Japanese Yen Bear Run Begins?

Currencies / Japanese Yen Feb 19, 2011 - 09:31 AM GMTBy: Justin_John

John Thomas, Mad Hedge Fund Trader, loathes YEN. He has been negative for over 6 months. I do not disagree with him. I think YEN is putting in a major top in place for maybe years and we can see a near 30-40% correction in YEN over the next 24 months. The return could be higher against the EURO which is probably going to be the best performing currency in the next 24 months with constant rate hikes to fight a surging commodity inflation.

John Thomas, Mad Hedge Fund Trader, loathes YEN. He has been negative for over 6 months. I do not disagree with him. I think YEN is putting in a major top in place for maybe years and we can see a near 30-40% correction in YEN over the next 24 months. The return could be higher against the EURO which is probably going to be the best performing currency in the next 24 months with constant rate hikes to fight a surging commodity inflation.

Note our previous calls on YEN:

Yen is the pick to short

Trend in YEN

Downwards pressure on YEN begins

There are three important drivers behind a YEN short trade:

1. Yields: Fundamental but long term, yields play a vital role in determining the long term prospects for YEN. YEN 2 Year bonds have an yield of 0.24%. They have hardly moved a few bps even with the inflation in the rest of the world. The low yields have been driven by massive savings of the Japanese households all of which gets invested in Japanese bonds. Japan is also the only country among G7 where corporates have “net cash” of nearly 700 billion Dollars that is net of any leverage at the corporate level, Japanese companies have cash surplus of 700 billion. Get that! The surging cash balances on the balance sheet is again channelized to Japanese bond markets where Japanese debt is held. This is the secret of the Japanese bond markets and its remarkable stability. That cash is not going anywhere in a hurry.

Recently though we have seen yields jumping for EUROZONE and UK driven by inflation and inflation expectations. EU 2 year bonds yields 1.4% up from 1.18% a month back while UK is 1.5% up from 1.38%. ECB has already communicated that they are going to raise rates soon. Reference Bini Smaghi comments at G20. There fore higher yield currencies (assuming they are safe) will now start gaining on YEN and hence cementing the long term top in YEN. EUR/JPY now targets 135 levels by 2011 end. 18% upside.

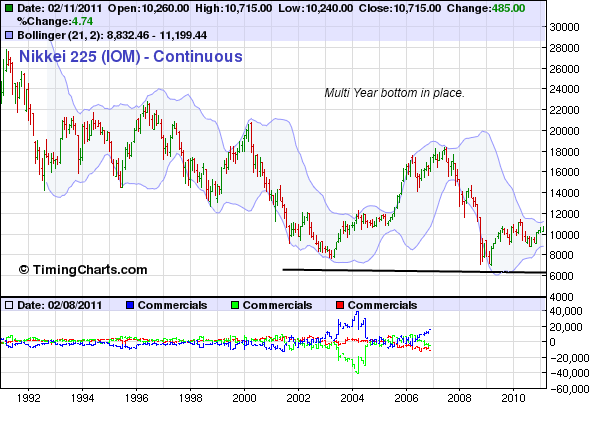

2. Nikkei: Japanese equity markets have an inverse correlation with Japanese YEN. The better the equity markets perform. Nikkei has broken through a short term trading range from 10,700 and is now heading higher with a clean break of its upper channel. But we still wait for a break of 11,100 to confirm our thesis for a Nikkei trading bottom.

Equity markets have been performing due to the recovery led by exporters. Exporters are going to perform even better as YEN starts to fall from here and thus leading Nikkei even higher pulling money out of the bond markets into Japanese equity markets.

3. Demographic: John Thomas has pointed out rightly that Japanese demographics are getting worse. As of 2008, the national birthrate was 1.37 children per woman, according to the Japanese health ministry. If this trend continues, Japan’s population will drop from 127 million currently to 95 million by 2050.

Simply put, Japan has too many non-working elderly people and too few people of working age to support them. As this discrepancy widens in the coming years, the costs of taking care of the aged will become an ever-greater burden on the already-weary Japanese of prime working age. Japan’s average life expectancy is the highest in the world – as of 2008, it was 86.1 years for women and 79.3 years for men. It is a story that has been retold many times but this is a long term trend and will not affect day to day trading. But the long term pattern of YEN is pretty much going to be driven by this fact.

And to top it all, Japan has a public debt of nearly $10 trillion which is 200% of its $5 trillion economy. Japan is demographics are scary and this is long term bet on the currency ability to withstand.

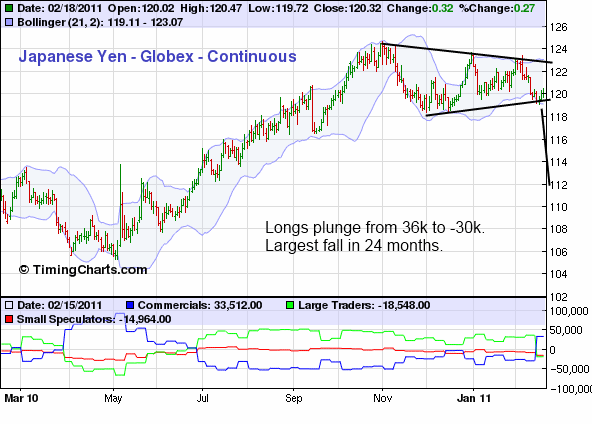

Given the above drivers, what does the YEN trade represent on COT? Well COT for week indicated the highest fall in YEN longs in the last 24 months signifying the losing traction from hedge funds and speculators who are unwinding the YEN long trades. This could be significant and we await a week more date to confirm that YEN speculators have started to unwind.

Given the extraordinary events and drivers behind the YEN short trade, my pick for shorting YEN is against the EURO irrespective of its sovereign issues. We have always highlighted EURO is not going to implode even as it plunged to 1.18 to the dollar. It has far too many nations in the world supporting it and diversifying it.A few hedge funds even with $1trillion in AUM shorting the EURO could only take it from 1.53 to 1.18. Imagine the weight behind the EURO to take down that short. The euphoria and fear behind shorting euro is gone. Even with Portugal and Spain yields flying of the handle, EURO hardly seems to be caring which only means EUR/USD trade has fully incorporated the debt crisis. Now ECB has gone ahead and given the go ahead to the markets that it will be raising rates soon and thus making ECB the first CB to raise rates. (2 hoots to Zero Hedge who has been relentlessly pursuing a short euro trade which according to them cannot exist for Greece and other to survive. Well markets have another thing for them).

So given the yields dynamics, EUR/JPY is the trade to go for.

Tags: japan demographics, nikkei, yen, yields

Source: http://dawnwires.com/investment-news/...

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2010 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.