Countertrend Moves In U.S. Dollar, Gold and Silver

Currencies / US Dollar May 12, 2011 - 10:39 AM GMTBy: Jeb_Handwerger

The US dollar has been reacting very bullish to the death of Osama bin Laden, the figurehead of Al Qaeda. Short-term investors have shown a renewed interest in the US dollar (UUP) as near-term resistance and the 50-day moving average have broken to the upside. Word has spread that this has been a critical blow to the Al Qaeda network, but countries are preparing for retaliatory attacks.

The US dollar has been reacting very bullish to the death of Osama bin Laden, the figurehead of Al Qaeda. Short-term investors have shown a renewed interest in the US dollar (UUP) as near-term resistance and the 50-day moving average have broken to the upside. Word has spread that this has been a critical blow to the Al Qaeda network, but countries are preparing for retaliatory attacks.

Bin Laden’s demise came at a crucial time as investors were rushing to flee the dollar for protection in silver (SLV) and gold (GLD). His death has certainly affected the foreign exchange markets and given a renewed interest in the US dollar, especially versus the euro (FXE) where debt concerns are resurfacing and where this past week investors left interest rates unchanged. Obviously, the view that geopolitical tensions in the Middle East will ease has caused a renewed interest in the resilience and the image of the US internationally.

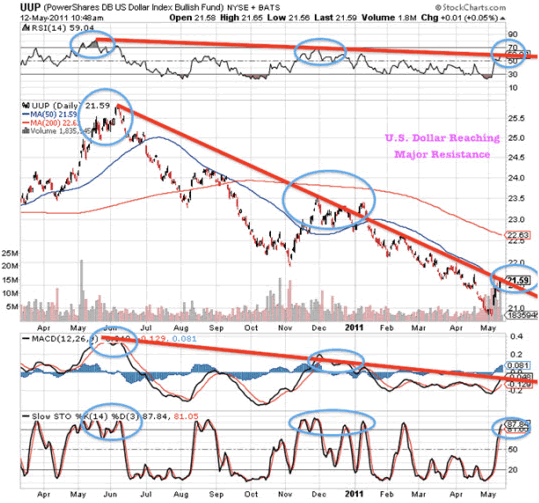

We may see continued “short term” weakness in gold and silver and strength in the US dollar as both markets were extremely divergent from the historic mean before this event reaching record levels. The US dollar is beginning to reach key resistance after a bounce.

Before bin Laden’s demise the US dollar was reaching extremely oversold levels. This dead-cat bounce is only temporary. Investors should use this opportunity to position themselves against long term US dollar weakness. There will be great rallies and crashes in this volatile downtrending market. One should use these counter trend moves as an opportunity to enter into gold and silver. Commodities tend to rebound aggressively from these dips. It has always been prudent to buy the countertrend moves or dips rather than chasing the herd when the sector is overheated. Hopefully, silver and oil (OIL) have taught this lesson to investors getting overly aggressive at overbought conditions.

Precious metals and commodities are going through a healthy technical correction. The recent parabolic move in silver has been followed by a waterfall decline as trailing stop losses have been hit. It was important to take partial short-term profits as technical targets are reached and back when the market was still moving higher before the panic began. Now the situation is reversed. Panic is seizing the silver and gold trading pits, an ideal time to buy for a long-term investor in hard assets.

Although we are seeing a countertrend rally in the US dollar and many are calling a top in gold and silver, sadly, nothing has really changed. We are possessed by the nudging fear that although bin Laden is gone, the malady of radical Islam and potential retaliation lingers on. The specters of our mounting problems such as a runaway budget, sickening unemployment, the victimization of the middle class, enormous entitlement programs are yet unsolved. Interestingly before bin Laden’s demise, Ben Bernanke attempted to assuage our enormous wounds by trotting out the same old, tired tropes. Glibly, he tried to assure us that everything was going to be alright. Many of us were unconvinced. Between Ben and Bin, we are between the rock of retaliatory terrorism and the hard place of fiscal woes.

The US dollar will soon meet major resistance and overbought conditions. Over the past 11 months these dollar rallies have fizzled out very quickly over four weeks. There is no concrete evidence at this juncture to predict a major turning point in commodities or the US dollar.

I invite you to partake of my members only stock analysis service for free by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.