Global Impact of the US Debt Implosion

Stock-Markets / US Debt Jan 24, 2008 - 04:04 AM GMTBy: John_Lee

We have written a series articles dating back to March 2007 tracking the US debt implosion, which are available here . The story started out in early 2007 with the blowout of Novastar and New Century, the multi-billion non-bank intermediary mortgage brokers. In summer of 2007 we witnessed the collapse of American Home Mortgage, America's largest subprime mortgage issuing bank. Then we saw a series of subprime write-offs amounting to hundreds of $ billions by banks, funds, and institutions around the world. Then the trouble moved up in the chain of the mortgage complex, with Fannie Mae and Freddie Mac announcing surprising losses.

We have written a series articles dating back to March 2007 tracking the US debt implosion, which are available here . The story started out in early 2007 with the blowout of Novastar and New Century, the multi-billion non-bank intermediary mortgage brokers. In summer of 2007 we witnessed the collapse of American Home Mortgage, America's largest subprime mortgage issuing bank. Then we saw a series of subprime write-offs amounting to hundreds of $ billions by banks, funds, and institutions around the world. Then the trouble moved up in the chain of the mortgage complex, with Fannie Mae and Freddie Mac announcing surprising losses.

In 2008, the problem struck core as Countywide, American largest mortgage issuing bank plunged into the single digits on the rumors of impending bankruptcy. The Countywide saga then ended last week with an orchestrated buyout by Bank of America.

In response to the damage, global central banks have lowered interest rates and willingly lent (printed) approximately $1 trillion dollars to banks and institutions while taking questionable debt assets as collateral at face value. Even with such drastic measures deployed, worry and uncertainty still linger.

So where do we stand now in 2008?

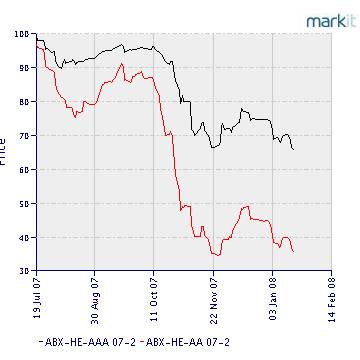

- According to the ABX index at Markit.com, AAA mortgages are selling at 70 cents on the dollar and look to go down further. This means that on every mortgage Freddie Mac and Fannie Mae guarantee, they are losing 30 cents on the dollar right away. Given that the mortgage exposure of Fannie and Freddie are in the hundreds of $billions, we look for Freddie to announce insolvency unless bailed out by the government.

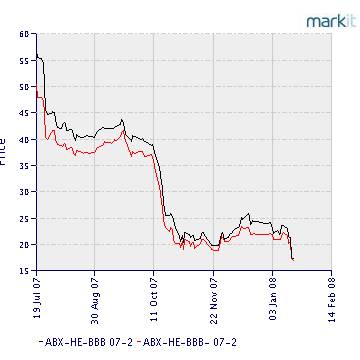

- Subprime debts are changing hands at less than 20 cents on the dollar. The entire subprime market, a key driver of the US economy and money creation, is over. Given there is upwards of $2 trillion of subprime debts, which are selling at 20 cents on the dollar, we will see a lot more subprime write downs to come not just from banks, but pension funds and endowments throughout 2008.

- Last year we speculated that credit card backed asset securities would be the next victim. The following chart of Capital One, America's top credit card issuer, confirms our belief. The company announced mounting payment delinquencies and failed to deliver target earnings. We anticipate much further room to fall for COF, and most credit card issuers to come under pressure. Credit card debts/backed securities are a multi trillion dollar market. The fall out from this market will make headlines no less spectacular than ones created by subprime.

- Commercial, municipal debts are now under pressure. Ambac is a AAA debt issuer with municipalities, cities, and private companies as clients. Ambac's clients have lesser credit quality. Ambac makes money by pawning its Moody AAA's rating and issuing tens of billions of its AAA bonds to fund Ambac client projects, and charging a nice spread/fee in the process. From Ambac's website:

Mr. Bernanke lied when he assessed the damage of subprime at $200 billion in November 2007. As illustrated in the following official chart published by the Federal Reserve, Asset Backed Securities (yellow line) have lost 40% of their value to $750 billion from over $1.2 trillion. While the 40% officially claimed loss is not as bad as the 30% - 80% loss (depending on grade) estimated by Markit.com, the estimate nonetheless is stunning and shocking.

“With our valuable AAA-rated financial guarantees and unmatched transaction structuring expertise, Ambac helps clients: Lower borrowing costs;“

S&P Moody's downgrade of ABK's credit rating would mean the disappearing of the fee spread and the end of chapter for the company.

What does this mean for 2008?

- The US debt binge is over. Foreign investors will increasingly shun US debt assets backed by mortgages, credit cards, car loans, and third party guarantees such as Ambac. This will create downward pressure for the dollar.

- Both the US economy and money supply growth will slow. The economy grows in dollar terms by the increase of dollar aggregates. Dollars are created and supplied through borrowing. If banks can't sell/flip those loans and mortgages they originated, they are likely to create a lot fewer loans and mortgages.

- US consumers are tapped out. Regardless of interest rates, frivolous lending of credits cards and home loans has come to an end through tightening lending practices. This will slow down consumer spending.

- Interest rates will remain tame. Can't raise them or it will crash trillions of already distressed debts, can't lower them much more with oil already at $100.

- Unlike debts which are strictly paper instruments; equities tend to survive through financial turmoil in the long run as they are quasi-tangible assets. Equity markets won't crash but will be volatile. With vastly diversified multinational listings, there is already a decoupling effect between the US economy and US stock market.

As the charts illustrated below, the rate of money creation has slowed down (in red), and this will create volatilities in the US markets.

In millions USD, total debt outstanding by Asset back securities issuer, left scale (top is $4.5 trillion)

% change in red year over year, right scale

In millions USD, household credit debt, left scale (top is $14 billion)

% change in red year over year, right scale

To avoid an outright deflationary collapse, the Fed and US government have to keep money supply growing, albeit via creative monetary and fiscal policies:

- Increase deficit spending and tax cuts.

- Forgive credit card and mortgage loans

- Indiscriminately lend to banks at any rate to keep them from failing.

This is an extremely bullish scenario for gold, not because the pace of money supply growth is increasing (in fact quite the opposite is occurring), but because of the irreparable damage to integrity of, and confidence in, the financial system through each bail out.

Technically gold has just overcome the all time high of $850 set in 1980, we see a brief pause here before challenging $1,000 this year.

We recently concluded exhibitng at the world's largest resource investment confernce in Vancouver. I participated in a panel and conducted a workshop. The write up can be found here .

Adventurous investors can find our All-Star Gold and Silver Juniors Report at http://www.goldmau.com

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.