U.S. Treasury Bond Market Bears Continue to Lose

Interest-Rates / US Bonds Jun 03, 2011 - 02:45 AM GMTBy: Adam_Brochert

I understand fundamental convictions when investing. Fundamental convictions have caused me to lose lots of money in the past. What is the point of being intellectually superior in your own mind and then losing money trading? Does it really make you feel better in the end to "be right" and lose money? Personally, I have decided it is better to be agnostic and make money. It has been a journey, believe me.

I understand fundamental convictions when investing. Fundamental convictions have caused me to lose lots of money in the past. What is the point of being intellectually superior in your own mind and then losing money trading? Does it really make you feel better in the end to "be right" and lose money? Personally, I have decided it is better to be agnostic and make money. It has been a journey, believe me.

As an example, I am a long-term precious metals bull but I am short silver right now in my trading account. Does that make me a traitor? Do I care if I am a traitor? Trading is rough and it is hard to win when you're not the house. The last thing you need is emotional or intellectual baggage that prevent you from seeing that you should be long instead of short or vice versa.

My point in writing this piece along these lines is that I have a bone to pick with the bond bears, particularly those who keep recommending that other people short U.S. government bonds.

If you know what you're doing, wait for the right set up, then take profits when appropriate, you can absolutely make money shorting bonds. You can also make money in this manner when you are bullish/long on bonds. I believe that the people recommending indiscriminate shorting of U.S. bonds, particularly using leveraged instruments, are not following the charts, but rather a fundamental conviction. This is fine over the long term, but levered ETFs are for trading, not the long term!

Everyone with a pulse and an IQ above George Bush (i.e. above 70 or so) knows that bonds are trash. We all know that the fundamentals are terrible for government debt, whether in the United States or any other developed economy in the world. In the long run, bonds are toast. In the long run, every asset class in a bull market is toast. These thoughts are not necessarily profitable ones in the short to intermediate term, however.

I am a Gold investor. My largest position, by far, is physical Gold held outside the banking system. I understand that fiat money is destined for the graveyard. I also understand that bonds are nothing but certificates of confiscation. But I don't actually see any confirmation that the secular bull market in U.S. government debt has ended. Yes, it is a bubble. Yes, it will pop. However, keep in mind that there will be a decade (or two or three) to make money shorting bonds if history is any guide. At this point, we don't even have a confirmation that the secular bond market bull market that began around 1980 is over! Was shorting internet stocks profitable in 1998? How about 1999? But how could it not be profitable when the fundamentals for shorting were sound?

This is where technical analysis should be respected. Figuring out a selling or buying point from a long term perspective in a situation where the fundamentals are in your favor is not pseudo-science in my opinion. Charts depict the price points that mark the emotions of fear and greed that oscillate from one extreme to another. But enough blabbering, on to the charts...

