UK House Prices Plunge 0.8% In November on Target for Forecast 15% Drop

Housing-Market / UK Housing Nov 30, 2007 - 07:25 AM GMTBy: Nadeem_Walayat

The Nationwide, one of Britain's biggest mortgage Lenders announced a sharp 0.8% Drop in House Prices for November, the biggest fall for 12 years, bringing the annualised rate down sharply to 6.9%. Whilst at the same time the Bank of England reported a slump in new home buyer mortgage approvals to a 3 year low. The fall house prices is inline with the Market Oracle forecast for a 15% drop in UK House prices as of 22nd August 07.

The Nationwide, one of Britain's biggest mortgage Lenders announced a sharp 0.8% Drop in House Prices for November, the biggest fall for 12 years, bringing the annualised rate down sharply to 6.9%. Whilst at the same time the Bank of England reported a slump in new home buyer mortgage approvals to a 3 year low. The fall house prices is inline with the Market Oracle forecast for a 15% drop in UK House prices as of 22nd August 07.

The Market Oracle is on target for its forecast for a UK house price gain of 3.5% for 2007 as of 31st December 06. House prices are expected to continue the downward trend during November and December to bring annualised house price inflation down sharply with the year on year gains to go negative by the April 2008 data release which is to coincide with the capital gains tax change that is expected to lead to an avalanche of buy to let selling.

Though off course the Government could change its mind and withdraw the proposed tax changes and therefore the expectation of a sharp drop in the 2nd quarter triggered by the tax rule change would need to be revised.

Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said: “House prices fell by 0.8% in November, reversing October’s surprisingly strong performance. This brings annual house price growth down to 6.9%. This is back in line with the softening trend we have seen in the second half of the year and is consistent with our forecast of house price growth of 5-8% in 2007. The 0.8% monthly fall is the first since February 2006 and the largest monthly fall since June 1995. However, monthly data can be volatile and the sharp fall this month is partly a reflection of the strength recorded last month and in November last year. A better picture of the underlying trend is captured in the three-monthly growth rate. This too fell back into line with its softening trend in November, returning to 1.5% from the 1.8% recorded in October. The price of a typical house in the UK is now £184,099, almost £12,000 more than this time last year."

It is only 2 weeks since Nationwide's last report suggesting a stagnating housing market with housing market expected to be supported by supply limitations and therefore not expected to fall during 2008. As my Septembers article Media Lessons from 1989! suggested, that the mortgage banks and estate agents and media reliant on advertising revenue from the industry won't actually acknowledge the true implications of further price declines until AFTER house prices have fallen.

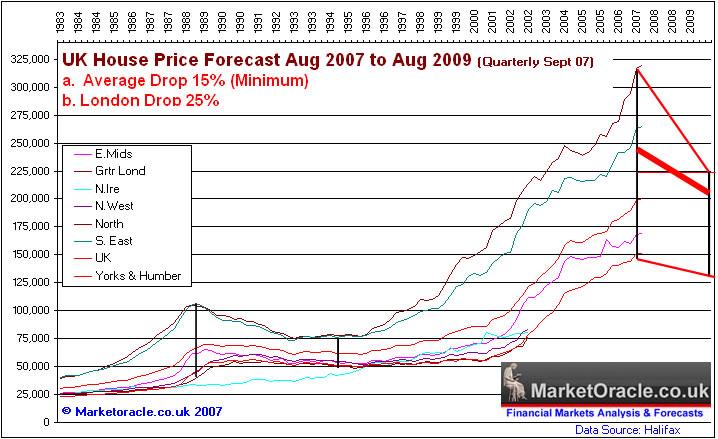

The following graph illustrates the expected overall contraction of 15% in UK house prices, with London expected to fall as much as 25% (last updated 22nd August 07).

UK House Price Affordability Index

The Market Oracle's affordability index clearly illustrates that UK house prices are now at extreme levels of unaffordability not seen since 1989. The index also clearly shows why house prices were extremely under valued for nearly 8 years right into 2002, when many housing pundits were prematurely calling for a UK house price crash.

UK Housing Market Forecast for 2008-09 - As of 22nd August 2007 |

||||

UK House Prices to fall by 15% over two years, falling prices to be accompanied by cuts in UK interest rates. (22nd Aug 07), |

||||

|

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of analysing and trading the financial markets and is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.