Stocks Bear Market Primary B Wave Rally Continues

Stock-Markets / Stocks Bear Market Oct 16, 2011 - 06:39 AM GMTBy: Tony_Caldaro

Another impressive week for the bulls: SPX/DOW +5.45%. We have seen quite a few of these since the bear market began, mixed in with some just as impressive downweeks: w/e July 01st S/D +5.5%, w/e August 26th S/D +4.5%, w/e September 16th S/D +5.05%. Economic reports for the week were light but still trending lower. On the uptick: retail sales, business inventories and the M1- multiplier. On the downtick: the trade/budget deficits, consumer sentiment, the monetary base, the WLEI, and jobless claims rose. Remaining unchanged were import/export prices. That’s 3 up and 6 down if you’re counting. Equity markets worldwide had impressive gains, especially the NDX/NAZ in the US +7.65%. Asian markets gained 3.1%, European markets were +3.2%, the Commodity equity group rose 7.6%, and the DJ World index gained 5.4%. Next week’s economic reports will be highlighted by industrial production, the CPI/PPI, housing and the FED’s beige book.

Another impressive week for the bulls: SPX/DOW +5.45%. We have seen quite a few of these since the bear market began, mixed in with some just as impressive downweeks: w/e July 01st S/D +5.5%, w/e August 26th S/D +4.5%, w/e September 16th S/D +5.05%. Economic reports for the week were light but still trending lower. On the uptick: retail sales, business inventories and the M1- multiplier. On the downtick: the trade/budget deficits, consumer sentiment, the monetary base, the WLEI, and jobless claims rose. Remaining unchanged were import/export prices. That’s 3 up and 6 down if you’re counting. Equity markets worldwide had impressive gains, especially the NDX/NAZ in the US +7.65%. Asian markets gained 3.1%, European markets were +3.2%, the Commodity equity group rose 7.6%, and the DJ World index gained 5.4%. Next week’s economic reports will be highlighted by industrial production, the CPI/PPI, housing and the FED’s beige book.

BEAR market rallies, and BULL traps

After the recent low at SPX 1075, a week ago tuesday, the market has had quite a strong rally over the past nine trading days. A general agreement to recapitilize European banks, when needed, has ignited an uptrend in their equity markets. All five European indices we track are in confirmed uptrends. Generally, equity markets, worldwide, have followed with rallies of their own. The US market has rallied 14.0% over this period with the tech stocks, (the NDX), displaying the greatest strength. During this rally, some investors et al, have turned bullish and others cautiously bullish. We are not in either of those camps long term, only medium term during this uptrend.

We noted last week, the most obvious count was five waves down into the SPX 1075 low to complete a Primary wave A decline. Primary wave B would now likely retrace 50.0% to 61.8%, (1223-1258), of the entire decline from SPX 1371 to 1075. And, the rally would offer another opportunity to hedge one’s portfolio. We expected this uptrend would be choppy and last one to two months. What has occurred, instead, is a spike up rally, with three 20+ point pullbacks along the way, reaching the 50.0% retracement level in a matter of only nine trading days. This type of market activity is a bit odd for a typical bear market rally. However, B wave rallies during bear markets can sometimes look like new bull markets. We have seen these types of spike up rallies before. In 2008.

