FED’s Adjusted Monetary Base

Interest-Rates / US Debt Sep 26, 2011 - 01:21 AM GMTBy: Tony_Caldaro

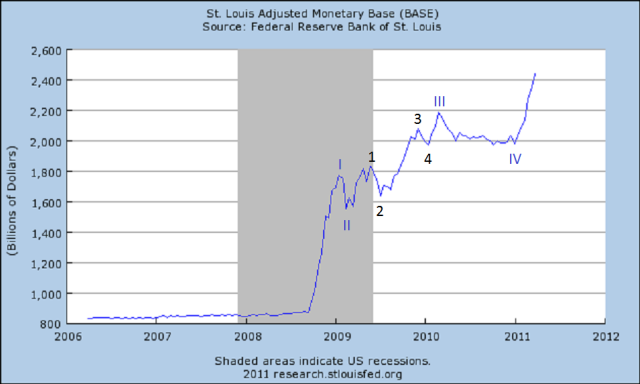

When the FED started increasing the monetary base exponentially in 2008 we started tracking its growth in Elliott Wave terms. Our first piece on this topic was published in November 2010: http://caldaro.wordpress.com/2010/11/29/feds-adjusted-monetary-base/. Then, we expected the monetary base to bottom just under $2 tln and expand to $2.5 tln in the coming months. We followed that piece with an update in April as the base was reaching the targeted level: http://caldaro.wordpress.com/2011/04/01/feds-adjusted-monetary-base-2/. This weekend, with the current economic situation in mind, we reviewed the FED’s recent chart to determine if it could provide any clues of another Quantitative Easing program in the near future. It did, and more!

When the FED started increasing the monetary base exponentially in 2008 we started tracking its growth in Elliott Wave terms. Our first piece on this topic was published in November 2010: http://caldaro.wordpress.com/2010/11/29/feds-adjusted-monetary-base/. Then, we expected the monetary base to bottom just under $2 tln and expand to $2.5 tln in the coming months. We followed that piece with an update in April as the base was reaching the targeted level: http://caldaro.wordpress.com/2011/04/01/feds-adjusted-monetary-base-2/. This weekend, with the current economic situation in mind, we reviewed the FED’s recent chart to determine if it could provide any clues of another Quantitative Easing program in the near future. It did, and more!

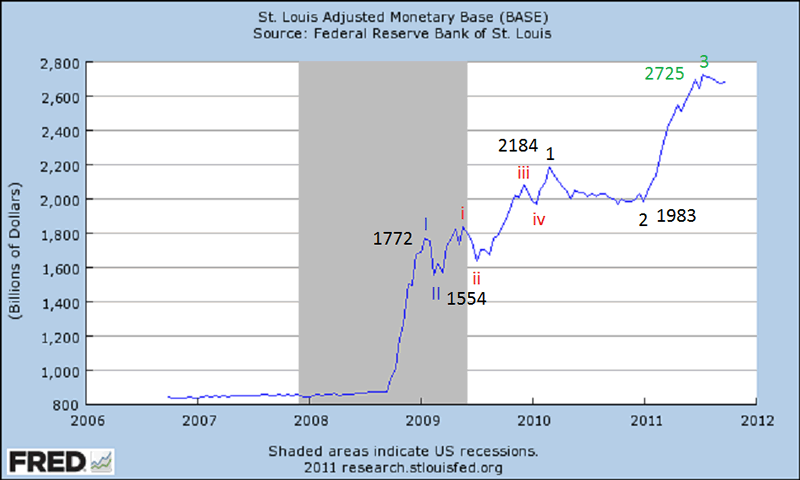

In our last review we labeled the monetary base expansion as five Primary waves (I-V). We expected this last increase, Primary wave V, to top at around $2.5 tln making it shorter than Primary III. In Elliott Wave analysis the third wave of any sequence can not be the shortest. This is what we just observed.

Notice this last increase in the monetary base ($742 bln) has already exceeded the increase during what we had labeled Primary III ($630 bln). Therefore the rise from early 2009 to early 2010 can not be Primary wave III. It must now be a wave of a lesser degree, i.e. Major 1 of Primary III. We have adjusted the wave count on the monetary base accordingly. This analysis suggests that we will not only have a QE 3 program in the near future, to complete a Primary wave III, but it will either be extended, like QE 1, or followed by a QE 4 program after it expires. Since QE 1 ended in June 2010, and QE 2 ended in June 2011, QE 3 is likely to be started in October/November and last until June 2012. An extended QE 3, or a QE 4, will follow and end in June 2013. The FED has recently provided some clues to fit this potential scenario.

At the conclusion of the August FOMC meeting the FED issued this in their statement: The Committee currently anticipates that economic conditions–including low rates of resource utilization and a subdued outlook for inflation over the medium run–are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013. They followed up this meeting with an extended two-day FOMC meeting in September. Former chairman Alan Greenspan was also invited. At the conclusion of this meeting the FED issued this in their statement: To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to extend the average maturity of its holdings of securities. The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less. This program should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate.

The first item of interest is the extended period the FED plans on holding down Fed Funds rates, mid-2013 or June 2013. The second item of interest was the implementation of the $400 bln ”Operation Twist” with a sterilized approach (selling short term treasuries to purchase long term bonds) ending by June 2012. The third observation is that the meeting was originally scheduled for one day, increased to two days, and former FED chairman Greenspan was invited. This suggests the FED created a game plan going forward. FED chairman Bernanke certainly did not need two days, and Greenspan’s presence, to suggest and get approved a sterilized program like Operation Twist by the committee. Notice June 2012, and June 2013 dates have already been mentioned. When we take into account all the various bits and pieces of data we track. We conclude the FED is likely to start a $1 tln QE 3 program in the next couple of months. They already know what a program like this would accomplish, in terms of the economy and the stock market. We will know for certain before year end. Best to your investing!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.