Disasters Rocking U.S. Dollar?

Currencies / US Dollar Mar 01, 2011 - 01:17 PM GMTBy: Axel_Merk

From earthquakes in New Zealand to revolutions in the Middle East, natural and man-made disasters are rocking the world. We are all too often made to believe that in times of crisis there’s a flight to the U.S. dollar. However, the U.S. dollar has instead had a rocky ride of its own thus allowing the crisis-ridden Eurozone to shine. What’s going on? Is there no crisis, or has the U.S. dollar lost its appeal as a safe haven?

From earthquakes in New Zealand to revolutions in the Middle East, natural and man-made disasters are rocking the world. We are all too often made to believe that in times of crisis there’s a flight to the U.S. dollar. However, the U.S. dollar has instead had a rocky ride of its own thus allowing the crisis-ridden Eurozone to shine. What’s going on? Is there no crisis, or has the U.S. dollar lost its appeal as a safe haven?

Over longer periods there is little correlation between the U.S. dollar and other assets. In the past two years, however, a mentality has arisen that whenever there is a crisis the U.S. dollar benefits; as the crisis abates money flows out of the U.S. dollar and once again into currencies and markets overseas that may be deemed riskier. That may well be a skewed pendulum, however, as the U.S. dollar may have a more difficult time attracting money at each subsequent crisis. Firstly, the U.S. is simply better at spending and printing money than the rest of the world; causing the balance sheet of the U.S. to deteriorate at a faster pace than that of the rest of the world. And secondly, policy makers around the world are addressing whatever the cause of the crisis may have been i.e., the “trillion-dollar” backstop provided in the Eurozone to support weaker countries. One can argue how effective such measures are, but generally speaking, the region may be safer than before measures were taken; not safe, but “safer”, meaning less money may flee back to the U.S. dollar the next time a crisis flares up.

But maybe there is no crisis? Saudi Arabia may make up for any shortfall of lost Libyan oil production and Egypt and Tunisia don’t affect U.S. markets anyway. The argument we heard in early phases of the sub-prime crisis was “it’s all contained". Intelligent people in both Libya and abroad did not think the Egyptian turmoil would swamp over to Libya. After all, the standard of living – and with it, presumably social stability - in Libya is higher due to wealth created by oil. For now, the extreme volatility in the oil markets suggests that market participants beg to differ as to how all of this unfolds. If anything, that is a healthy process; it’s when everyone agrees that bubbles are created.

To understand the dynamics unfolding we have to dig a little deeper into the “it’s all contained” argument. People don’t like autocratic rule but we have argued that people may put up with oppression as long as they can feed themselves. Escalating food prices may be a key reason revolts and revolutions are happening now. (See also our analysis of Politics of Inflation.) However, U.S. policy makers generally disregard food inflation for a couple of reasons:

•The U.S. economy is not very dependent on food. Yes, people need to eat but only a small portion of disposable income is spent on food in the U.S.

•Food inflation in the rest of the world is really the problem of the rest of the world. Federal Reserve (Fed) Chairman Bernanke, when pressured on whether U.S. monetary policy exports inflation to the rest of the world, has argued that other countries have plenty of tools at their disposal to address inflationary pressures there. That is correct but in the absence of foreign policy makers heeding Bernanke’s advice, the world is less stable; $100 oil is a reminder that global instability does come home to roost.

•Food inflation is temporary. There is a widely held belief that food inflation is due to special factors such as a plethora of bad crops throughout the world. However, the Financial Times writes: “The World faces a protracted bout of extremely high food prices, the US government has warned, overwhelming farmers’ ability to cool commodity markets by planting millions of additional hectares with crops.”

•Not only can farmers plant more, they can also farm more efficiently. Developing countries, over time, may greatly enhance the productivity of their farmland. That is correct, but let’s not forget that as the standard of living is rising in the developing world, there’s a shift towards a more protein based diet. A lot of corn will be needed to feed the cattle to produce the meat to satisfy demand.

•Acknowledging these drivers, it’s still a question of whether we are merely seeing a bout of inflation, i.e. a reset of the price level or an era of continuously rising food prices. Even with little agreement on where we are headed in the medium term, most would agree that there is no such thing as continuity in agricultural commodity prices. As an example, Bloomberg reports that wheat prices fell 8.6% from February 18 until February 25.

While we believe food inflation will be with us for quite some time and may contribute to an unstable world possibly for years to come, the Federal Reserve appears to be firmly in the camp of heavily discounting food inflation. The European Central Bank (ECB), in contrast, has historically taken commodity inflation more seriously than the Fed – ECB President Trichet talks about his concern over “second round effects”, i.e., commodity inflation stirring inflation throughout the value chain.

