Stocks Bear Market Investing, Tepid Interest in QE2 Winners Raises Questions About QE3

Stock-Markets / Stocks Bear Market Aug 31, 2011 - 08:59 AM GMTBy: Chris_Ciovacco

The Federal Reserve printed money in 2009 and bailed out the stock market. The Federal Reserve printed money in 2010 and bailed out the stock market. As the financial markets anticipate the next Fed statement due to be released on September 21, the markets are again teetering on the edge of a deflationary abyss.

The Federal Reserve printed money in 2009 and bailed out the stock market. The Federal Reserve printed money in 2010 and bailed out the stock market. As the financial markets anticipate the next Fed statement due to be released on September 21, the markets are again teetering on the edge of a deflationary abyss.

On August 30, the Fed released the minutes from their last policy meeting. Before we take a look at the buying interest in top-performing QE2 ETFs, let’s review the key portions of the Fed minutes:

Committee’s forward guidance regarding the federal funds rate, by being more explicit about the period over which the Committee expected the federal funds rate to remain exceptionally low, would be a measured response to the deterioration in the outlook over the intermeeting period. A few members felt that recent economic developments justified a more substantial move at this meeting, but they were willing to accept the stronger forward guidance as a step in the direction of additional accommodation. Three members dissented because they preferred to retain the forward guidance language employed in the June statement.

The Committee noted that it had discussed the range of policy tools that were available to promote a stronger economic recovery in a context of price stability, and to indicate that those tools, including adjustments to the Committee’s securities holdings, would be employed as appropriate.

The most important phrases appear to be “were willing to accept the stronger forward guidance as a step in the direction of additional accommodation” and “to indicate that those tools, including adjustments to the Committee’s securities holdings, would be employed as appropriate”. The “step in the direction of additional accommodation” implies that there will be another step, which supports the stance that more quantitative easing (QE) may be on the way.

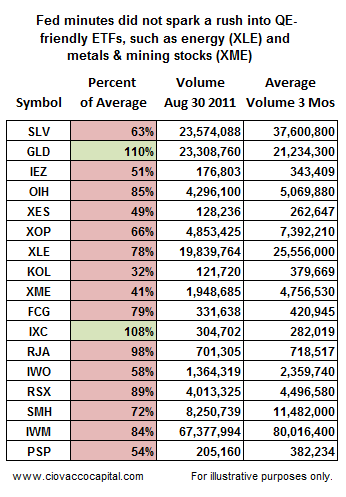

On August 18 we examined the winners from QE2 to assess the market’s stance on the probability of a third round of quantitative easing (QE3). The statements from the Fed minutes above were new information for traders as of 2 p.m. on August 30. If traders and institutional investors believed QE3 was due to be announced after the September 21 Fed meeting, common sense tells us the trading volume for the winners from QE2 should be above average. The table below shows just the opposite – trading volume for the QE2 winners was unimpressive on the day the Fed minutes were released.

You can make the argument that volume in general has been light due to August vacations. We do not buy that argument. When profits and manager performance are on the line, vacations do not get in the way of what is perceived to be an opportunity to front run the Fed. You can read the lack of interest in QE2 winners in one of two ways:

- The market does not believe QE3 is imminent.

- The market questions if QE3 will be effective in boosting asset prices in a sustained manner.

We believe the odds of QE3 being announced at the September meeting are higher than what is baked into the market’s cake. We will continue to monitor the QE2 winners for clues to assist us in making the best decisions possible. It is possible volume and interest in QE2 winners will pick up in the coming days, but until it does, we will continue to hold cash and a small allocation to bonds (TLT). If you missed the August 30 video below, it describes possible strategies based on how the present day market behaves relative to similar markets from 1987, 1990, 1998, 2000, and 2007.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.