U.S. Dollar Teetering on the Abyss

Currencies / US Dollar Nov 15, 2011 - 03:01 AM GMTBy: Toby_Connor

We all better hope I'm wrong on this one, but I think the CRB just put in its three year cycle low in October. I'm also afraid that Bernanke has done irreparable damage to the dollar. If I'm right about both of those assumptions then we are on the brink of a historic inflationary period.

We all better hope I'm wrong on this one, but I think the CRB just put in its three year cycle low in October. I'm also afraid that Bernanke has done irreparable damage to the dollar. If I'm right about both of those assumptions then we are on the brink of a historic inflationary period.

I've marked the major three year cycle bottoms in both the CRB index and the dollar index on the chart below with blue arrows. (Actually the CRB cycle tends to run about two and half years on average).

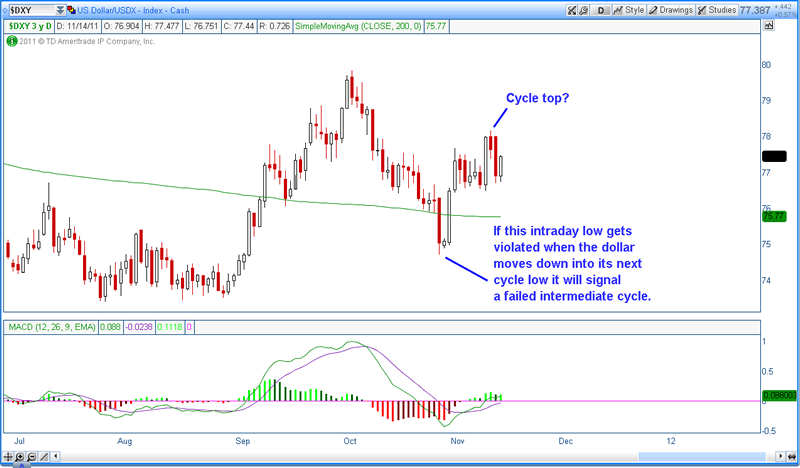

The dollar is now a great risk of forming a left translated three year cycle. A break below the October 27 intraday low would initiate a pattern of lower lows and lower highs of an intermediate degree. When the intermediate cycles start to roll over that is usually a sign that a major cycle has topped. If the dollar's three year cycle has topped after only five months we will be at great risk of a severe currency crisis in the fall of 2014 when the next three year cycle low is due. Even more concerning is if the CRB cycle has bottomed. If it has then commodities are poised for a huge surge higher during the next two years as the dollar deteriorates.

The next couple of weeks are going to be critical for the dollar. Sometime in the next two weeks the dollar is going to drop down into its next daily cycle bottom. On average that cycle lasts about 20 to 25 days. Monday will be the 12th day of the cycle.The reversal last Thursday has the potential to mark the daily cycle top. If that top holds then the dollar is at great risk of moving below the October 27 intraday bottom sometime in the next two weeks as it moves down into its next daily cycle low.

The dollar must hold above the October 27 low. Failure to do so would indicate that the cancer has now infected the currency markets, most specifically the US dollar. A penetration of the October 27 low would indicate that the current intermediate cycle topped in only two weeks. That should potentially lead to another 15-20 weeks of generally lower prices on the dollar index with the next intermediate degree bottom due sometime in early to mid March.

If that scenario plays out we are almost certainly going to see the CRB break its down trend line confirming a major three year cycle bottom has been formed.

The extremely mild nature of the decline so far is a serious warning sign that QE1 and QE2 are going to eventually trigger massive commodity inflation.

At this point all we can do is hope that the three year cycle in the CRB will stretch slightly long and bottom early next year. If it fails to do so and the major three year cycle low did occur in October, then we have some serious inflation heading our way in the next two years.

More importantly to precious metal investors, if the dollars three year cycle has already topped then there is a very strong possibility that the next two years, as the dollar collapses down into its 2014 bottom, will drive the bubble phase in the gold bull market.

Click here to go to the premium website then click on the subscribe link on the right-hand side of the page. You will see the special offer at the bottom of the subscription page.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2011 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.