FOMC Meeting March 13, Fed Expected Stand Pat as U.S. Economic Recovery Remains Stable

Economics / US Economy Mar 13, 2012 - 04:55 AM GMTBy: Asha_Bangalore

It is widely expected that the Fed will stand pat at the March 13 FOMC meeting. Nevertheless, the Fed’s view about the economy should reflect nuanced modifications, which will offer hints about the next policy step.

It is widely expected that the Fed will stand pat at the March 13 FOMC meeting. Nevertheless, the Fed’s view about the economy should reflect nuanced modifications, which will offer hints about the next policy step.

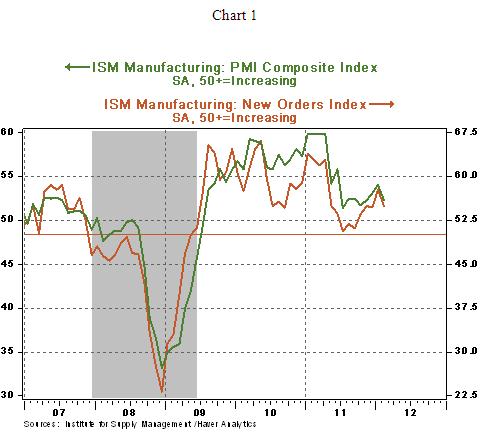

The key question is if there is a need for additional policy action to support economic growth. Incoming economic data present a mixed picture. The ISM factory survey shows continued growth but at a slower pace compared with readings of recent months. The composite index moved down to 52.4 from 54.1 and the index measuring new orders stood at 54.9 from 57.6 in January (see Chart 1). Factory production data for February are scheduled for publication on March 16.

