Emerging Markets Central Banks Continue Trend of Tightening Interest Rates

Interest-Rates / International Bond Market May 01, 2011 - 06:21 AM GMTBy: CentralBankNews

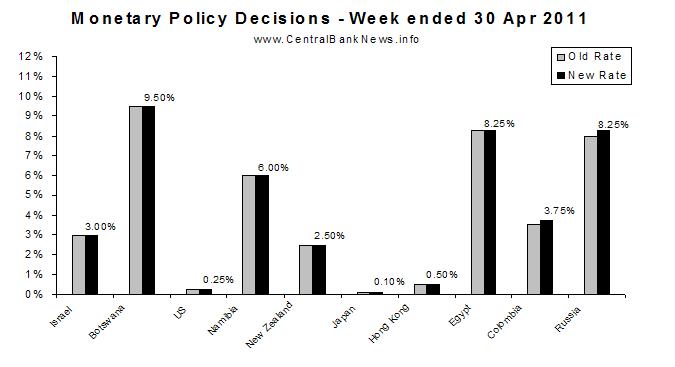

The past week saw 11 central banks announce monetary policy decisions, with just 3 making adjustments to interest rates. All 3 policy moves were tightening from emerging markets: Colombia + 25bps to 3.75%, Vietnam +100bps, and Russia +25bps to 8.25%. Meanwhile those that held rate unchanged were: Israel 3.00% Botswana 9.50% US 0.25% Namibia 6.00% New Zealand 2.50% Japan 0.10% Hong Kong 0.50% and Egypt 8.25%.

In terms of themes, it was a continuation of the emerging market monetary policy tightening theme with another one of the BRICs (Russia) making another move. But the lack of activity from the other banks also hinted at another theme; that of policy risks. Indeed as inflation begins to peak from the surge in commodity prices, perhaps toward the middle of the year, banks will have to tread increasingly carefully. The age-old trade-off in monetary policy concerns fighting inflation through tools that usually hamper growth, applying these tools too hard can result in an economic hard landing. This is precisely the risk that many of the banks which held-off tightening over the week are dealing with.

Next week the Reserve Bank of Australia will announce its monetary policy decision, with the rate expected to remain unchanged at 4.75%. Also up next week is the European Central Bank which will likely hold its rate at 1.25%, making for an intermittent tightening cycle following its previous 25 basis point hike last month. The Bank of England is also set to announce policy, and is likely to keep its asset purchase program unchanged at GBP 200 billion, and the bank rate also unchanged at 0.50%.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/04/monetary-policy-week-in-review-30-april.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.