so they are totally indifferent to market bias.

All we do is report the truth of the condition when we see it.

This provides a powerful ancillary component of service to those users inclined to take on short-term speculative side-bets, and gives one very specific parameters to use in the course of such endeavor.

Using this ancillary compression trade side-bet, those trading long Bond futures had a short-term road map to earn over $800 per contract in a single trading session.

Above, CHART-POINTS further went on to note another pending sell trigger six ticks above the market. If elected, a two point move to the downside was conveyed, which would cite a bearish price target of 117 11/32.

Basis futures, each point in the long bond equates to $1000 per single contract traded.

As such, our CHART-POINTS in effect spelled out a trade set-up with the potential to earn $2000 per single contract traded.

Within one week’s time by February 9, that $2000 per contract side-bet was also an extremely profitable one as Bonds printed a low of 117 3/32 before reversing higher to close the session at 118 10/32.

…Bonds Daily Bar Chart: (2/9/2011) Current & Forecast

Outcome & Current Assessment | Near-Term::

Above, the recent chart from February 9 clearly illustrates an outcome remarkably consistent with our forecast. Moreover, along the way our forecasting disciplines cited two ancillary opportunities from which participants so inclined could act upon. In this case, both were profitable with minimal to no drawdown.

So, where do Bonds go from here? As the article states, Bonds are set to rally. The conditions present in both the bullish and bearish renditions of our analysis place Bonds at a point in both time and price that is ripe for a rally.

Are we calling a bottom in Bonds? NO. Are we calling a short-term bottom in Bonds? NO. We are still respecting a long standing downside target of 116 along with another set of bearish projections beneath the 108 level.

Well then what in the hell are we doing? We are doing our job correctly.

summary:

The ability to track, forecast, and convey truth resident in the price action dear readers, is what best-practice forecasting guidance is all about.

Get used to it, we’re here to stay and will not leave the square until those with oppressive monopoly powers have been unseated from their thrones.

Until next time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.