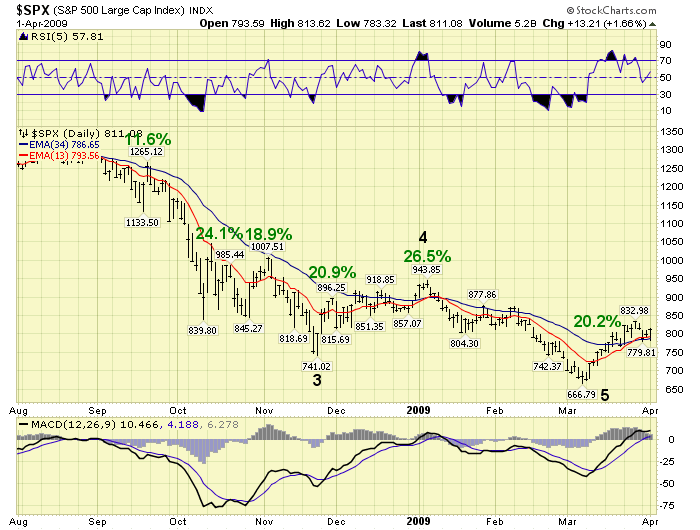

A general review of the Sept08-Jan09 time period uncovered four incidents of this type of volatility. Sept. 18th 2008 kicked off a two day 11.6% rally which failed to generate an uptrend. Oct 10th 2008 kicked off a three day 24.1% rally which failed, and Oct 28th kicked off a six day 18.9% rally which also failed. Only the Nov 21st 20.9% rally, lasting five days, continued higher into Jan 2009, for a total gain of 26.5%, generating an OEW uptrend. None of these four rallies ended the 2007-2009 bear market. The one that did, was a nine day 20.2% rally starting on Mar 6th 2009. Before that fifth spike up rally, the market had completed five waves down into Mar08, a B wave rally into May08, and then another five waves down into Mar09 to complete a zigzag pattern. Our current market has only just completed the first five waves down. And, bear markets are not five wave patterns.

Another bullish view that has been circulating is what one might call; ‘a bull trap scenario’. This scenario suggests that real bear markets lure investors into thinking the small downtrends are only corrections during a bull market. Then when most are bullish again after a big rally, despite the previous drop, the bear market collapses taking many portfolios with it. The bear, the scenario suggests, does not make its presence known early in the bear market, but much later. The theory is; “If this was really a bear market it wouldn’t have tipped its hand so early with the nasty August decline. These nasty types of declines occur in corrections of bull markets, and not bear markets.”

