Is the Fed Too Late to Head Off a US Recession?

Economics / US Economy Dec 04, 2007 - 09:41 AM GMTBy: Donald_W_Dony

With the ongoing weakness of many of the key leading indicators spurred on by the subprime mortgage debacle, has the U.S. already started to slip into a recession? We know the housing and banking sectors remain in a free fall with no apparent evidence of a bottom and that consumer confidence has dramatically declined in recent months. But is that the signal of the start? And what is the definition of a recession?

With the ongoing weakness of many of the key leading indicators spurred on by the subprime mortgage debacle, has the U.S. already started to slip into a recession? We know the housing and banking sectors remain in a free fall with no apparent evidence of a bottom and that consumer confidence has dramatically declined in recent months. But is that the signal of the start? And what is the definition of a recession?

The standard believe is that a recession begins with back-to-back quarters of negative growth; but that is simply a rule of thumb and does not always apply. Take for example in 2001, not only did we not have successive quarters of negative GDP growth in that year but the average for the year was almost 1%.

Is the central bank too late this time around?

There is no doubt that the markets are braced for repeated Fed rate easings, first on December 11 and later in 2008, but the real question is whether the Fed is simply starting too far behind the economy at this point? The central bank has a long history of starting rate cuts too late. For example, the Fed thought it had things under control having cut rates almost 100 basis points by July 1990 but the economy still managed to slide into a recession by September. During the last cycle, the Fed had cut rates by 150 basis points before the recession began and the easings, did not stop the economy from running its course.

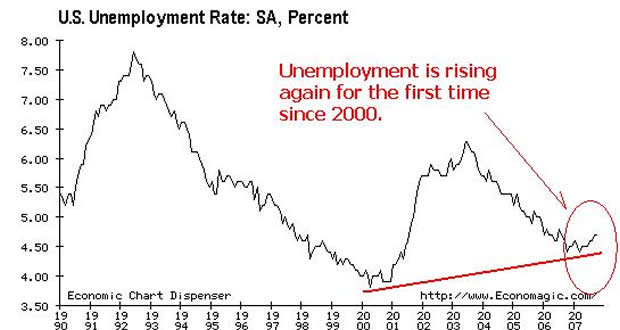

But how do we know if the U.S. has begun to fall into a recession? One very tried and true measurement that tells us if a recession has already started, is the unemployment rate. Once it rises at least 0.5ppt from the cycle low, and it does not matter if that low is 2% or 7%, the economy has always slipped into recession. This acid test works 100% of the time. It is important to remember that it is not the level that matters but the change. (See Chart 1). We know that the jobless rate hit bottom in March at 4.4%; so basically, the U.S. is on the threshold now at 4.9%.

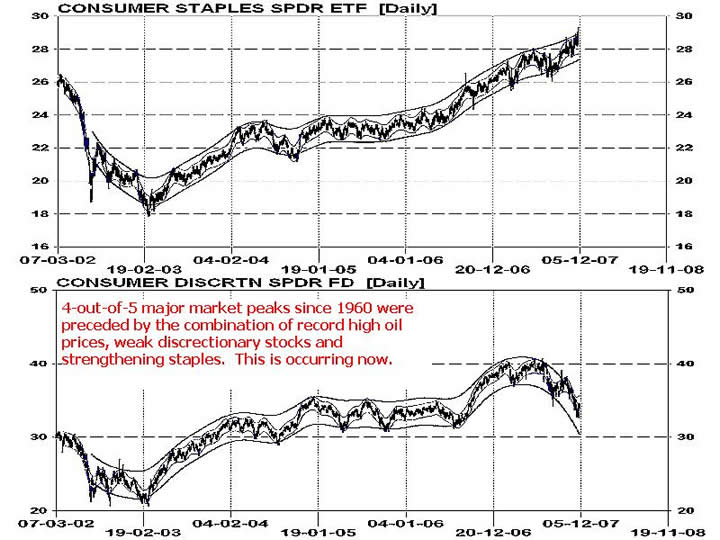

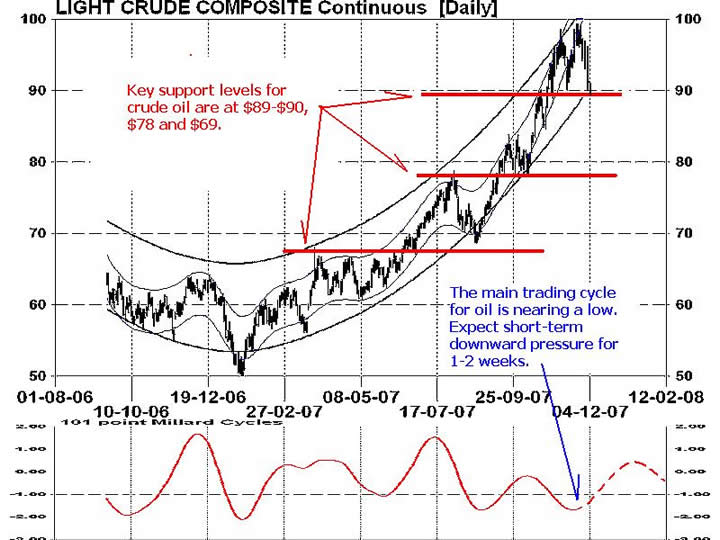

Another time tested indicator of market peaks and loaming recessions is the shift in consumer spending from discretionaries to staples (Chart 2). Though this dance occurs regularly near the end of a each business cycle, it is most important to note when in combination with record high oil prices (Chart 3). This drain on consumer spending caused by high energy costs plus the clear move toward defensive stocks has herald the crest in major equity markets 4-out-of-5 times since 1960.

Before there is any real concern, it pays to note that recessions are an important part of the business cycle. There has been as many recessions as expansions, but they just happen to be much shorter in duration. They last, on average, about 11 months and tend to move the level of GDP down by 2%.

Recessions are simply haircuts and not Armageddon. They are actually very necessary because they help to squeeze out the excesses from of the economy.

Investment approach: The worst performing S&P sectors during a recession have been consumer discretionary and financials which decline, on average, by 30%. The best performing sectors historically were telecomm, health care and utilities; the classic defensives.

More economic and financial market research is available in the December newsletter. Go to member login and follow the links.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.