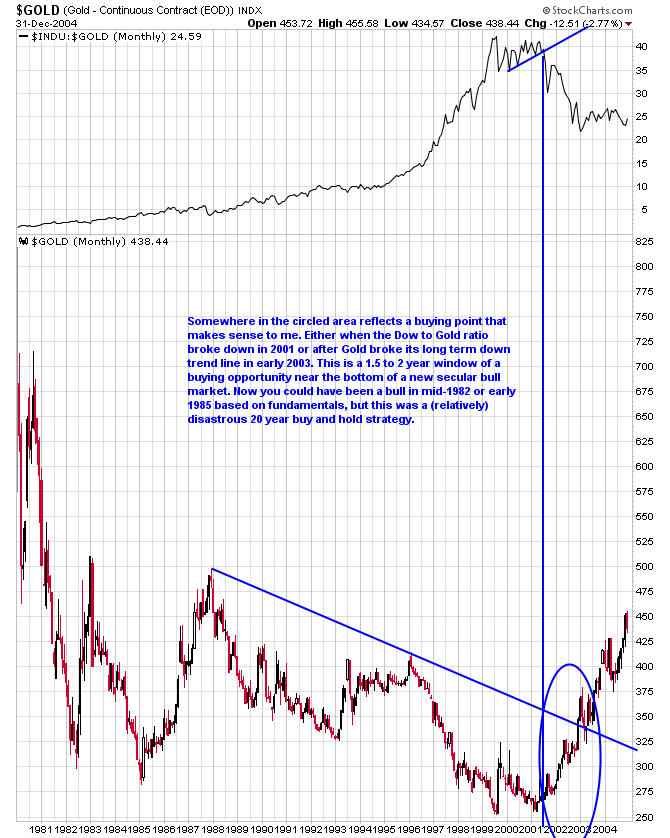

First, let me use an example near and dear to my heart. Here is a monthly log scale chart of the Gold price ($GOLD), in U.S. Dollars, from 1980 through 2005 with my thoughts (at the top is an additional plot of the Dow to Gold ratio [$INDU:$GOLD]):

Fundamentalists saw Gold as real money throughout the 1980s and 1990s. They were right. They were very right. But man, they sure missed out on a lot of investment returns in bonds and stocks during this period. I would rather make money than be right. What about you? What are your goals when trading or investing?

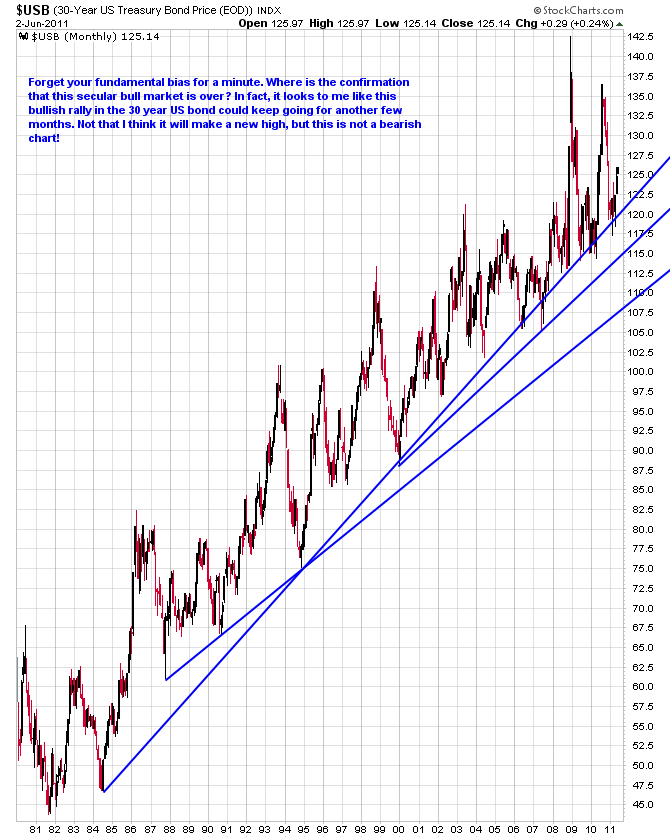

Anyhoo, here's the ultimate secular chart that every fundamental bond bear needs to pay attention to on a regular basis. This is a monthly log scale chart of the 30 year U.S. Treasury bond ($USB aka every bond bear's favorite short) from 1980 thru today's close:

Bond bears, repeat after me: We are not in a confirmed secular bond bear market yet. Using triple levered bond bear ETFs against an aging secular bull market is a recipe for serious losses. There will be plenty of time to make money shorting bonds if one is so inclined. Why rush, when fundamentals and prices can take years to align? Were Gold's fundamentals lousy in 1999? So why was there a double bottom put in during 2001, a full 2 years later?