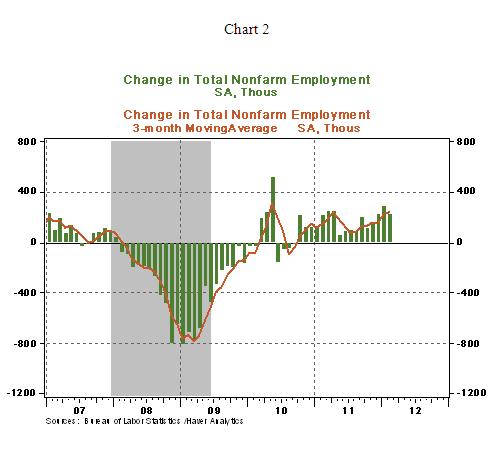

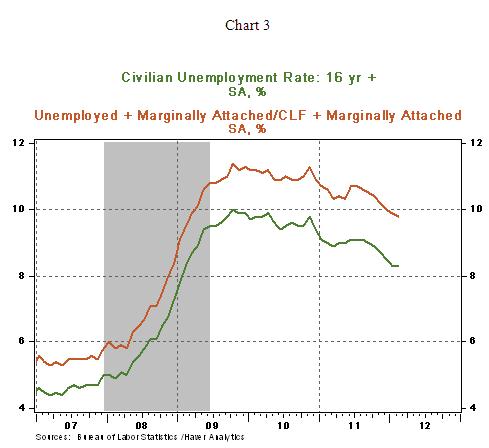

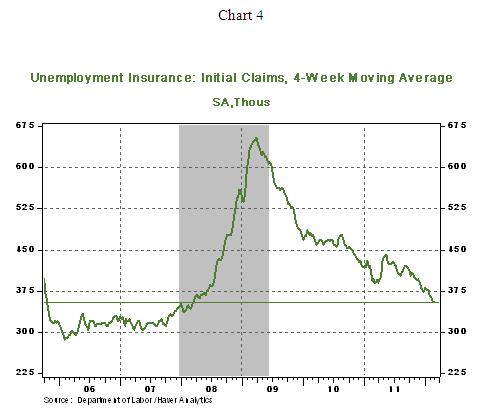

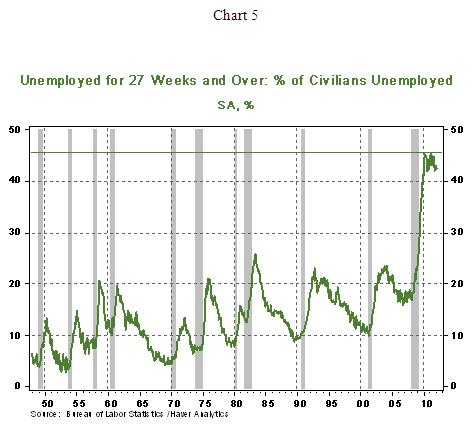

On the labor market front, payroll employment rose 227,000 in February, with the three-month moving average at 245,000. The unemployment rate is holding steady at 8.3%, with an increase in labor force participation accounting for an unchanged jobless rate. Initial jobless claims continue to trend down. Charts 2-4 point to improving labor market conditions, but the unemployment rate remains at an elevated level after ten quarters of economic growth and the percent unemployed for six months and over is problematic (see Chart 5). The percentage unemployed for 27 weeks and over has declined to 42.6% in February from 45.5% in March 2011. However, from a historical perspective, the absolute level of long term unemployment remains a major area of concern. Bernanke indicated at the February 29 testimony that the “job market remains far from normal.”

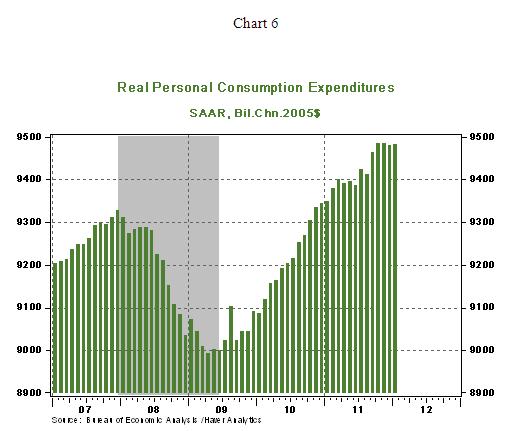

Consumer spending has held steady for three straight months ended January, despite the jump in auto sales during two of these three months. Auto sales advanced in February also, estimates of consumer spending will be available later in the month. Chairman Bernanke noted that real household income and wealth of households held steady in 2011 to make a point that support for spending continues to remain weak.

In the housing sector, on the demand side, although houses are affordable, credit availability is tight and uncertainty about employment and the future path of prices is holding back home sales. On the supply side, inventories of unsold homes have dropped below the historical median, but roughly a third of home sales are distressed properties. The large number of distressed properties continues to exert downward pressure on home prices.

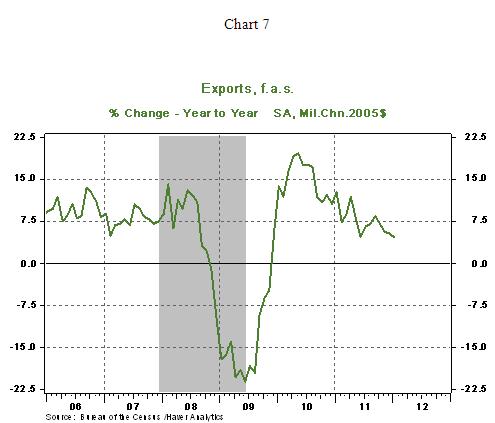

On the international front, exports have slowed as projected. Headwinds from Europe will prevail on the risk radar screen in the months ahead.

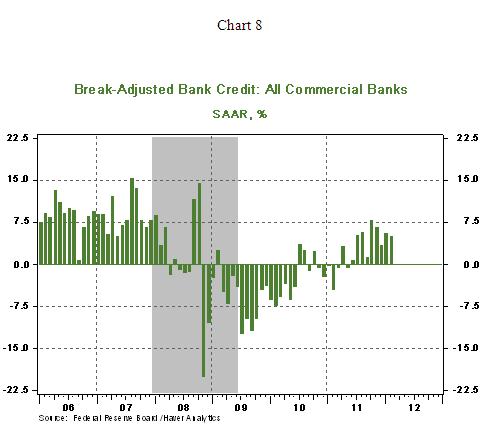

On balance, the economic scale has not tipped significantly in favor of immediate monetary policy easing since the last FOMC meeting. Bank credit, an important driver of our economic forecast has posted impressive growth in January and February. Continued growth in bank credit is supportive of self-sustained economic growth. But, the persistence of longer-term unemployment, the elevated unemployment rate, sluggish demand for homes, stagnant consumer spending, continued price home price declines, and headwinds from Europe are factors that will leave a bias toward monetary policy easing, with Fed ready to step in if the recovery falters. In addition, the looming Iran nuclear controversy with the risk of higher oil prices hangs like a dark cloud on the global economy. Stay tuned for tomorrow’s analysis of the FOMC policy statement.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.