Deleveraging is Over — It’s Time to Cut the U.S. Budget Deficit

Interest-Rates / US Debt Nov 30, 2011 - 03:34 AM GMTBy: Colin_Twiggs

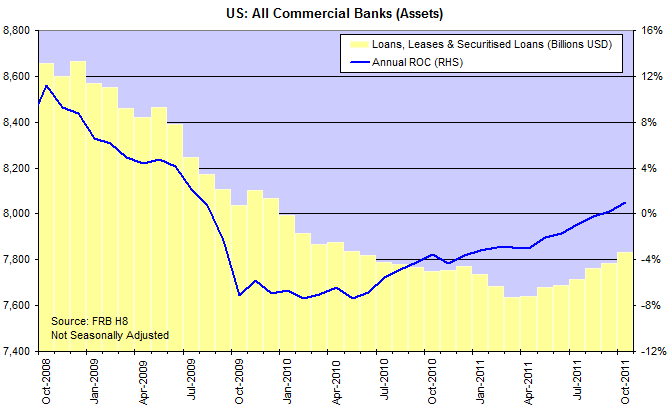

US commercial bank loans and leases bottomed in April 2011, after shrinking more than $1 trillion in the previous two years. The annual rate-of-change has now recovered to positive territory, relieving downward pressure on asset prices, including stocks and real estate. Deleveraging has come to an end and is only likely to resume if the economy suffers further financial shocks.

US commercial bank loans and leases bottomed in April 2011, after shrinking more than $1 trillion in the previous two years. The annual rate-of-change has now recovered to positive territory, relieving downward pressure on asset prices, including stocks and real estate. Deleveraging has come to an end and is only likely to resume if the economy suffers further financial shocks.

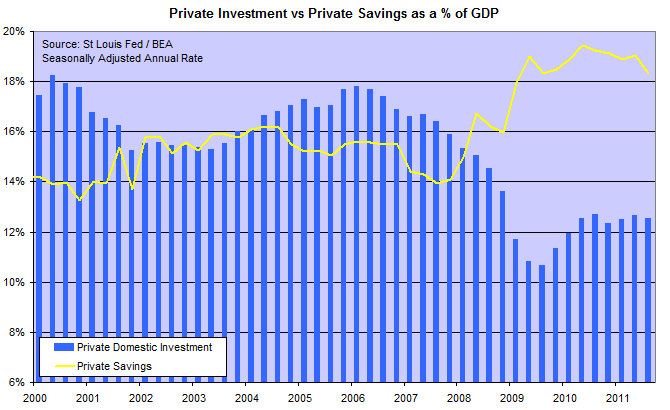

You would expect the gap between savings and investment to close when net debt repayments cease, but a significant shortfall between Gross Private Savings and Domestic Investment warns of continued instability.

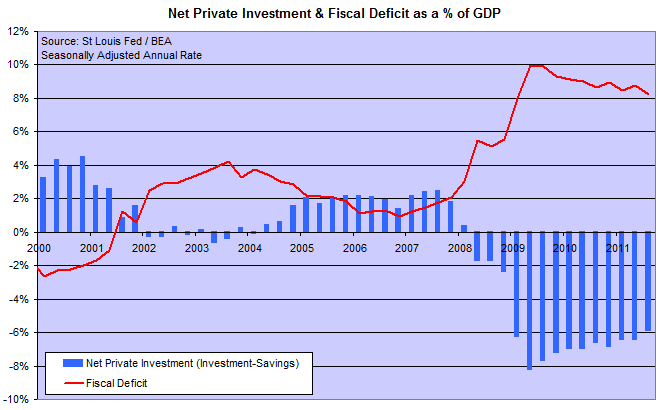

The Investment – Savings gap is reflected by strong, negative Net Private Investment on the chart below. If it were not for the fiscal deficit, the US would risk a significant contraction in national income.

For the benefit of those who may have missed my earlier coverage of this issue:

Debt repayment after a financial crisis/balance-sheet recession creates a gap between savings and investment that has serious implications for the economy. The resultant shortfall between spending and income risks a sharp contraction in national income. The gap may be relatively small but, like a puncture in a car tire, the impact can be huge. It only takes each of us to withhold 2% of what we earn (e.g. to repay debt) for a gap to appear between spending and income. A for example may earn $1.00 but now only pays 98 cents to B, who will pay 96.04 cents to C, who will pay 94.12 cents to D, and so on through the entire supply chain. By the time we get to L, they will only earn 80 cents where they previously earned $1.00.

The solution, as Keynes pointed out, is for government to offset the shortfall by running a fiscal deficit. The chart above shows that Treasury has been doing exactly that — spending more than they collect by way of taxes — in order to prevent a contraction. The problem is that continual deficits have two serious side-effects. The first is a loss of investor confidence as the ratio of public debt to GDP rises. The second is inflation — if private investment recovers and starts competing with government for ever-scarcer resources. By inflation I do not just mean an increase in the CPI, but also rising asset prices as experienced in the 2004 to 2008 housing bubble, when government ran a deficit while net private investment was positive.

As the chart shows, the fiscal deficit is being funded by net savings (plus a little help from China). So what would happen if we cut the deficit?

- An optimistic view would be that cutting the deficit would restore confidence and encourage more private investment, shrinking the savings – investment shortfall.

- Pessimists, however, would warn that private sector balance sheets have been impaired by falling asset prices and investors are reluctant to borrow even at current low interest rates. A shrinking deficit without a counter-balancing rise in investment would send the US back into recession.

The truth lies somewhere in between. Corporate balance sheets are generally in good shape while small-to-medium business and home-owners have suffered significant impairment. And one of the major factors inhibiting investment is the uncertain political/economic environment.

Deleveraging has ended and the time has come to start cutting back the government deficit — but cautiously. Cutting the entire deficit in one hit would be more of a shock than the economy could bear, but setting out a four-year plan to cut the deficit by say 2 percent a year would do a lot to restore confidence and set the economy on a path to recovery.

By Colin Twiggs

http://www.incrediblecharts.com

Colin Twiggs is author of the weekly Trading Diary newsletter, with more than 130,000 subscribers. His specialty is blending economic and technical analysis of stocks, commodities and currencies. He successfully forecast the GFC in January 2007 and has been warning of a second dip since May 2011

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use .

© 2011 Copyright Colin Twiggs - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.