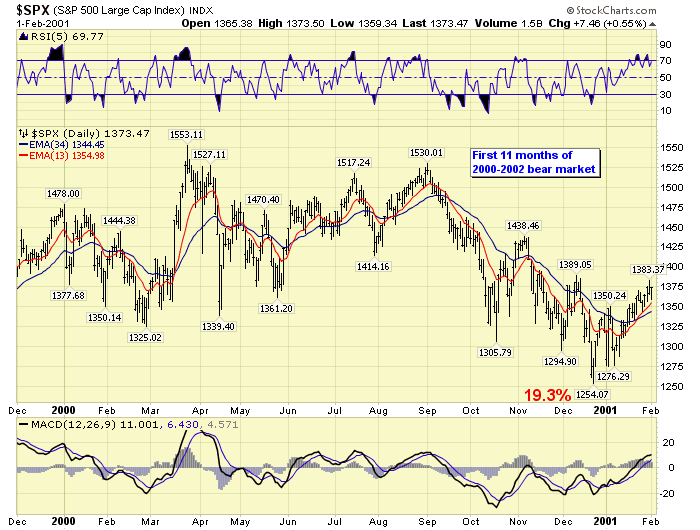

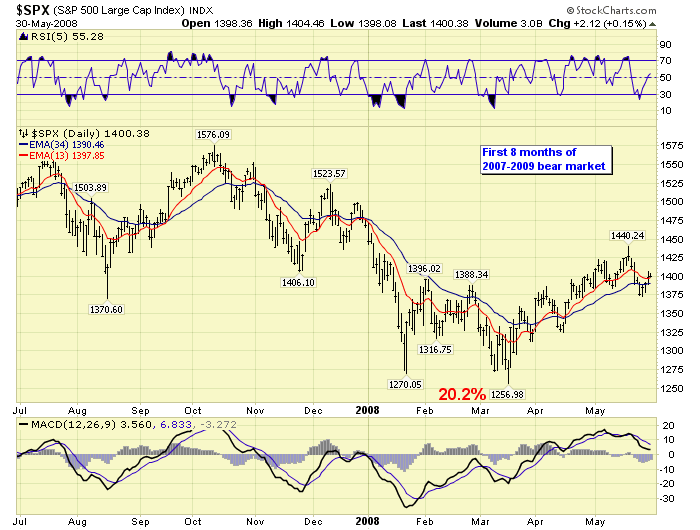

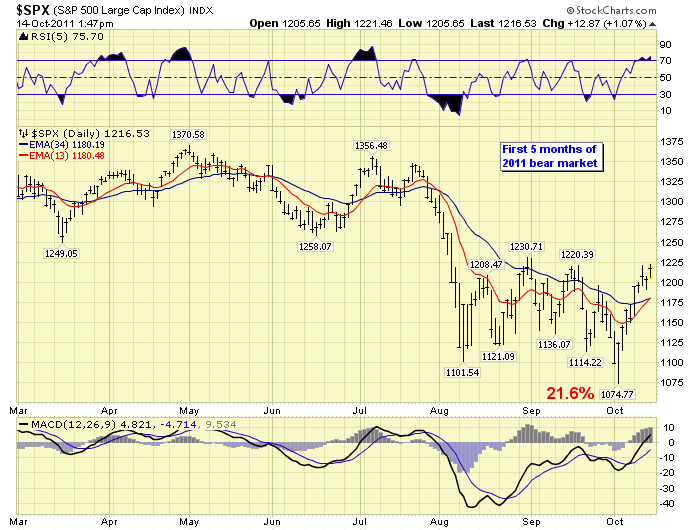

We reviewed the previous two bear markets to determine if their beginning was any different than the beginning of this one, including that August drop.

2000: Eleven months into that bear market we observed a decline of 19.3%, a nice rally, and then the bottom fell out.

2008: Eight months into this bear market we observed another modest 20.2% decline, a nice rally, then we all know how that ended.

2011: So far five months into this correction/bear market we have observed a similar 21.6% decline, now a nice rally, then … While 2000 could be considered a bull trap, we really did not notice much of a difference between 2000, 2008 and 2011. In fact, the beginning of 2008′s bear market compares quite favorably, wave for wave, with the recent 2011 decline. All three simply look like the beginning of bear markets. And, the impressive rallies have all been bull traps until the bear market ended with a completed OEW pattern.

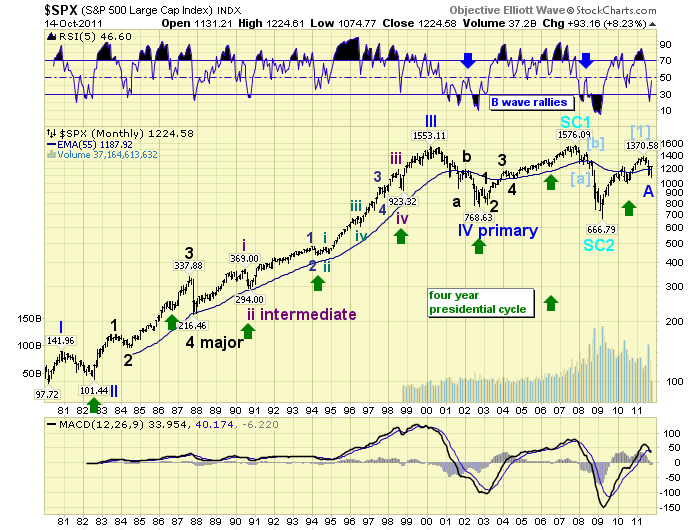

LONG TERM: bear market highly probable

While reviewing the charts we observed a situation that is unique to OEW. During the previous two bear markets, i.e. 2000-2002 and 2007-2009, the monthly RSI hit neutral on each of their B wave rallies. This is noted in the monthly chart below with two blue arrows in the RSI section of the chart. Now observe, this anticipated B wave rally is approaching that very same RSI level.

