QE3 Coming Soon? Treasury TIPS Say No

Interest-Rates / US Bonds Aug 04, 2011 - 06:26 AM GMTBy: Tony_Pallotta

Using the Treasury TIPS (Treasury Inflation Protected Securities) one can determine inflation expectation simply by subtracting the treasury yield for the same maturity. As an example.

10 Year TIPS currently yields 0.29% (inflation adjusted yield)

10 Year Treasury currently yields 2.66% (non inflation adjusted yield)

The difference of the two is the inflation expectation over 10 years in this example 2.37%

Who cares and what does this have to do with QE3? The Fed has made it very clear a deflationary environment scares the hell out of them. Any threat of deflation and the Fed will flood the market with liquidity in an attempt to cause inflation. Sure there are benefits in their eyes of higher stock prices but to simply think if the SPX hits a certain level QE3 will be enacted is naive group think.

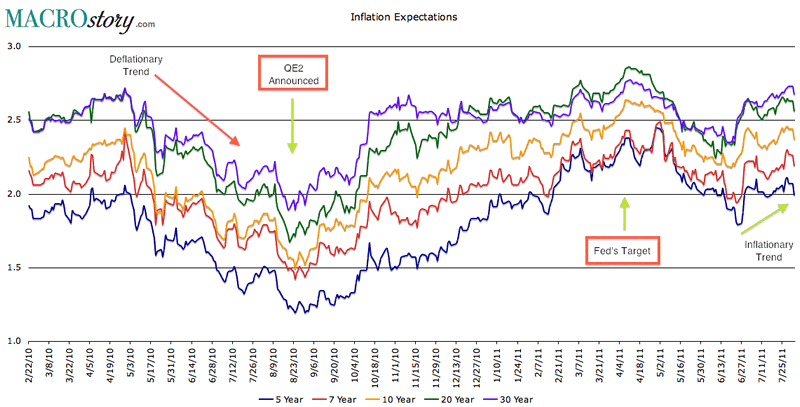

Below is a chart of inflation expectations over the past few years.

Notice the trend going into the announcement of QE2. Clearly inflation expectations across the entire treasury curve were moving below the Fed's target of 1-2%.

QE2 was successful in rising inflation expectations as indicated by the sharp move higher once the program commenced.

Today look where inflation expectations stand, well above the levels of last summer. Should the economy soften further, demand will fall and so will the threat of inflation so QE3 is still quite possible but as of today I would not expect an announcement at Jackson Hole this month other than a reference that if inflation expectations fall that the Fed will begin another program.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.