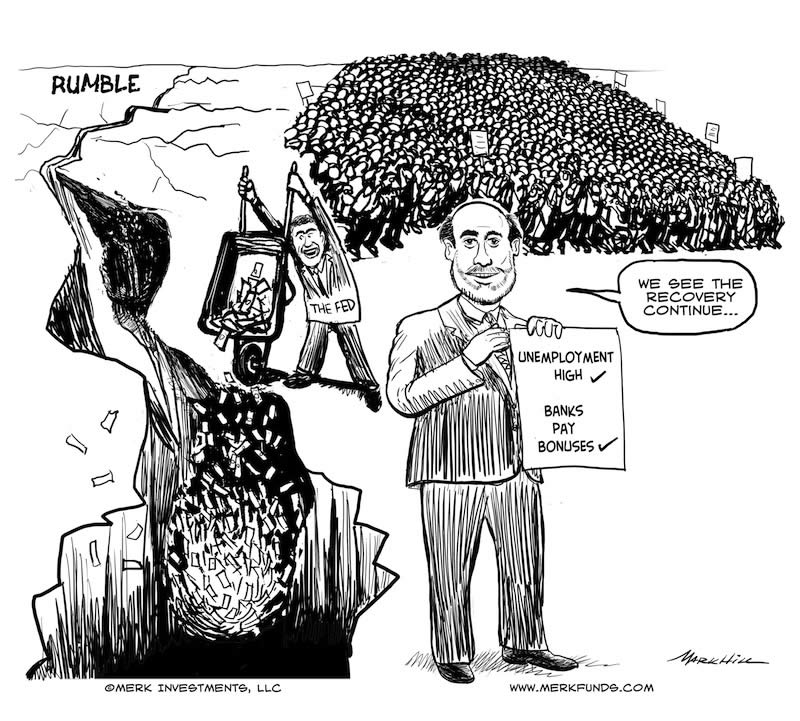

The relevance of all this is that in the U.S. it’s business as usual as far as monetary policy is concerned. According to Fed Chair Bernanke, the U.S. economy must grow at a rate of at least 2.5% per annum just to keep unemployment stable, however, he has made it clear that he will pursue policies to boost growth above that level. With oil prices soaring, he is facing yet another headwind. Rather than mopping up the liquidity that, in our assessment, has contributed to global commodity inflation, he may be tempted to keep the printing press in high gear to promote economic growth.

It doesn’t really matter whether we think there is a crisis. What matters is that the Fed doesn’t think its policies are contributing to global instability and continues on its expansionary path. After all, the banks continue to sit on their money and as such, the economy is certainly not in overdrive. With the exception of social instability spreading globally, the Fed may be very much on course:

•Bernanke may want a weaker dollar. Unlike his predecessor, Bernanke embraces the U.S. dollar as a monetary policy tool to boost economic growth.

•Bernanke wants higher inflation. Having explicitly called for higher inflation since last August, he has since praised the progress the market has made in pricing higher than inflation expectations. The challenge with raising inflation expectations is not only that it may be difficult to lower those expectations later but that it is difficult to control where that inflation appears. Bernanke, in our assessment, needs to get home price to rise and is willing to put up with rising prices in other areas.

•We often focus on housing as a reason the Fed wants to boost growth, but we can also focus on WalMart: in the 13 weeks that ended 1/29/2010, WalMart’s sales declined 1.2%. Keep in mind that unlike government statistics, WalMart’s sales are not inflation adjusted.

Also keep in mind that WalMart has been expanding its produce section in recent years; the section very much exposed to food inflation. As a result, on a real basis, sales have had rather substantial declines. Given that WalMart’s sales comprise more than 10% of total U.S. retail sales, we don’t believe there is such a thing as “company specific” problems; WalMart’s problems are those of the U.S. economy.

In contrast, the rest of the world is taking steps to stem inflationary pressures. Russia is the latest country to raise interest rates, following countries ranging from Sweden to Norway, Canada to Australia and Korea to China. In the Eurozone, the pairing down of some emergency facilities (leading to a draining of liquidity; a form of monetary tightening) and recent hawkish talk suggest interest rates may be raised later this year.

Ensure you sign up for our newsletter to stay informed as these dynamics unfold. We manage the Merk Absolute Return Currency Fund, the Merk Asian Currency Fund, and the Merk Hard Currency Fund; transparent no-load currency mutual funds that do not typically employ leverage. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.