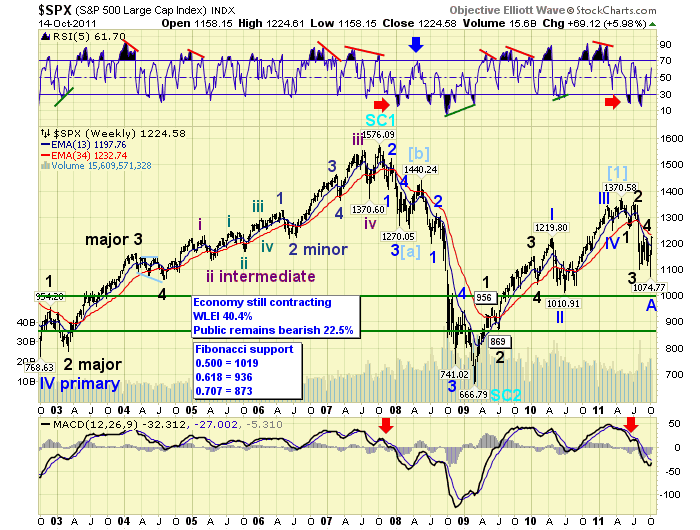

Also of note, now referring to our weekly chart below, is the weekly RSI during the last bear market. Notice how it hit overbought just before that B wave rally concluded.

We continue to count this highly probable bear market as five Major waves down completing Primary wave A at the recent SPX 1075 low. Completed bear markets are not five wave structures so we have no reason to change the count. Primary B wave rallies, however, can last for weeks (maybe this one), months (2001 and 2008), or even a year (1938-1939). We have no way of knowing, ahead of time, how long one might last.

What they do have in common is that they normally retrace 50.0% to 61.8% of the entire previous decline. Since this one is moving quite fast, and we’re expecting a more moderate bear market than 2007-2009, it may conclude in a matter of weeks. Our original projection was for a month to two months, and we will remain with that for now. Once it does conclude we expect bear market low support at one of the three Fibonacci levels posted on the weekly chart.

