Euro USD Currency Elliott Wave Technical Analysis

Currencies / US Dollar Apr 25, 2011 - 02:49 AM GMTBy: Tony_Caldaro

We have written about the Euro in sections of various reports before, but this is the first report dedicated just to the EURUSD. The Euro, the currency of the European Union, replaced the ECU, a basket of european currencies, in 1999 on a 1:1 basis. For the record the Euro officially started trading in 1999. However, we do have charts for the ECU going back to 1991. In the 1990′s the basket of ECU currencies contained twelve different currencies.

We have written about the Euro in sections of various reports before, but this is the first report dedicated just to the EURUSD. The Euro, the currency of the European Union, replaced the ECU, a basket of european currencies, in 1999 on a 1:1 basis. For the record the Euro officially started trading in 1999. However, we do have charts for the ECU going back to 1991. In the 1990′s the basket of ECU currencies contained twelve different currencies.

The largest components were the DEM 32%, FRF 20% and the GBP 12%. Oddly enough, as you will observe from the following charts, the ECUUSD had only twice the value of the DEMUSD. Even though the German DEM made up only one third the value of the ECU basket. The following charts clearly display this 2:1 relationship.

This first chart displays the DEM from 1960 to 2005.

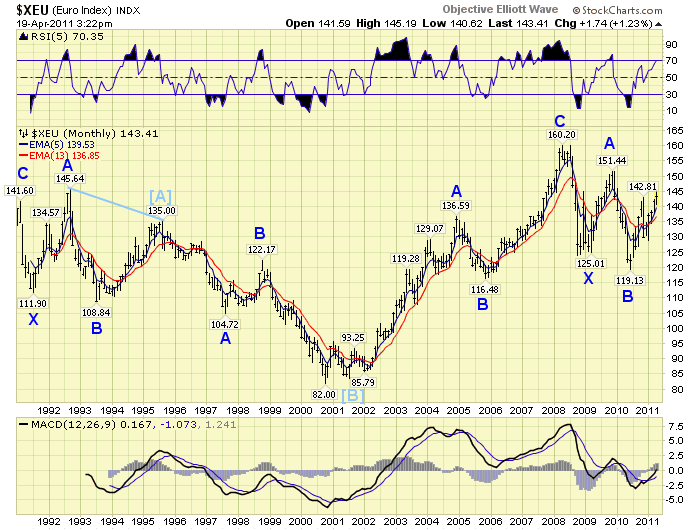

The second chart displays the ECU/EUR from 1991 to 2011. Notice the 2:1 EUR to DEM relationship during most of the 1990′s into the 2000 low. The whole point of comparing the DEM to the ECU/EUR is to aid in our historical analysis of the Euro.

When we review the DEM chart we observe the typical cyclical price movement of the established western currencies. Cycle peaks every 17 years and cycle lows about every 17 years as well, but only offset by 7 years. Counting from the Supercycle low in 1985 we have a double zigzag Cycle wave [A] advance into 1995. This aligns with the Cycle wave [A] wave peak in 1995 for the ECU/EUR.

Then between 1995 and 2000/02 both the DEM and ECU/EUR declined in three Primary waves into a Cycle wave [B] low. Nearing that low we need to default to the EURUSD charts since the Euro started trading in 1999. After the 2000/02 Cycle wave [B] low the EUR embarks on a multi-year, double zigzag, Cycle wave [C] to complete the Supercycle bull market. We see the first completed zigzag between 2000 to 2008, (EUR 82.00 and 160.20). Then the Primary X wave into the 2008 low at EUR 123.94. What follows is the second ABC Primary wave zigzag into an anticipated 2012 top. Primary waves A (EUR 151.44) and B (EUR 119.13) have already completed. Primary wave C has been underway since early 2010.

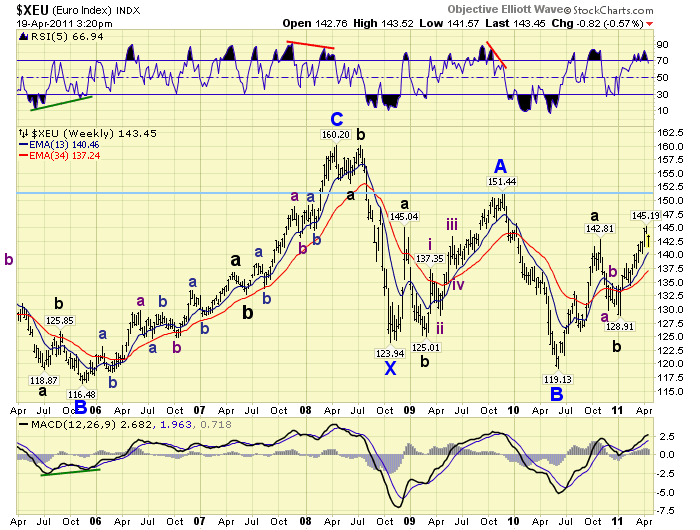

The EURUSD weekly chart above better illustrates the current Cycle wave [C] and Primary waves A, B and C. Notice Primary wave A (EUR 123.94-151.44) was a zigzag with three Major waves, and Major wave C subdivided into five Intermediate waves. Primary wave B (EUR 151.44-119.13) was a simple wave. Primary wave C, however, is also unfolding as a zigzag with three Major waves. In fact, Major wave C may subdivide into five Intermediate waves before it concludes.

When we apply fibonacci relationships to the entire structure we arrive at a 2012 EURUSD topping range between 155 and 159. The details. At EUR 159 Cycle wave [C] = Cycle wave [A]. At 157 Primary C = 1.5 Primary A. Then at 155 the second ABC of Cycle [C] = 0.382 the first ABC of Cycle [C]. You can track the Euro along with use by scrolling down the following link: http://stockcharts.com/def/servlet....

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.