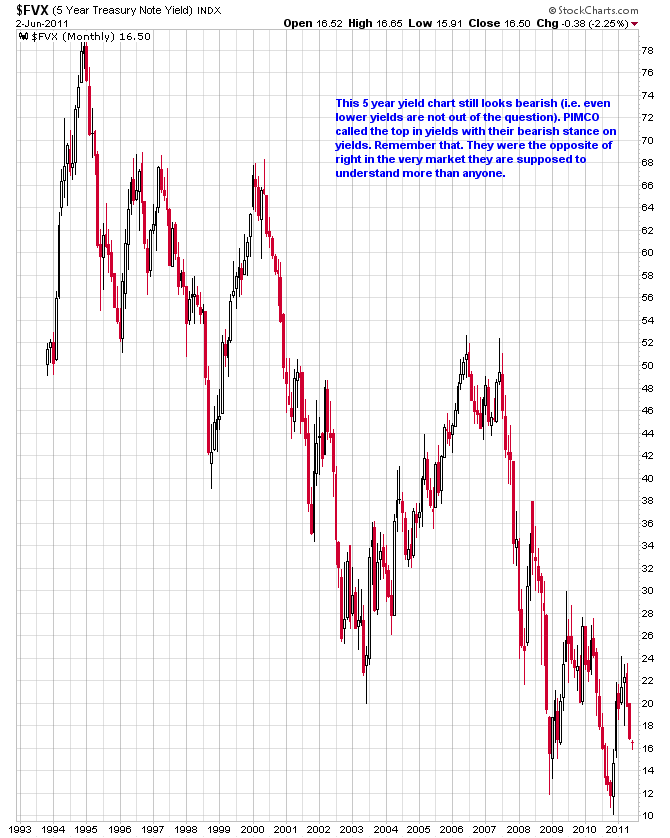

Next up, a long term monthly log scale chart of the 5 year US Treasury bond yield thru today's close:

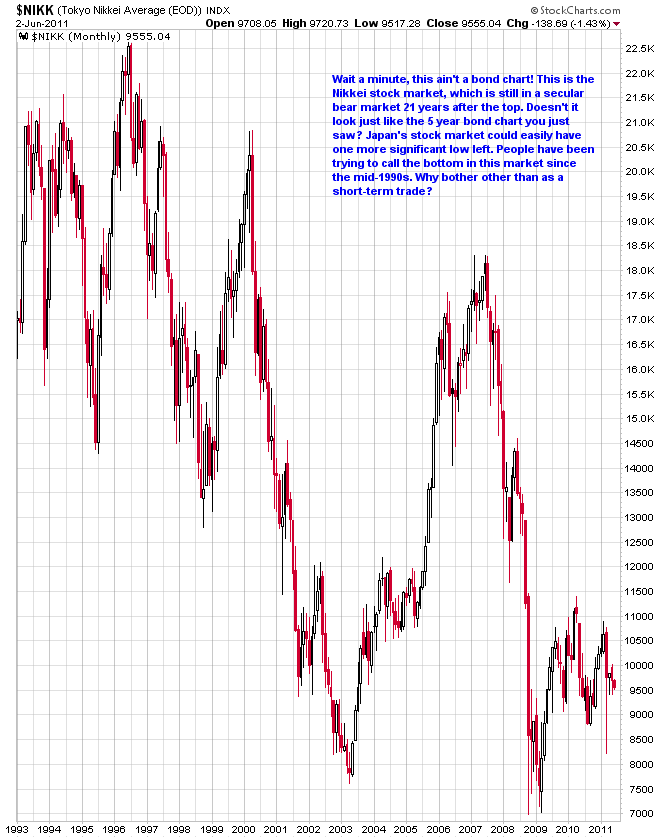

And here's a similar looking chart of a different bond during the same time series:

Didn't mean to play a trick on you, but most people understand that Japan is in a secular bear market, but there is a cognitive disconnect in many when it comes to the bear market in U.S. government bond market yields (i.e. the bull market in U.S. bond prices). Japanese government bonds remain strong to this day despite their even worse debt situation!

I am not a bond bull or a paperbug. Far from it. But not being a bull and being short are two different things. I believe there is more money to be made by being long Gold over the long term than by trying to short U.S. bonds over the long term at this point. Time will tell if I'm right...

I am beginning to plan a low cost subscription service for investors and traders. The goal will be to make money rather than congratulate each other on being fundamentally correct while losing money. Please email me at abrochert@yahoo.com if you would be interested.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.