20 Warning Signs Of A Global Doomsday

Politics / Global Economy Jul 06, 2011 - 06:35 AM GMTBy: EconMatters

Worries rries of a Lehman-like financial crisis spreading through Europe and the world has made Greece talk of the market lately. Not to let Greece dominate the spotlight, the U.S. debt ceiling debate is also getting to be as traumatic since a failure to raise the debt ceiling could mean imminent default and credit downgrades for the United States sovereign debt.

Worries rries of a Lehman-like financial crisis spreading through Europe and the world has made Greece talk of the market lately. Not to let Greece dominate the spotlight, the U.S. debt ceiling debate is also getting to be as traumatic since a failure to raise the debt ceiling could mean imminent default and credit downgrades for the United States sovereign debt.

In the midst of all these different crises, global markets rise and fall in lockstep with news coming out of Europe and the U.S. The U.S. stock market, after suffering a correction phase since April, snapped back last week, scored the best week in two years, but only to retreat again after the long July 4th weekend. The commodity and currency markets are not immune either with investors switching back and forth between risk-on and risk-off trades.

In this environment, one has to ask ...Are there other indicators signaling a global market doomsday?

According to Oxford Analytica, there are fifteen "Global Stress Points" ranging from medium to extreme high impact to the entire world. These are listed below ranked by its potential impact by Oxford (See Graph). Around 60% of the "stress points" are related to geopolitics, war or unrest, while only about five events could be classified as financial crises.

- Dollar Collapse

- Taiwan / China Armed Hostility

- Israel / Iran Armed Conflict

- Mexico State Hollowing

- Global Protectionism

- Latin America Hydrocarbon Disruption

- Iraq State Institutions Collapse

- Russia Military Aggression

- End of Euro

- India / Pakistan War

- Pakistan State Collapse

- Argentina Sovereign Default 2.0

- North Korea Military Conflict

- War in North Africa

- Lebanon Civil War

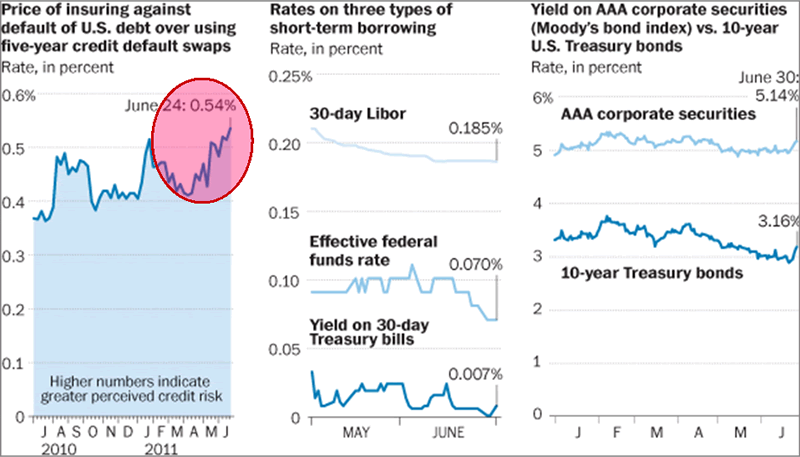

Since a U.S. dollar collapse is ranked as the greatest risk to the world, and dollar's fate is largely dependent on if the bond market has faith in Uncle Sam, it might be helpful to add five additional warning signs that the bond market is freaking out (See Chart):

- Prices of bonds maturing start falling (i.e., investors start to demand higher interest rates to hold U.S. government debt)

- A narrower spread between rates on Treasury bills and other short-term credit or near substitutes, e.g. LIBOR - This would be a sign of waning faith in the U.S. government.

- A narrower spread between Treasuries and near substitutes - A sign of falling creditworthiness of Uncle Sam

- Price spikes in U.S. CDS (credit default swaps, insuring against a U.S. debt default) - According to Markit, the most noticeable movement has occurred in 1-year spreads, which have converged closer to 5-year spreads, and is up about 430% since early April, while 5-year CDS also has risen about 46%.

- Higher volatility in the U.S. bond market - Another sign of lost confidence from bond investors.

|

| Chart Source: the Washington Post |

So far, out of the 20 signs, there's one that's sending up a red signal flare - U.S. sovereign debt CDS, which is directly linked to the dollar (See Chart Above).

The U.S. does not have control over many of the indicators listed here, but at least the No. 1 risk factor --the U.S. dollar--is influenced by the national debt and by the monetary and fiscal policies set by the U.S. government and the Federal Reserve.

The longer the debt ceiling debate lingers, the more likely the bond market would start reacting and demanding higher interest rates. A sovereign credit downgrade as a result of missing the debt ceiling deadline would just translate into billions more in interest payments, piling on to the existing debt.

The United States is not like Iceland or Argentina, resorting to default as retorted by some could mean calamity not only to its citizens, but also to the rest of the world. Unless the government and this Congress get their act together, there will be no bailout, and instead of one lost generation to the Great Recession, there could be multi-generation missed in the next Grand Depression.

Disclosure - No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.