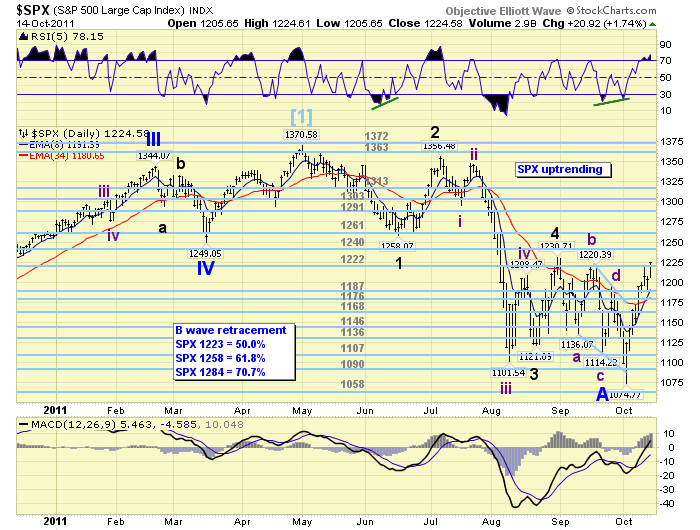

MEDIUM TERM: uptrend high SPX 1225

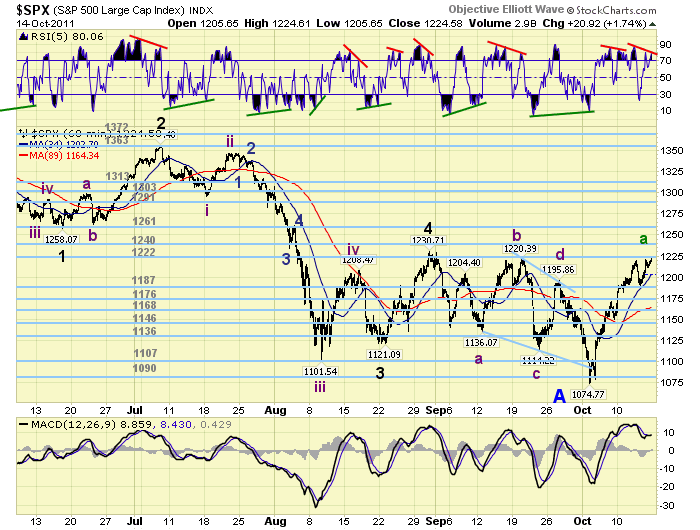

This week all four major US indices confirmed uptrends, but only four of the nine SPX sectors have confirmed. This uptrend, thus far, appears to be quite selective. While the market has soared 150 SPX points, 14%, in just nine trading days. It has had three pullbacks between 21 and 29 SPX points. Our short term OEW charts have remained positive since around SPX 1130. This suggests this rally is only Major wave A of an expected ABC Primary wave B.

Remember we expected Major wave A to get overbought, Major B oversold, and Major C overbought again. The market is currently starting to get overbought on the daily chart. This suggests Major wave A is likely going to conclude within the OEW 1222 pivot range. After a 150 SPX point rally and another negative divergence on the hourly we believe this is a good possibility. After Major wave A concludes, the market should experience a fairly big pullback for Major B, then rally again to complete Major wave C.

Since this recent rally has been quite strong, we have added another Fibonacci retracement level to the current 50.0% (SPX 1223) and 61.8% (SPX 1258) levels, 70.7% (SPX 1284). We have OEW pivots at 1222, 1261 and 1291. So this additional level also fits the Primary wave B scenario. Should the market rally above this last level then we may have to rethink what exactly is unfolding in this volatile market. These levels are posted on the daily chart above.

SHORT TERM

This week we received another WROC buy signal coincident with a confirmed uptrend. Some of you will remember the last time that happened. It was in August, only a few days before that uptrend topped at SPX 1231. This does not bode well for this uptrend.

We are marking the current high with a tentative green Major wave A label. The market may rally a few more points but we believe it will remain within the OEW 1222 pivot range. The technicals display a double negative divergence on the hourly chart, plus a weakening MACD. This is usually a prelude to a pullback of some degree. We also observe negative divergences on smaller timeframes as well. Since this rally has been fairly steady with small pullbacks for its length. It has been difficult to count the internal waves with any degree of certainty. A decline below SPX 1200 would suggest a Major wave B pullback is underway. Short term support is at the 1222 pivot, the low 1200′s and then the 1187 pivot. Short term resistance is at the low 1230′s, then the 1240 and 1261 pivots. Best to your trading!

FOREIGN MARKETS

The Asian markets were all higher on the week for a net gain of 3.1%. No confirmed uptrends yet.

The European markets all rose gaining 3.2%. All five indices are in confirmed uptrends.

The Commodity equity group all rose as well gaining 7.6%. No confirmed uptrends here either.

The DJ World index has not confirmed an uptrend but gained 5.4% on the week.

COMMODITIES

Bonds remain in a downtrend and lost 0.6% on the week.

Crude has yet to confirm an uptrend but gained 4.9% on the week.

Gold appears to be uptrending and gained 2.5% on the week.

The uptrending USD ran into quite a turbulent currency week losing 2.7%. The EUR rallied 3.7% and the JPY lost 0.7%.

NEXT WEEK

Monday kicks off the economic week with the NY FED at 8:30, then Industrial production at 9:15. On tuesday we have the PPI and the NAHB housing index. Then on wednesday the CPI, Housing starts, Building permits and the FED’s Beige book. On thursday, weekly Jobless claims, Existing home sales, the Philly FED, and Leading indicators. Friday is Options expiration. The FED gets active again this week with four speeches from four different members. This is a rarity! On tuesday, FED chairman Bernanke gives a speech titled; “The Effects of the Great Recession on Central Bank Doctrine and Policy” at the Boston FED. On thursday, FED governor Tarullo gives a speech at Columbia in NYC. On friday FED governor Yellen gives a speech in Colorado. Then on saturday FED governor Duke gives a speech in Virginia. Looks to be a very interesting week. Best to you and yours!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.