PIMCO Wrong as Bond Bears Plow Into U.S. Treasuries

Interest-Rates / US Bonds Oct 03, 2011 - 06:03 AM GMTBy: Mike_Shedlock

Bill Gross at Pimco has had a change of heart. Bloomberg reports Bond Bears Piling Into Treasuries as Yield Forecasts Cut by Most Since ’09

Eight months ago Bill Gross, manager of the world’s biggest bond fund, said Treasuries “may need to be exorcised” and cleaned them out of his $245 billion Total Return Fund. The company then used derivatives to bet against the debt in March.

Now the Pacific Investment Management Co. fund has 16 percent of its assets in U.S. government securities as the debt posted the highest quarterly returns in almost three years.

“We’ve rebalanced,” Mohamed A. El-Erian, chief executive officer and co-chief investment officer at Newport Beach, California-based Pimco said in a Sept. 27 radio interview on Bloomberg Surveillance with Tom Keene in New York. “The U.S. benefits the most from a flight to quality.”

Bill Gross Exorcised

This is what I said on March 10, 2011: Pimco Dumps All Remaining Treasuries in Total Return Fund; Six Reasons to Fade Bill Gross

Pimco's Bill Gross has been dumping US government debt in favor of other alternatives including emerging-market opportunities.

Six Reasons to Fade Pimco

I view this setup as favorable for US Government bonds. For starters there is no Pimco selling pressure, only potential buying pressure when Gross changes his mind.

Second, everyone seems to think the end of QE II will be the death of treasuries. While that could be the case, sentiment is so one-sided that I rather doubt it, especially if the global recovery stalls.

Third, the US dollar is towards the bottom of a broad range and any bounce could easily wipe out gains in higher yielding emerging-market debt.

Fourth, the global macro picture is weakening considerably with overheating in China, state government austerity measures in the US, and a renewed sovereign debt crisis in Europe on top of a supply shock in oil. Emerging markets are unlikely the place to be in such a setup.

Fifth, chasing yield means chasing risk, and that is on top of currency risk. Chasing risk is highly likely to fail again at some point, the only question is when.

Sixth, several interest rate hikes are priced in by the the ECB this year. Will all those hikes come? I rather doubt it, and if the ECB doesn't hike, look for the US dollar to rally, perhaps significantly.Neutral on Treasuries

Now that Pimco has "rebalanced", I am neutral on treasuries. The bulk of the treasury gains are in.

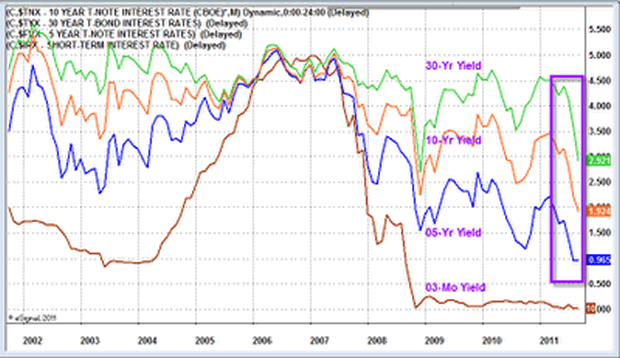

Yield Curve as of 2011-10-03

That is one hell of a rally (falling yields) for fixed-income treasury bears to miss out on, especially since the much ballyhooed "hard currencies" of commodity producers went the opposite direction taking into account currency moves.

Since March the Canadian dollar has fallen from 103 to 95 and the Australian dollar from 102 to 97 having hit a high over 110 in July. The Brazilian REAL plunged from a recent high near .65 to a low near .52.

Many hyperinflationists did far worse. They shorted the start of this treasury rally.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.